It’s hard to believe that summer is almost over and it’s time for the kids to go back to school. For many who just graduated from college, it’s time to begin their first real job! As our adult children move from college to the real world, it’s a good time to make sure they are ready to succeed and to be responsible for their own financial lives.

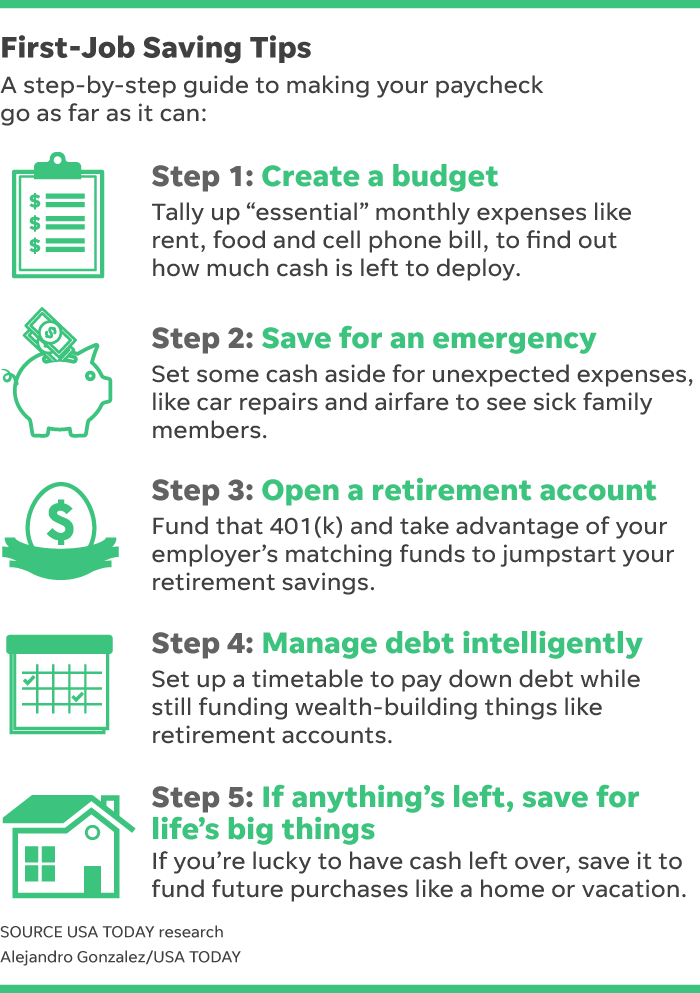

For those who are planning to rent an apartment rather than moving back home after graduation, start-up costs can accumulate quickly, going well beyond the price of rent alone. There will be a deposit needed for utilities, the cost of setting up and maintaining internet access, and expenses such as furniture, kitchen supplies and moving costs. Being able to cover these costs will require a budget — the most basic of all financial tools, and the most critical for people who are starting life on their own.

It’s exciting when our children get their first job offer. The starting salary may sound great — and it may even include a signing bonus! But if they’re not thinking about how much money in taxes comes off the top first, it can be quite surprising and a substantial hit to the budget.

Let’s use the example of someone with a starting salary of $50,000. A single filer making $50,000 in 2022 falls into the 22% marginal federal tax bracket. This doesn’t include Social Security or Medicare taxes. For simplicity’s sake, let’s assume they withhold 20% for taxes out of their paycheck, so the $50,000 now drops down to $39,000 on an annualized basis or $3,250 per month.

If the company has a 401K program that matches up to 3% of salary ($1,500 per year), they should contribute to get the “free money” from their company. (At a minimum, we recommend that they start out contributing 3% of their salary to their 401K so that they obtain the full match.) This will reduce their taxable salary from $50,000 to $48,500, since the $1,500 contribution into the 401K is not taxed. After taxes and retirement contributions, your child has to live on $3,200 per month. That amount of money must cover all other monthly expenses: rent, utilities, health insurance, car insurance, car payment, groceries, restaurants and entertainment.

This is where the budget comes into play. A great habit for them to start with is writing down everything that they spend so that they can see where the money goes and how fast it can disappear. If your adult child can stay on your health insurance (as they are allowed to do until age 26), then that will save them money each month. Once they are no longer living at home and they have a different permanent residence, they will need their own auto insurance. You also will want to make sure that they have renters’ insurance for their apartment to protect their belongings. This is relatively inexpensive, costing under $500 in many cases.

Debt is a silent killer for savings, eating away at assets each month. Credit card debt is the worst debt, with interest rates often exceeding 20%. If you have student loan and credit card debt, work on paying off the higher-interest debt first.

Student loans may take many years to pay off, so focus on eliminating credit card debt and then managing your spending going forward.

It’s important to discuss the concept of growing wealth with adult children who are starting their first jobs. As we mentioned earlier, many companies have 401Ks that match employee contributions. If a 22-year-old puts away $1,500 into a 401K every year until age 70 and earns an average of 5% annually, the value of that investment would be $300,000, not including the money from the match. The match equates to free money, and starting early sets them on a great path to earlier retirement. If their employer does not offer a 401K, starting an IRA or Roth IRA can accomplish the same goal initially.

The cost of adulting is not cheap. Buying a car, clothes for work and furniture are one-time expenses, which should be looked at as an investment and not a splurge. There will always be expenses that arise that can throw a wrench into the budget for those starting out, so we also recommend that your child begin a rainy-day fund for unexpected expenses.

We are here to help you and your family with these new and exciting endeavors. At all stages of life, budgeting is critical to your financial well-being. By helping your children start early and creating a habit right out of college, you can help them experience more financial freedom as adults.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Source: USA Today

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.