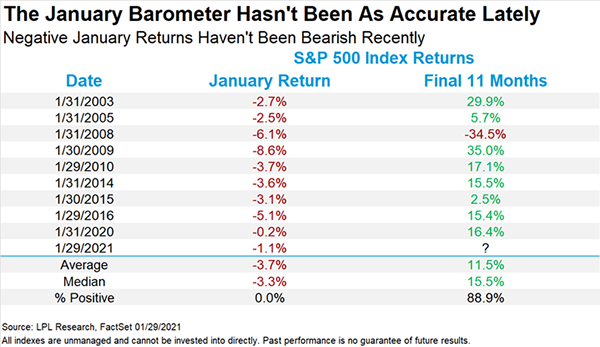

Following a three-month rally that coincided with the election and the vaccine rollout, stocks took a rest last week, and the end of January brought a slightly negative start to the year. Some market pundits believe the performance of the S&P 500 in January predicts the performance for the rest of the year, but this theory hasn’t played out often over the last two decades, as the chart shows below. Since 2003, the average return was over 11% during the 11 months following a negative January — and that number is skewed by the financial crisis of 2008.

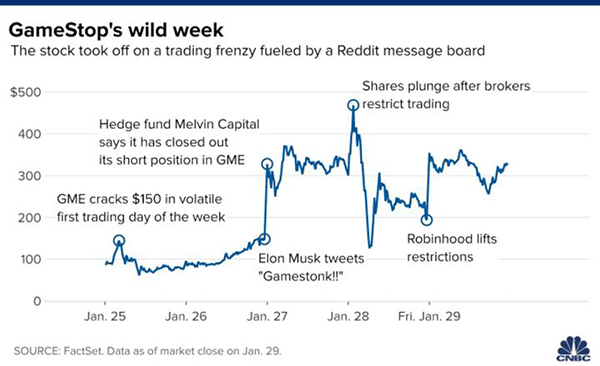

Last week, the news consuming the markets was all about GameStop. The video game retailer started the year trading around $17 per share, and on Thursday of last week, the stock hit a high of $483, for a gain of more than 1,625%. This story is not about a retailer undergoing a fundamental shift in business philosophy and changing its outlook; it’s about a group of people on Reddit, called WallStreetBets, who are buying the most heavily shorted stocks on Wall Street en masse.

Shorting occurs when investors attempt to make money on a stock that falls in price. Instead of buying low and selling high, investors who short stocks borrow shares and sell them immediately. If the stock drops in price, they buy the shares back at the lower price before delivering them back to the lender — effectively making money by selling high and buying low. But if the stock price goes up instead of down, the investor may have to buy the stock at the higher price to deliver the shares that they borrowed, taking a potentially sizable loss.

If the price of the stock moves up very quickly, as GameStop did, then the lender can ask for additional collateral to cover the loan. This becomes a cycle: The investor then has to sell other holdings, raise cash and buy back the stock they are shorting, forcing the price up even higher and creating a “short squeeze.” Part of the phenomenon we are seeing with Reddit is a desire to cause institutions such as hedge funds, which are betting against this group of stocks, to lose as much money as possible. The traders following the advice on Reddit do not fully understand the market fundamentals and are attempting to make a quick dollar.

These bubbles do not end well historically — markets always return to fundamentals — and this fad, too, shall pass.

So, what can we learn from all this? Markets do not move up in a straight line. Bubbles like GameStop come and go, leaving volatile markets in their wake. We view these movements as opportunities, never as a time to panic or gamble unnecessarily. We will continue to stay the course, and while we know this will not be the only bump in the road in 2021, the public markets will continue to look forward, anticipating what’s ahead. From an investment perspective, we use the above insights to help with the strategic and tactical asset allocation based on where we see the portfolio heading over the next five to seven years, with short-term adjustments along the way.

We are not trying to time the market, but we will try to take advantage when we see where the market is heading. Having a well-balanced, diversified, liquid portfolio and a financial plan is the key to successful investing. The best option is to stick with a broadly diversified portfolio that can help you achieve your own specific financial goals – regardless of market volatility. Long-term fundamentals are what matter.

Sources: FactSet, CNBC, LPL

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI AC (All Country) Asia ex Japan Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of Asia, excluding Japan. The Dow Jones Industrial Average is a popular indicator of the stock market based on the average closing prices of 30 active U.S. stocks representative of the overall economy.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. It is not possible to invest directly in an index.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.