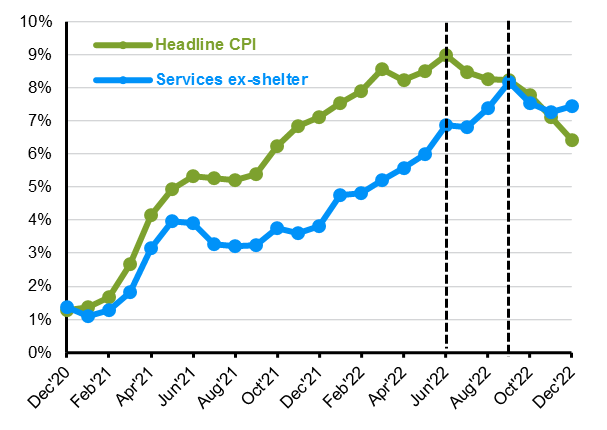

The story for investors last year was all about inflation. The 2023 narrative is shifting toward how quickly inflation can cool — and how much cooling will be sufficient to get the Fed to pause its campaign of hiking interest rates.

Last week, the December Consumer Price Index (CPI) report marked the fourth consecutive decline in headline CPI on a year-over-year basis. The Fed will want to see further evidence that inflation is cooling, especially in the service sector (see chart below) before it will be comfortable pausing rate hikes. Housing costs are generally the biggest-ticket item on most households’ spending budgets, and shelter costs (rent and mortgage payments) make up roughly one-third of the CPI index.

Services Ex-Shelter to Keep the Fed Hiking but at a Slower Pace

Year-over-year percentage change, seasonally adjusted

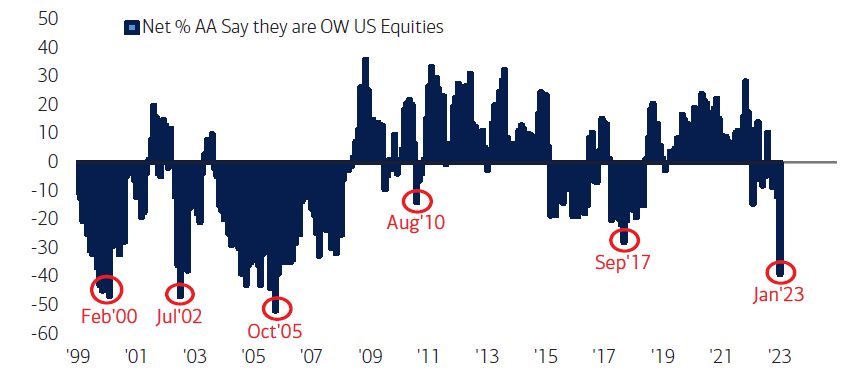

Unfortunately, many retail investors tend to sell low and buy high when investing in the stock market. As a result of the difficult last year in the stock market, investors have pulled more money out of U.S. equities than at any time since 2005. Most of this comes down to behavioral finance: Investors worry more about losing money than they do about making money.

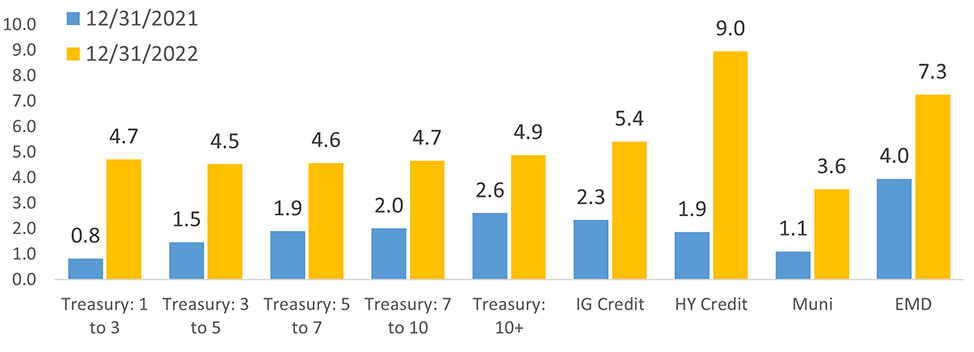

At the same time — and for the first time in many cycles — cash/money market now offers a better yield than the dividend yield on the S&P 500. This offers a good alternative for those looking for income, but it does not replace the long-term growth that can potentially be achieved in the equity markets. While money market rates and short-term Treasury rates are very attractive for the first time in many years (see the chart below), the rates still do not keep pace with current levels of inflation.

Many investors think that they are going to move to cash — or to the sidelines — so they can wait out the downside or potential recession, earn interest on their cash, and then get back in when the market has “settled down.” As we have written many times, market timing rarely works, and it’s very difficult for individual investors to remove emotion out of the decision making when the market is falling. This often leads to subpar long-term results, compared to what the results would have been if they had just stayed the course.

January Sees Collapse in U.S. Equity Allocation

Net % say they are overweight U.S. equities

Yield Comparison

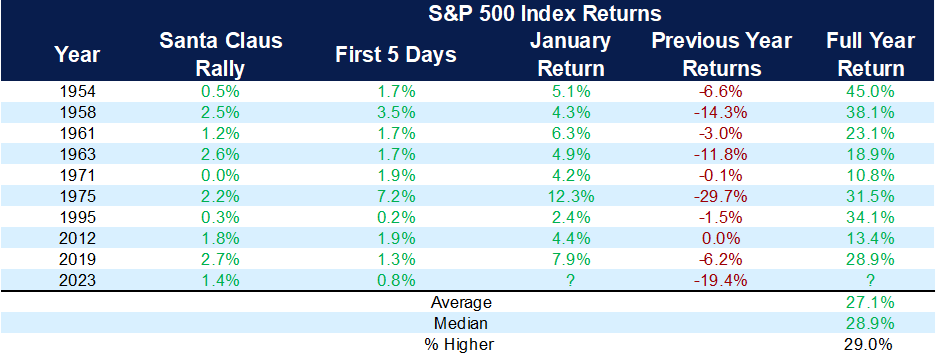

The market ended 2022 on a down note, with the S&P finishing the last four weeks of the year down, but January has started very differently. The Santa Claus rally — which refers to the stock market’s tendency to rally in the last five trading sessions of a calendar year and the first two sessions of the next — did eke out a gain this year. On top of that, the first five trading days also were also positive. When the market finishes positive in January, it finishes the year higher 70% of the time.

The chart below shows that the last nine times that there has been a positive Santa Claus rally, positive results for the first five trading days of the year, the month of January finished higher, combined with a negative prior year, the average return for the year has been 27.1%. (Remember that past returns are no guarantee of future returns, but the negative sentiment that exists for the market may not be warranted.)

If Stocks Are Down the Previous Year, This Trifecta Is Very Bullish

Trifecta of the Santa Claus Rally, first five days of the year and January All Green (1950-present)

This is only one indicator, but it’s clearly a sign we should not ignore going forward. Santa Claus did come to town last year, marking the seventh consecutive year stocks were higher during this historically strong period. The Fed will eventually have to acknowledge that price pressures also are easing in a broad manner. The implication is that the Fed does not need to maintain as strict a policy as it has. This is what investors are currently betting will happen, at least in the bond market. We expect more turbulence ahead, but we don’t think investors should wait for the all-clear signal that everything is better before investing in the market.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Bank of America, Carson Investment Research, JP Morgan

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.