October saw the best month on record for the Dow since 1976 — a nice reversal after a tough September. The market continues to focus on inflation as the Federal Reserve meets this week to announce a fourth consecutive increase of 75 basis points.

We also have been receiving questions about what next week’s midterm elections may mean for the market — and for your portfolios. The United States is undergoing probably the greatest bout of political volatility since the Civil War. In six of the seven federal elections since the Financial Crisis of 2008, voters have removed the party in power over either the Senate, the House or the presidency.

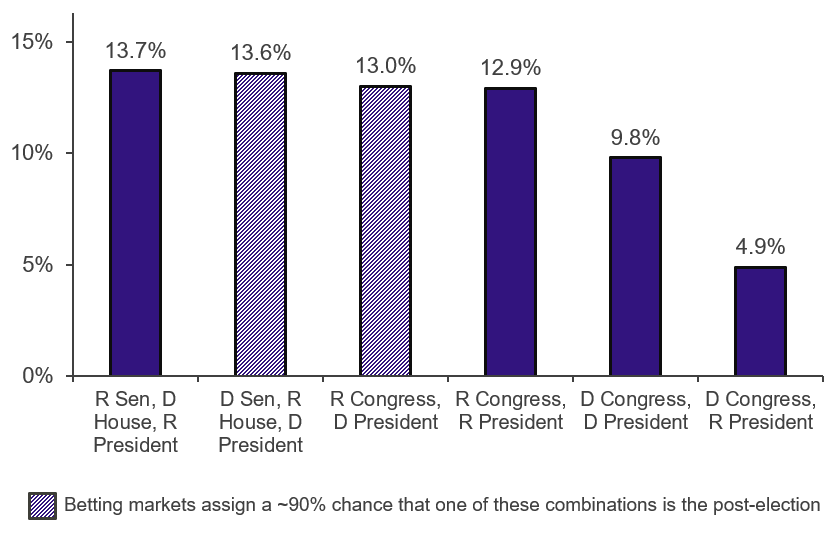

It is difficult to predict who will win an election, but it is even more challenging to predict how the market will react. The market does not care who wins, but which policies are eventually enacted — and how they may affect the economic landscape. Changing a portfolio based on potential election outcomes is not a prudent decision. The chart below provides some perspective; no matter which party is in the White House and which party controls Congress, the markets have performed well over the long term.

Average Annual S&P Performance Based on Partisan Control

1933-2019 (excluding 2001-02, when Sen. Jeffords changed parties)

Here are a few potential implications from the upcoming midterm election:

1. Stocks have done well under every possible party configuration. Through peace and war, high taxes and low taxes, the market has persevered. Most partisan combinations saw double-digit returns, except for one, and that may have been due to bad luck.

2. The stock market is influenced by many factors, of which only a few are attributable to a president or Congress. Political actions are a small piece of the pie. For example, the 1973-1974 oil shock and the 2008 recession accompanied two of the worst markets in recent history. They both happened to occur when there was a Republican president and Democratic Congress. While certain policy decisions may have impacted these outcomes, a tremendous amount of geopolitical and financial complexity led to the ultimate result.

3. A Democratic House and Democratic Senate is the least probable outcome — but the clearest with regard to policy implications. If the Democrats were to win both the House and Senate, President Biden would be able to focus on remaining portions of the Build Back Better program, including additional spending, tax increases and opposition to fossil fuel infrastructure. The market may like this outcome the least.

4. A Republican House and Democratic Senate would probably bring gridlock after Jan. 3, along with a lame-duck session in Congress in November and December. Such a split in Congress would make it difficult for any real legislative policy changes to occur. As the chart above shows, the market has performed well with this political mix.

5. Republican control of the House and Senate would give them the most leverage. There could still be action during the lame-duck session, but it would require more compromise. The big issue between Congress and White House would be the debt ceiling that must be raised at some point in 2023. When one party controls Congress and the other party controls the White House, the market historically has seen positive results.

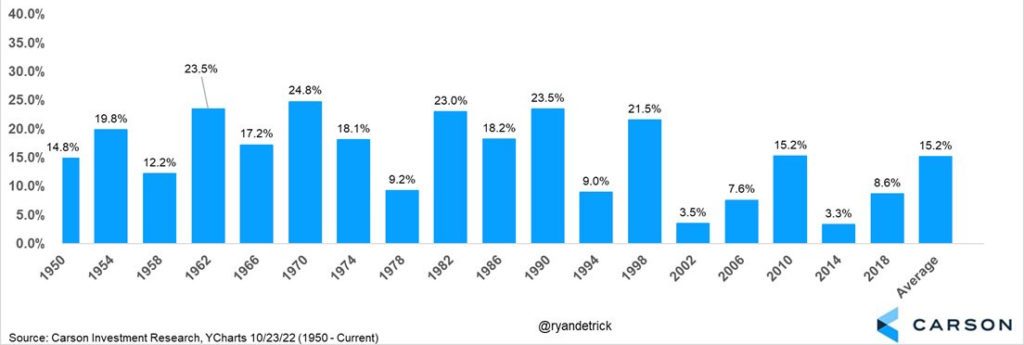

Simply getting to the election has acted as a catalyst for the stock market. The chart below shows the S&P 500 performance for the six months following midterm elections going back to 1950, and in each case, we have seen positive returns. The S&P 500 has not declined in the 12 months following a midterm election since 1942. Volatility in the market tends to be higher during midterm election years, and this year has been no different — with inflation, rapidly rising interest rates and geopolitical turmoil overseas.

Politics is an emotional game. and some of our worst biases and behavioral mistakes show up when we let our emotions influence our decision making. Investing is no different. We are here to work with you through the political noise and election-year volatility, regardless of the political winds.

Here Comes the Best 6 Months of the 4-Year Presidential Cycle

S&P 500 performance, November-April during midterm years

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: American Funds, Baird, Carson

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.