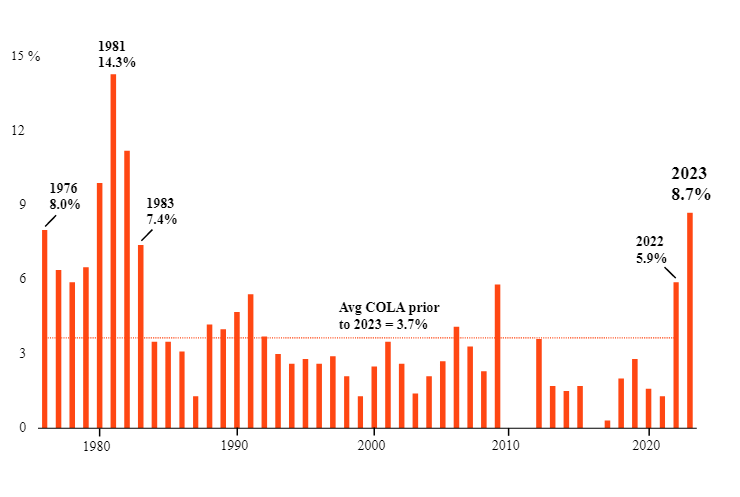

As we approach the end of the year, the IRS and Social Security Administration have released their 2023 adjustments. High inflation has led to a high cost of living adjustment (COLA) that will hit Social Security benefits next year: The 8.7% increase is the largest ever granted to today’s retirees, and it comes on the heels of a sizable 5.9% increase in 2022. The last time COLA exceeded 6% was more than 40 years ago, during double-digit inflation. As shown in the chart below, the average COLA before 2023 was 3.7%, and over the last decade, the average increase was only 1.9%.

2023 COLA is the highest ever for today’s retirees

Social Security cost of living adjustments, 1976-2023

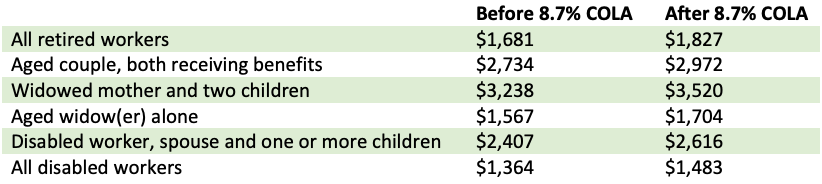

On average, Social Security benefits will go up more than $140 per month – from $1,681 to $1,827 — and the average disability benefit will increase by $119 per month. To find out exactly how much you will receive next year from Social Security, you can calculate the change by multiplying your net Social Security benefit by 8.7%. The chart below provides average Social Security benefits for different recipients and may help provide further clarity.

Estimated average monthly Social Security benefits in 2023

The table shows the average monthly Social Security benefits for different qualifying recipients both before and after the 8.7% cost of living adjustment.

The threshold for the taxation of Social Security benefits is not indexed to inflation and remains constant. As the benefit and other retirement income adjusts upward over time, more people will cross the threshold and pay more in taxes for their benefits. An individual’s Social Security income is taxed based on a combined income formula that includes wage income, interest, dividends, pension payments and taxable distributions from 401Ks and IRAs. If your combined income is above $34,000 for a single person and $44,000 for a couple, up to 85% of your benefit could be taxed.

The COLA should not influence the timing of when you file for Social Security. COLA takes effect automatically for all clients 62 or older, regardless of whether they are currently collecting or have filed for benefits before Dec. 31. Before age 62, an individual’s future benefit is adjusted for inflation through a different methodology.

The decision to start collecting benefits should be driven only by your circumstances, such as age, life expectancy, marital status and cash flow needs.

There are tradeoffs to consider for filing earlier or later than full retirement age; filing early permanently reduces the amount of monthly benefit, for example.

The IRS announced on Friday that due to higher inflation, it is raising contribution limits for retirement savings plans for 2023 based on cost-of-living adjustments. According to Mercer, the limit increases are the largest ever.

Individual contributions to 401Ks or similar retirement plans will see a $2,000 jump to $22,500, for those under the age of 50. Those who are 50 or older will be permitted to contribute an additional $7,500 per year, for a total of $30,000. At the same time, the IRS raised the limit for contributions to a pre-tax or Roth IRA to $6,500, up from $6,000, where it has been the last four years. Those 50 and older can still make an additional $1,000 catch-up contribution, which is not adjusted for inflation.

Income limits for a Roth IRA will increase as well. The income range for married couples filing jointly increases to $218,000 to $228,000 (from $204,000 to $214,000). For those filing as single, the income phase-out range for Roth IRAs increases to $138,000 to $153,000. SEP IRA contribution limits will go up to $66,000 from $61,000.

This year’s COLA can help you keep up with higher costs. In the short run, managing withdrawals from the portfolio may help smooth out the tax bumps during a period of high inflation. In the long term, however, tax planning should be a multi-year approach and strategic in nature.

Whether you are planning for the next year or next decade, managing taxes throughout retirement needs to be well thought out, working with your financial advisor and tax professional to understand the tax impact of any planning decisions.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Blackrock, CNBC, Fidelity, Social Security Administration

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.