As expected, the Fed did not raise the Fed Funds rate last week, but it did leave the door open for at least one more rate hike this year. The Fed also indicated that fewer interest rate cuts may happen next year than had been previously expected. The bias position of “higher-for-longer” caught the market somewhat by surprise, as the Fed’s board of governors moved rate projections for next year to just 50 basis points (.50%) of interest rate cuts, compared to the 100 basis points (1.00%) reduction from the June forecast.

Fed Chairman Jerome Powell said the Fed is concerned that continued economic growth could reignite inflation. Instead of wondering how high rates will go, investors are now wondering how long they will remain high.

Markets did not react favorably to the news. Other circumstances continue to weigh on the market as well, most notably the pending government shutdown and autoworkers strike. While we don’t believe a government shutdown negatively affects the market over the longer term, the uncertainty caused by a shutdown can have short-term implications.

For example: The Fed is data dependent, and if there is a shutdown, key data may not be available for the Fed to interpret. If the shutdown were to last for several weeks, this could impact the Fed’s decision as to whether to raise rates; the shutdown’s economic impact would lead to additional headwinds, potentially giving the Fed pause.

In some ways, Chairman Powell’s rhetoric may be geared toward the stock market. If he were to pivot to a more dovish tune — favoring lower rates sooner — this may push the market higher (for both stocks and bonds) and could result in loosening of financial conditions. This in turn could also reignite inflation — which is exactly what he wants to avoid.

The Fed is working hard not to allow inflation to rear its head again, after it has steadily declined over the last six months.

The underlying data still suggests that inflation is moderating, even though August CPI was higher than expected. As we have written before, shelter costs — a measure of rents only and the largest component of CPI — continue to drop as rents appear to be flattening out or declining in many cities.

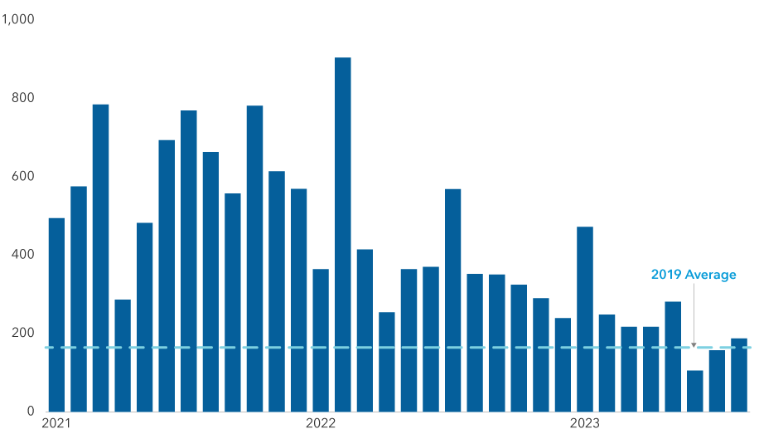

At the same time, the unemployment rate rose from 3.5% to 3.8% in August. The labor market is a key factor for the Federal Reserve for setting policy, and it is showing softness. As seen in the chart below, the U.S. nonfarm payroll — which represents about 80% of all workers — is a measure of how many people are employed in manufacturing, construction and goods. While it saw an uptick in the last few months, the level of nonfarm payroll remains well below the last three years.

This is a good sign for the Fed, as one of the goals of lowering inflation is raising unemployment. The supply chain of workers also is on the rise, as the employment-to-population ratio (for prime-age workers) has recovered to where it was in the late 1990s and early 2000s.

A Cooling Job Market Could Remove Pressure for Additional Rate Hikes

Monthly change in U.S. nonfarm payroll employment (thousands)

The investor’s mood has shifted over the last few months, going from optimism about the year’s strong start to negativity and concern that the market is going lower. Volatility, as measured by the VIX index, rose 25% last week from levels not seen since before the pandemic. The market, as measured by the S&P 500 Short Range Oscillator, is moving closer to oversold territory. Oil prices are hovering around $90 per barrel. The 10-year Treasury has climbed to more than 4.5%. A government shutdown is on the horizon.

For long-term investors, however, it can be helpful for stocks to pull back and catch their breath. The economy is picking up steam as economists have raised GDP expectations for the remainder of the year. The Fed did not change its long-run rate expectations. Credit markets remain solid, and the U.S. economy continues to create jobs.

Two additional strong forces, artificial intelligence and industrial policy, could continue to move markets higher. AI continues to improve efficiencies, which in turn raise profit margins. Fiscal policy has incentivized companies to invest in manufacturing, clean technology and infrastructure projects. These trends are projected to continue for many years and potentially deliver support to equity markets.

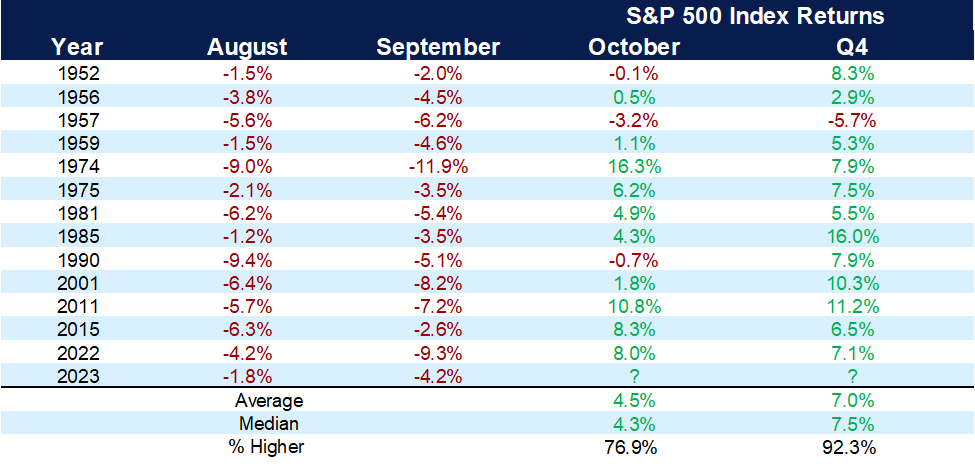

The chart below is a good reminder that a down performance in August and September doesn’t mean the fourth quarter will play out the same way. Since 1952, the S&P has returned an average of 7% during the fourth quarter when August and September were negative.

Down Big in August and September Isn’t a Bad Thing

S&P 500 performance when down 1% or more in both August and September

When the markets are feeling the most negative is a time to feel optimistic. You can always find reasons to be negative and feel like the market will go down, but there also is always the ability to be optimistic and find market opportunities.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Source: CNBC, Capital Group, Bloomberg, Bureau of Labor Statistics, JP Morgan, Carson Financial

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.