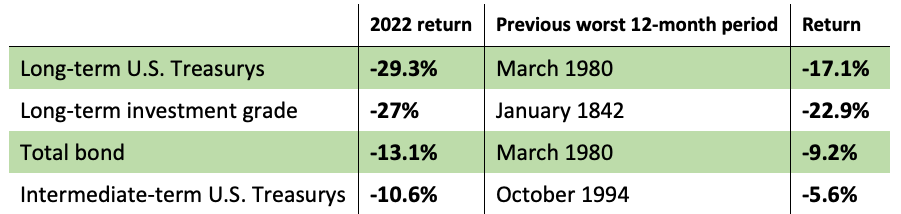

As we all are aware, bonds experienced a significant meltdown in 2022. Historically thought of as the boring, relatively safe part of an investment portfolio, bonds typically are a shock absorber. As we wrote many times last year, bond returns were anything but boring. Edward McQuarrie, a professor emeritus at Santa Clara, said 2022 was the worst year on record for U.S. bond investors; longer-dated bonds like the 30-year U.S. Treasury lost 39.2%. (You would have to go back to the late 1700s to find a worse return!)

Returns on U.S. Bonds Hit New Historic Lows in 2022

The bond dynamic appears to be shaping up very differently for 2023. The Fed is poised to continue raising rates (even as we write this, the Fed will raise rates again this week). However, the increase is unlikely to be as dramatic as 2022. Strong yields and the prospect of a less hawkish Federal Reserve are breathing new life into bonds. (A hawk is one that supports higher rates, whereas a dove supports lower rates.)

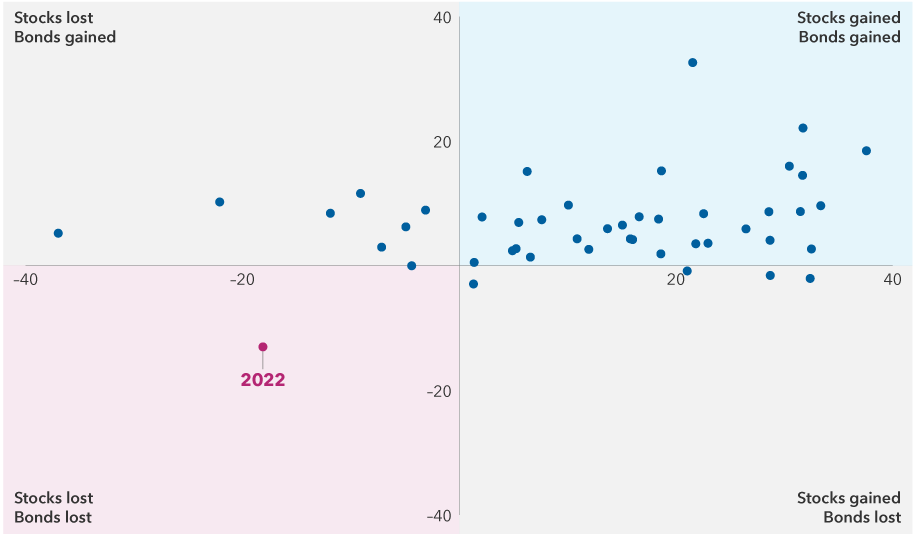

In 2022, there was pessimism in the global markets that was tied to central banks raising rates to rein in decades-high inflation. Both the stock and bond market indexes were down double digits. The losses were unique, with 2022 being the first time in 45 years that both stocks and bonds declined together. The chart below shows stocks and bonds going back to 1977. Notice that 2022 is the only year in the bottom left quadrant, reflecting same-year declines for both.

Annual Returns for Stocks and Bonds Since 1977

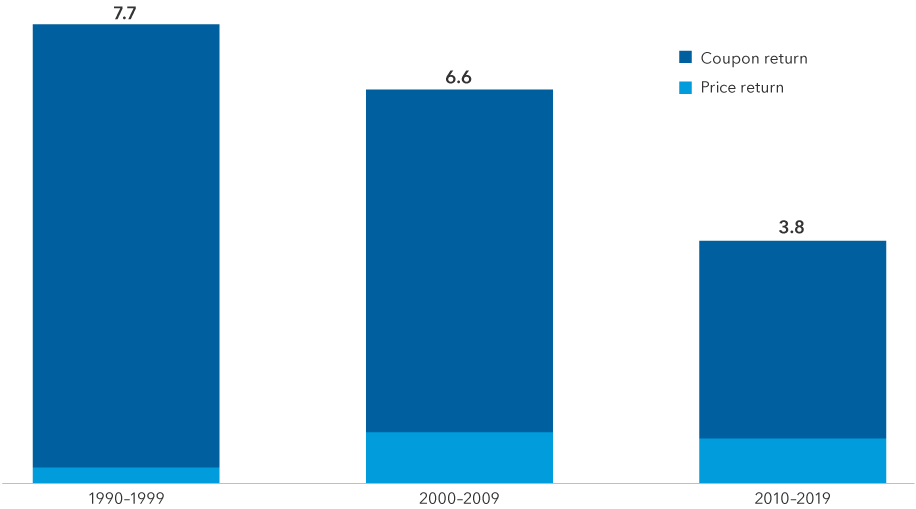

After the Fed hiked rates seven times last year, bonds today offer more income and higher return potential. The yield on the Bloomberg U.S. Aggregate Bond Index, a widely used benchmark for investment-grade bonds, ended the year at 4.68%. This same index ended 2021 with a yield of 1.75%. Bond return comprises both price changes and interest paid. With higher yields, bonds offer more cushion from the income component compared to the start of last year. In the past three decades, bond total returns were driven predominantly from the coupon component, not price changes. If bonds today offer more income and higher coupons due to higher rates, there is a chance for potential higher returns in fixed income.

Total Return Components of the Bloomberg U.S. Aggregate Index

Investors are hoping that we do not repeat the same interest-rate volatility that hit bond markets last year. Inflation is moving in the right direction, and the Fed has dialed down the pace of hikes. Signs of a slowing economy have started to appear beyond the softening of housing demand. Consumers have begun to pull back on buying cars, and retail sales softened in December. The Fed wants to see lower inflation and to achieve that, it needs unemployment to rise and GDP — i.e., demand for goods — to fall.

As of now, the market expects the Fed to pivot from rate hikes to rate cuts either later this year or early in 2024. That would be a positive for bond prices as yields would begin to fall. If we happen to enter a recession, Fed policymakers could look to rate cuts sooner, which in turn would boost returns for fixed income even further.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Bloomberg, CNBC, Capital Group

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.