Last week, the Federal Reserve bank announced to the market a change that has been a few years in the making. The Fed will no longer be strictly beholden to a 2 percent inflation target or an employment mandate.

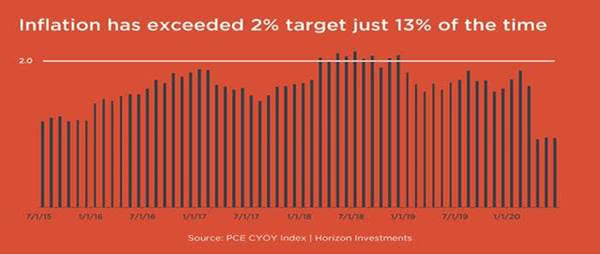

As seen by the chart below, inflation has exceeded the 2 percent target only 13 percent of the time in the last five years. In 2018, the Fed raised rates consistently until the market dropped almost 20 percent in the fourth quarter and then reversed course in January 2019.

Going forward, the Federal Reserve will target an average inflation rate of 2 percent over time. Average inflation targeting implies that when inflation is below the 2 percent level for a period of time, the Fed will work to push inflation over the target level for an unknown period of time to compensate for the lower inflation level.

The Fed did not specify over what period of time it will seek to maintain the average inflation above or below 2 percent or what tools it may use to achieve its goals.

The Fed currently relies on three main tools of monetary policy:

1. Adjustments to short-term interest rates

2. Quantitative easing

3. Forward guidance

Adjustments to the Fed Funds rate have long been the standard instrument for tightening or loosening the supply of money in circulation, incentivizing people to either save or spend more. Quantitative easing is when large-scale asset purchases are made by the central bank to put downward pressure on longer-term interest rates, making monetary policy more accommodative. Forward guidance is the path of future short-term rates.

Other central banks also use negative interest rates as a monetary policy tool; however, the Federal Reserve bank does not believe that this is a desirable option. Despite the amount of money that central banks around the world have added to the economy since the global financial crisis, inflation has remained low. The world has witnessed Japan having very aggressive monetary policy for 30 years with no resulting inflation or growth.

The Fed also is embracing the idea that the economy can allow unemployment rates to head much lower without adverse consequences on consumer prices and worrying that if we become fully employed again, as we were pre-pandemic, it will have to raise rates because of fear of inflation.

Given that inflation is below the current 2 percent target and unemployment is still high due to the pandemic, the changes that the Fed made are not likely to have any big, immediate impact on monetary policy decisions. As the economy recovers, the new statement suggests that the Fed will be holding off on tightening the money supply even if unemployment falls back to the pre-pandemic levels and inflation rises above the 2 percent target.

The implication of the policy change is that the Fed will not be hiking interest rates for years. How long exactly is unknown, and only time will tell, but the next policy review is in five years, and many think that is a logical timeline.

What does this mean for equity and fixed income markets? This new policy stance is more supportive for equity and bond markets and negative for the U.S. dollar.

So what can we learn from all this? The investment maxim of “don’t fight the Fed” will take on new meaning as we will watch and see how the Fed will respond with its new policy.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.