After Apple and Tesla announced plans recently to split their shares of stock, there has suddenly become a growing buzz that more companies will follow in their footsteps. Having seen the market response to these announcements, companies like Amazon, Google, Chipotle, Netflix, Costco and Home Depot may come under pressure to split their high-priced stocks in the near future.

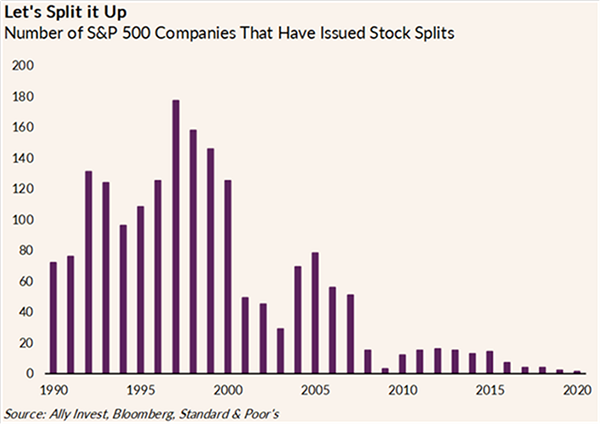

Stock splits used to be a common occurrence. If the stock price broke the $100 level to the upside, that was often a signal to the markets that the company would split the shares of stock to make it more affordable to retail investors. As seen in the chart below, stock splits reached their peak in popularity during the dot-com craze. However, today there are 63 companies in the S&P 500 whose share price is above $250 per share, nine companies trading over $750 per share and seven companies greater than $1,000 per share.

After the market collapse in 2000 and then the financial crisis in 2008, many investors were investing only in index funds and mutual funds, and companies were focused more on the institutional investors rather than individual investors.

There appears to be a new group of younger investors that are now buying stocks. These investors care about the actual price of the share, and companies seem to be taking notice. Many brokerage platforms now offer fractional share ownership of stocks, and these younger and new investors may not be concerned about the actual valuation of the company as much as they are focused on the actual price of the stock.

As already mentioned, there are several positives for companies splitting their shares:

* There is wider appeal to more individual investors by reducing the share price.

* Stocks don’t appear as “expensive” when the price of the share of stock is reduced.

* Help investors with portfolio composition. If a stock price isn’t as highly valued in terms of price, i.e. if you have $10,000, it may not be prudent to buy one or two shares of a stock priced at $1,000 per share.

* Doing so shows confidence in the company’s future.

What many investors are missing is the key component of stock splits: that the split itself is simply an accounting issue that brings the stock price down by increasing the number of shares outstanding up. The stock split adds no real financial value to the company.

If you own a pencil, and then break the pencil in half, your pencil is not suddenly more valuable. You still own only one pencil.

It’s the same idea with a stock split. If you own one share of stock at $1,000 per share and then split the stock in half, you now own two shares of stock at $500 per share each. Yes, the actual price is now $500 per share and seemingly more attractive than buying at $1,000. However, from a valuation perspective, or multiple perspective as in the Price-to-Earnings multiple, that valuation has not changed at all.

So, what can we learn from all this? At the end of the day, buying a company solely because of a planned stock split isn’t likely to be a good long-term investment strategy.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.