In financial circles, “inflation hawks” is a term used to describe policymakers who are willing to let interest rates rise to keep inflation under control. As the Federal Reserve transitions from a dovish stance to a hawkish one in 2022, the market has continued its selloff. Investors appear to be pricing in an even more hawkish stance as they brace for possible action on interest rates from the Fed and keep a watchful eye on tensions between Russia and Ukraine. So far, the Fed has not taken action regarding rate hikes, but it has increased the pace of balance sheet tapering, hoping to slow economic growth so that inflation does not overheat.

The Fed has signaled that it is ready to act on inflation as the data supports it. There is much speculation (but no real knowledge) about how much and how often the Fed may raise rates this year and next to stem inflation. The 10-Year Treasury bond — a benchmark for other debt assets such as corporate bonds, auto loans and home mortgage rates — has started to advance in anticipation of higher rates. Once the 10-Year Treasury starts moving higher, other assets tend to follow, creating a natural slowing of the economy.

Consider home prices as an example. When interest rates are as low as they have been over the last several years, home prices tend to rise as demand increases and inexpensive mortgage rates allow people to have access to monies at lower rates. As the 10-Year Treasury begins to rise, mortgage rates will rise as well, thus slowing down the rate of home appreciation as monthly payments rise and the demand for mortgages decreases.

So how do higher rates affect stock market valuations — and why is the NASDAQ selling off more than other major U.S. indexes? As we previously have written, the 10-Year Treasury acts as the risk-free rate, used to discount future cash flows and earnings for stocks. Fundamental stock market analysis estimates future earnings and cash flows of corporations. These future earnings must be discounted back to today’s dollars to estimate the realistic stock price and the value of a company. As the risk-free or discount rates rise, this reduces the value of future cash flows. This is why we are seeing the more growth-oriented stocks of the NASDAQ selling off more than traditional, brick-and-mortar stocks.

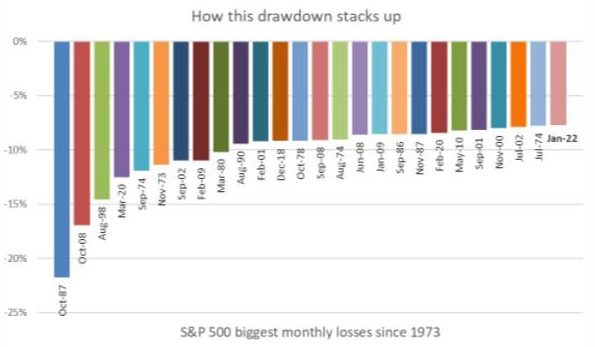

The S&P 500 crossed the 10% correction threshold this week, and while drawdowns in the market never feel good, the chart below shows us this is not the first time we have seen a month like this. (It won’t be the last month like this in our investing lifetime, either.)

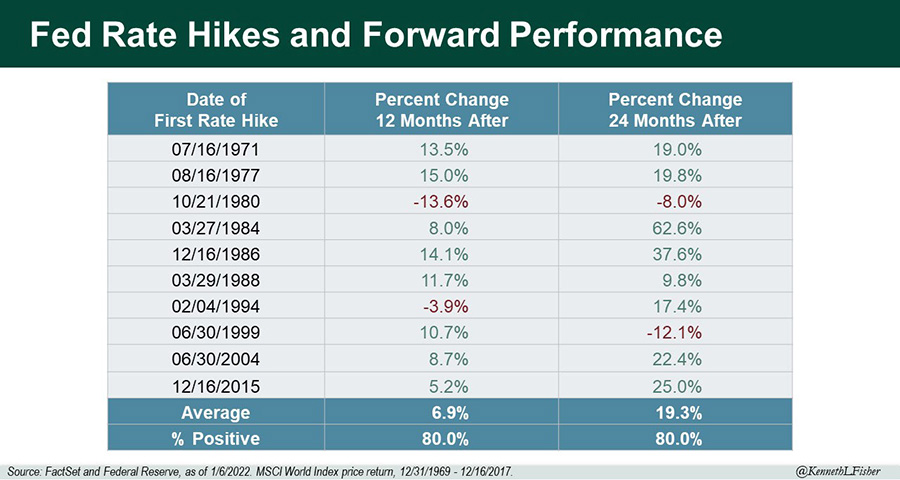

How does the market typically perform when the Fed raises rates?

As seen in the chart below, during the last 10 cycles of rising rates since 1969, the forward performance of the market has been positive 80% of the time, with an average 12-month return of almost 7% and a return of almost 20% two years later. We don’t know how many times the Fed will raise rates this year or next, nor do we know where inflation will be in 12 months. But the stock market is the most well-known leading indicator, and we believe a lot of the selling we are seeing now is in advance of the Fed beginning to raise rates.

So, what can we learn from all this? So far, 2022 has shown a propensity for avoiding the dips, whereas 2020 and 2021 were about buying the dips. We are experiencing larger market selloffs as the volatility index (VIX) has almost doubled this year. We also have experienced the first market correction in the S&P 500 in more than 400 days. Investing is a disciplined process, done over time. It’s important to remember that panic is not an investing strategy. Neither are “get in” or “get out” — those sentiments are just gambling on moments in time.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: FactSet, Blackrock

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures