We have grown accustomed to years of low inflation and lower prices for goods and services, but raw materials, semiconductors and labor now seem to be in short supply. (Anyone doing home construction knows this all too well.)

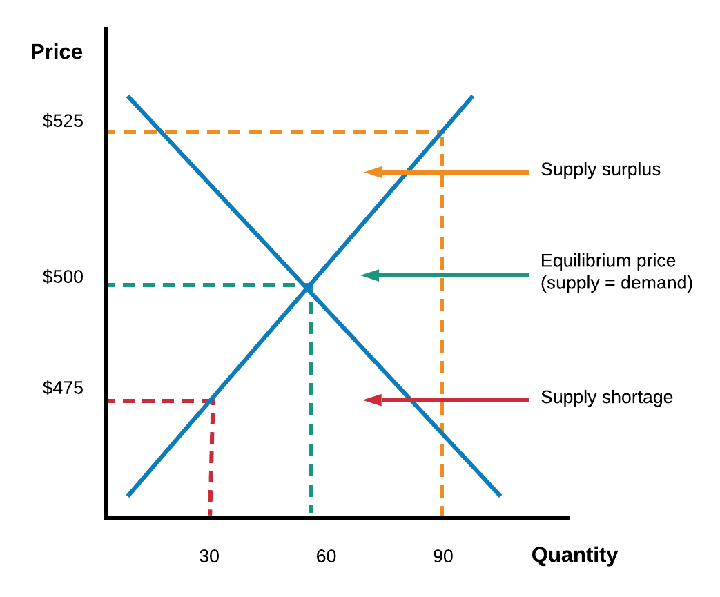

In simple terms, prices are determined by the laws of supply and demand. If demand is low and supply is high, the prices you pay for goods and services are lower. However, if demand is high and supply is low, prices will rise to meet the demand — until the supply can catch up. As the chart shows, if you have a lower quantity of goods and a higher demand for them, retailers can charge a higher price. At higher prices, buyers will begin to demand less of an economic good, and at the same time, sellers will supply more goods for additional revenue. As the supply of goods increases, prices will fall to find an equilibrium between supply and demand. When the supply of goods outpaces demand, prices drop even further.

Remember, multiple factors may affect supply and demand, causing them to increase or decrease in various ways. For example, in Texas and other parts of the country, we are seeing a housing shortage. There is a lack of supply and a strong demand for homes, as people moved to Texas from California and New York in record numbers since the pandemic began. Restaurant prices are higher as commodity prices have risen due to scarcity. Trucking companies are having a hard time attracting new drivers, so they are paying higher salaries, and cost increases are passed on down the line. These are just a few examples that are causing higher, temporary inflationary pressures.

Federal Reserve Chair Jerome Powell says the Fed expects near-term pricing pressures to diminish as supply bottlenecks are resolved and as sharp price declines from the pandemic fade from inflation calculations. The New York Fed’s recent monthly survey of consumer expectations also suggests that many expect the inflation bump to be short-lived.

In the 1970s, President Jimmy Carter took office during a period of stagflation, which occurs when there is high inflation and low economic growth. Several factors are in play today that were not happening during the high inflation of the 1970s:

* Central bank stimulus: Central banks in the ’70s reacted to high inflation by tightening the monetary supply. Today’s response is the opposite, with an increased money supply.

* Fiscal stimulus: We have seen unprecedented fiscal stimulus domestically and abroad. These programs help support business, consumer and investor confidence.

* Capital spending: Supply constraints that exist today may lead to additional capital investment by businesses, especially in semiconductor manufacturing.

* Service sector rebound: As the world economy continues to rebound from the global pandemic, and with Europe and Asia behind the U.S. in the reopen trade, the service sector’s reopening may offset manufacturing weakness.

So, what can we learn from all this? While the current environment does have some resemblance to the 1970s, the differences are probably strong enough to keep investors focused on the positives: reflation driven by solid growth accompanied with inflation, rather than higher prices with slower growth. Optimism in the stock market remains elevated, even with the recent sell-off in the market. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. In the case of potential tax on capital gains or personal tax hikes, the S&P 500 has historically performed well in years of tax increases. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

Given the difficulty of timing the market, the most realistic strategy for a majority of investors is to invest and stay invested over time. Procrastination, or not investing, is worse than bad timing. We continue to view more risk being out of the market than in the market. Riding out future market volatility, in addition to having a diversified portfolio, means staying the course. From an investment perspective, we use trends to help with the strategic and tactical asset allocation and where we see the portfolio heading over the next 5-7 years with short-term adjustments along the way.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. With regards to investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Schwab, Lucidchart, The Wall Street Journal

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures