The news last week that President Trump has COVID-19 has shifted the narrative back to the potential risk of a second wave of COVID-19 lockdowns. If this were to occur, we would see a return to recession for the global economy and a bear market for stocks.

Even as virus cases are on the rise around the world, as seen by Israel instituting a second national lockdown, the United Kingdom rolling out new restrictions, and new cases in France and Spain prompting politicians to consider similar measures, we believe that a return to widespread national lockdowns is unlikely for three reasons:

1. Healthcare systems are not overwhelmed.

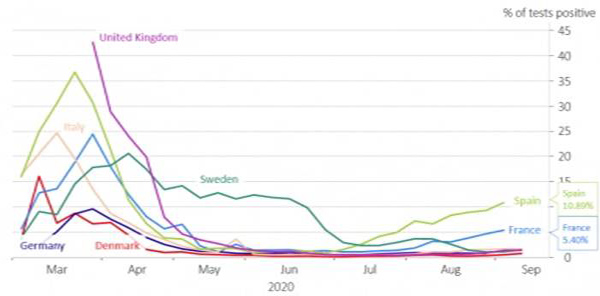

The outbreak in Europe today is different from the outbreak in March and April, as it has not been accompanied by a spike in hospital admissions. At the same time, the hospitalization rate in the U.S. has fallen sharply, according to the U.S. Centers for Disease Control. The rise in new cases in Europe is not alarming when viewed as a percentage of those being tested, as seen in the chart below. The percentage of positive tests is trending upward mainly in France and Spain.

2. Huge economic costs are a factor.

The high economic and social costs make it more likely that governments will respond to new outbreaks with effective targeted restrictions rather than national lockdowns. Countries that deployed lockdowns earlier this year experienced large declines in economic activity, tens of millions of lost jobs and stock market declines.

3. Localized restrictions are paying off.

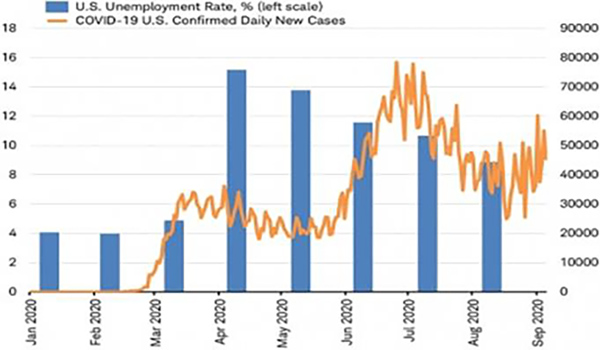

The U.S. experienced a spike in COVID-19 cases this summer. However, as seen in the chart below, the return of targeted restrictions in some states did not lead the economy back into a recession. In fact, the labor market continued to improve over the summer months, recovering almost half the jobs lost in March and April.

China also saw surges in cases in parts of its country and used localized and targeted restrictions. The International Monetary Fund now predicts that China will be the only country in the world to grow its economy, even though it experienced the first wave of COVID-19 at the beginning of the year, and then a second wave this summer.

What does this mean for you?

Continuing to focus on the fundamentals can help you weather the potential market response to an uptick in coronavirus cases. Follow your financial plan and ignore the noise. Remember that market downturns offer the chance to buy stocks at lower prices, which could position a portfolio well for future growth. There are no guarantees that stocks will perform to anyone’s expectations, and decisions could result in losses including a possible loss in principal, but it may be helpful to remember that some investors use downturns as opportunities to buy stocks that were previously overvalued relative to their perceived earnings potential.

Moreover, if you typically invest set amounts into your portfolio at regular intervals — a strategy known as dollar-cost averaging (DCA), which is commonly used in workplace retirement plans and college investment plans — you are using a method of investing that helps you behave like the value investors mentioned above. Through DCA, your investment dollars purchase fewer shares when prices are high, and more shares when prices drop. Over extended periods of volatility, DCA can result in a lower average cost for your holdings than the investment’s average price over the same time period. DCA does not assure a profit or protect against a loss in declining markets.

We will continue to stay the course, just like we did during the national lockdown in March and April. We remain hypervigilant going into the 4th quarter and will make tweaks to the portfolios when necessary.

Sources: Bloomberg, Charles Schwab, European CDC

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.