Now that we are in October and entering the 4th quarter of 2020, everyone’s focus has turned to the upcoming election and how that may impact their portfolio returns. We continue to focus on our clients’ long-term investment plan and on not letting the outside noise affect prudent investment strategies. Historically, whether the incumbent wins or loses, election volatility has usually been short-lived and has quickly given way to upward-moving markets.

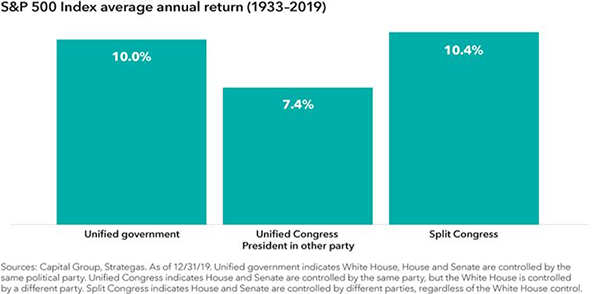

One of the concerns investors have during this investment cycle is a potential sweep by the Democrats leading to a reversal of policies, such as deregulation or tax cuts. Assuming that such an outcome will lead to lower stock prices is over-simplifying the stock markets and their forward-looking abilities. History shows that stocks have done well regardless of which party is in control, as seen in the chart below. The “least good” outcome has been when Congress is controlled by the opposite party of the White House, but even this scenario has provided a 7.4% average return. Voters can take comfort that whether the government is unified under one party or led by a split Congress, all scenarios historically have provided positive equity returns.

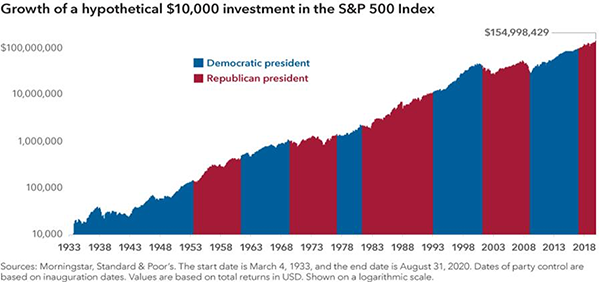

Politics can bring out strong emotions, as seen by the debate this week, but investors need to stay focused on the long term. Which party is in power hasn’t made a meaningful difference to stocks. Over the last 85 years, the general direction of the market has been up, whether the president is Republican or Democrat. What should matter more than the results is staying invested to benefit from the markets moving higher. Each election is important and unique in its own way, and the chart below shows that markets continue to be resilient amid uncertainty, so maintaining long-term focus is critical.

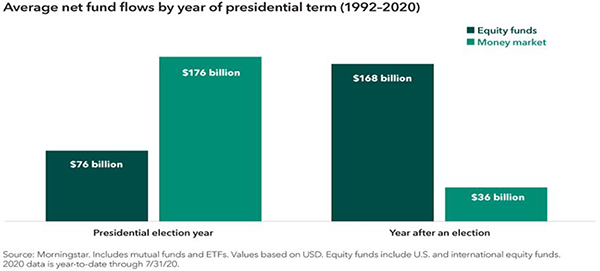

We understand that it can be tough to avoid the negative messages and the noise that constantly bombards us in today’s world. History has shown that elections have had an impact on investor behavior; in election years, investors tend to add money to cash, and then immediately following an election, monies flow into equities as seen in the chart below.

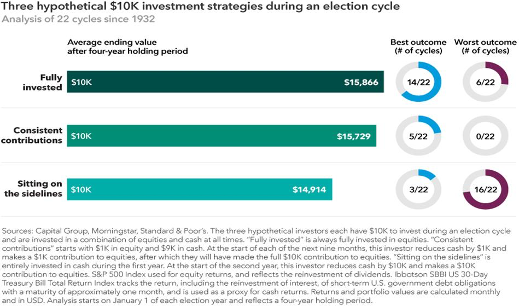

This suggests that investors want to minimize risk during election years and wait until uncertainty has subsided to reinvest their monies into stocks. However, market timing is rarely a winning strategy, and staying invested is the key to long-term success. Historically, the best way to invest in election years is to stay invested. Sticking with a long-term financial plan based on individual objectives and avoiding market timing around politics is usually the best course of action.

What can we learn from all this? The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of who prevails in next month’s election. The economy, and therefore the market, is bigger than the direction that the political winds are currently blowing. Ultimately, it’s the long-term fundamentals that matter. Now more than ever, it is important to maintain an investment strategy based on your own goals, time horizon and risk tolerance.

Data Sources: Capital Group, Strategas, Morningstar, Standard & Poor’s

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.