It is hard to believe we are already more than halfway through 2021. The U.S. equity markets had a strong start to the year — in fact, if the year ended today, the return on the S&P 500 would be higher than the return for seven of the last 10 years.

Fixed income (bonds) has remained negative for this year as longer-term interest rates, such as the 10- and 30-year Treasury bonds, have increased since January. (As interest rates move up, bond prices fall, and vice versa.) In June, we saw a strong reversal in the fixed-income market, and bonds performed well as the 10-year Treasury rates continued their decline.

For the second half of the year, we are closely watching the following major themes:

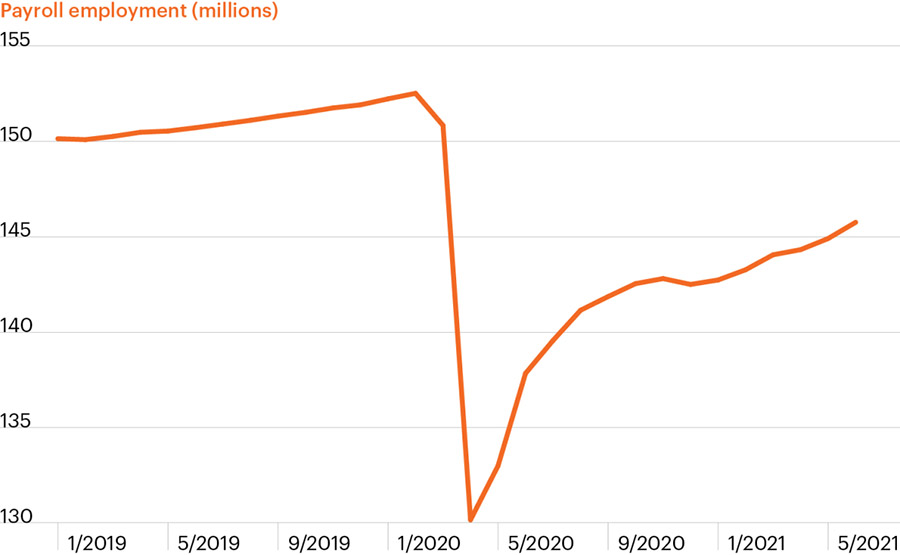

Inflation and Employment: The bond market recently has been acting as if the inflation threat is already over. We have seen prices of lumber fall back to Earth, while oil prices are near $75 per barrel. Last Friday’s job report showed a 3.6% year-over-year hike in hourly earnings. The labor market showed strength in June, adding 850,000 jobs, and the U.S. economy added 3.3 million jobs in the first half of the year. Meanwhile, the unemployment rate rose to 5.9%, up from 5.8% in June. The good news is that the economic recovery continues, and growth is strong. There is a broad expectation that labor supply will return in the fall as kids go back to school and unemployment benefits cease in most states.

The Federal Reserve Bank: All eyes remain on the Federal Reserve Bank and what it will do with interest rates in the next few years. The inevitable question: When will the Fed begin the tapering of asset purchases? Tapering is the reduction of the rate at which the Federal Reserve or bank accumulates new assets on its balance sheet. When the Fed is purchasing large amounts of bonds and other securities, it is increasing liquidity in the financial markets to maintain stability and promote economic growth. As the Fed begins to taper, it is reducing the pace of its purchase of Treasury bonds, which in turns reduces the amount of money it feeds into the economy. Bond yields rise in reaction to the Fed’s tapering. The common assumption is that the Fed will prepare the markets for tapering by the end of the year.

Uncertainty in Washington: A bipartisan group of Senators has agreed to a $1.2 billion infrastructure bill, and the president has announced support for it. However, the devil will be in the details; if the bill passes, there is no agreement in place on how to pay for it. As we have written before, passing tax reform to pay for the infrastructure bill will be difficult, given the current makeup of Congress.

COVID variants: Concerns over the current Delta variant and rising Gamma variant may give some people pause about returning to work. The economy is booming in the U.S. as progress has been made with regards to vaccinations. In parts of the world where vaccinations lag, economies have not reopened to the same extent as in America.

China: China appears to be cracking down on technology companies and bitcoin mining, as we recently discussed. Newly proposed rules seek to restrict Chinese companies from trading on the U.S. stock exchanges. China wants to restrict foreign governments, such as the U.S., from having access to the data of Chinese companies trading on our exchanges. These attempts to restrict business, break up large technology companies and remove bitcoin mining from mainland China could slow down China’s economic growth.

The biggest second-half theme for the markets remains the health of the overall economy. As long as interest rates stay low, additional stimulus from the Fed continues and more people return to work, the economy will continue to expand. The Fed will have its hands full making sure that the economy remains strong (but not too strong) and the recovery continues both here and abroad.

So, what can we learn from all this? Economic reports for the second half of the year will be closely watched — inflation, wages, commodity prices and employment data, to name a few. How the Federal Reserve Bank reacts may affect how long our economy continues this unprecedented recovery.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: FS Investments, Bureau of Labor Statistics, CNBC

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures