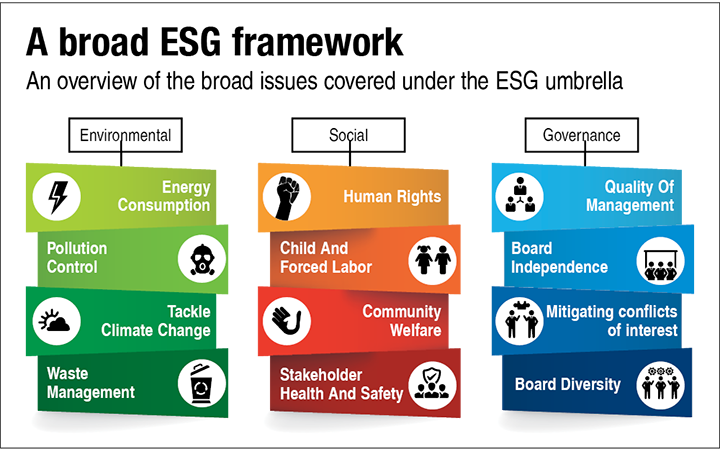

ESG Investing (also called “socially responsible investing”) is not a new fad or trend, but it is making headlines more often in mainstream market commentary. ESG stands for Environmental, Social and Governance, and the abbreviation was first used in a 2004 report published by the United Nations. The table below highlights a broad overview of issues under each umbrella.

A recent example of governance changes in the corporate world was the changing of the makeup of Exxon’s board through the addition of three board members who are political activists. Shareholders voted against Exxon’s recommendations and instead elected new board members who are focused on climate change as well as financial performance. Morningstar’s CEO recently called ESG investing the “new normal,” and the CEO of Blackrock, in his last two annual letters to shareholders, emphasized that ESG principles are “core to long term value creation” for clients.

ESG investing means investing in companies that predominantly focus on environmental and social responsibility.

The goal of ESG investors is to drive capital to companies that work to meet or exceed commonly established standards in each of the three realms. Independent and third-party research groups use a set of criteria to rank and evaluate each company for ESG investing.

1. Environmental: What impact does a company have on the environment? This can explore what chemicals are used in manufacturing and sustainability efforts used in a supply chain, for example.

2. Social: How does the company improve its social impact, not just internally, but also within the community? This explores how a company advocates for social good in the wider world, examining its hiring practices and inclusiveness in the workforce.

3. Governance: How do the board and management drive positive change? This also can involve a company’s leadership makeup and how it interacts with shareholders.

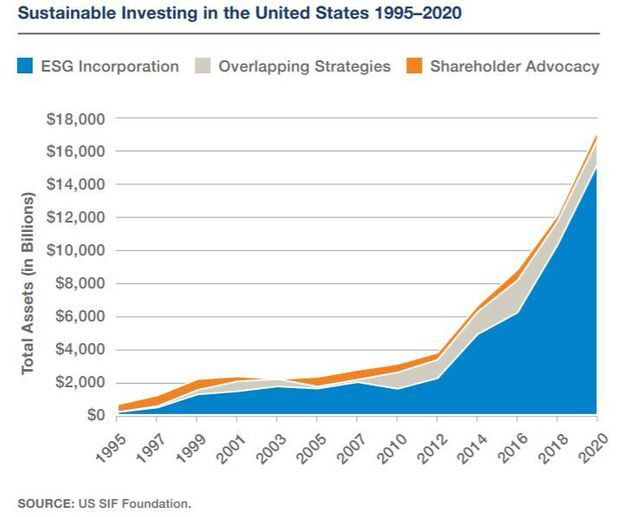

The pandemic has intensified discussions about sustainability and the financial markets, and as the chart below shows, the rise of ESG investing has increased eight-fold since 2000. Almost half of investors currently invest in ESG products — almost double the number of investors since 2019. Investors are placing a significant emphasis on companies’ ESG policies, and the factors driving demand for sustainable business practices are not going away. Proponents of ESG investing argue that sustainability makes for good business and that companies that focus on ESG principles benefit from increased profitability and therefore, higher valuations.

So, what can we learn from all this? ESG criteria are an increasingly popular way for investors to evaluate companies and how they manage their businesses. Many mutual funds and exchange traded funds (EFTs) now offer funds that employ ESG criteria. As with any investment, an investor must weigh the pros and cons and assess the trade-offs any investment offers. Investors should only invest as much as they are willing to lose, and if one does invest, it should be a part of a diversified portfolio.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Robb Report, US SIF Foundation, JustBureaucracy.com, Bloomberg

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures