As we wind down the summer and get ready to enjoy Labor Day weekend, we are looking forward to cooler weather and calmer markets than we have seen in August. The month played out like we thought it would, with the markets taking a respite from the strong start to the year and stocks falling nearly 5% from the late July peak.

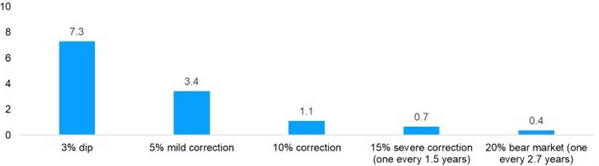

Each year, the S&P 500 typically experiences three corrections of 5% or more and one correction of at least 10%. (In March, we saw a pullback of nearly 8% after the failure of Silicon Valley Bank.) On average, a bear market happens almost every three years. Interestingly, the markets typically see more than seven 3% corrections in a year.

It is vital to remember that volatility is normal — even in a bull market. Thinking of volatility in the stock market as a series of speed bumps rather than a roadblock can help you remain focused on the long-term plan rather than the short-term pain.

Volatility Is the Toll We Pay to Invest

S&P 500 per year (1950-2022)

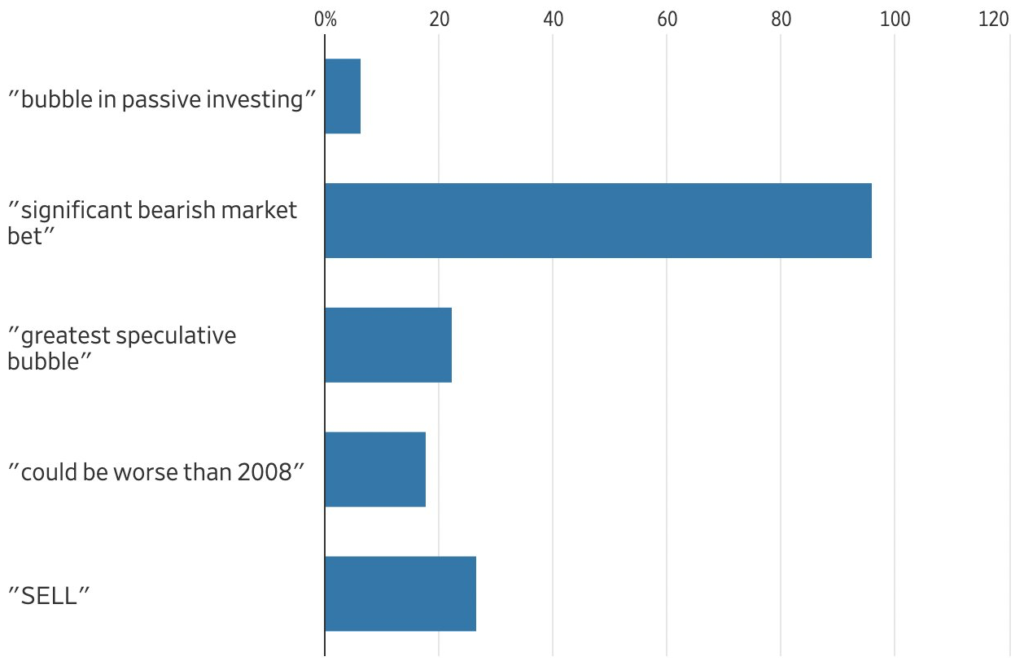

Michael Burry, known for correctly predicting the epic collapse of the housing market in 2008, recently made news with another big bet against the stock market. It’s important for investors to remember that he is a trader who runs a hedge fund. He is not focused on long-term investing. He is hoping that one of his bets hits it big, and he then keeps a large portion of his investors’ profits. He is hoping for one big hit, but the assumption is that he knows he will have many strikeouts along the way.

It may take years for his investment theory to play out — if it plays out at all. We don’t have insight as to changes he makes or when he may decide to close out his short bet against the market. This is not the first time that he or other outspoken hedge fund traders have made bold predictions on the direction of the market. The chart below provides some interesting perspective on Burry’s recent warnings and how the market has fared for the six months that followed. This is a good reminder not to listen to the noise or get caught up in the headlines about large bets against the market.

Burry-ed

Six-month annualized S&P 500 rise after Michael Burry warnings

As fall approaches, we will begin to hear more discussion of a potential government shutdown on Oct. 1. Despite the debt-ceiling agreement earlier this year, Congress has not agreed on spending levels for fiscal 2024.

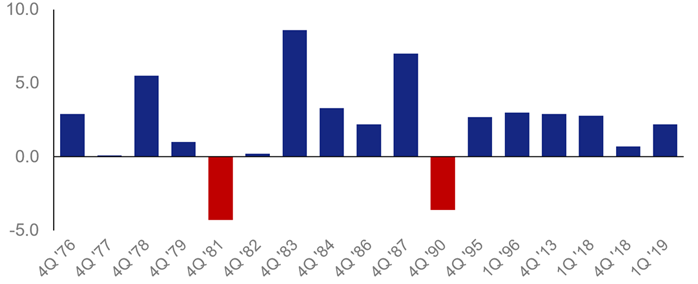

Historically, government shutdowns have not had a major impact on GDP or the stock market. The last six government shutdowns occurred in quarters with positive GDP growth. If another shutdown were to occur, this would be the seventh. However, Moody’s — the only one of the three major rating agencies that has not downgraded the U.S. debt — has commented that a shutdown this fall could lead to either a potential downgrade or put the U.S. on watch for one.

A shutdown may lead to higher spending, which could continue to keep the economy humming along. At the same time, the U.S. is experiencing higher interest service costs due to higher interest rates, higher spending on entitlements and lower tax revenues. All of these factors are worsening the federal deficit. It is more than likely that after the 2024 election, we will be looking at a period of fiscal austerity to rein in spending.

Real GDP Growth Rate During Past Government Shutdowns

Percentage change from the preceding quarter

This year’s key players — the Federal Reserve Bank, Wall Street and Main Street — all suggest that the outlook feels better today than at this time last year. With the market pulling back some in August, valuations look less lofty heading into the final quarter of the year. For fixed-income investors, better protection is being provided as well, with interest rates near peak. It is important to remember that even bull markets see periods of volatility — and volatility is perfectly normal for this time of year.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Carson, FactSet, U.S. Bureau of Economic Data

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.