The Dow Jones and S&P 500 suffered five straight days of losses, the worst weekly performance since June. Different factors may have caused the selling last week: the Delta variant and its impact on slowing economic growth, the Federal Reserve’s tapering and how it may handle inflationary pressures, current stock valuations and potential tax hikes proposed by the Biden administration. Typically, it is something investors don’t see coming — such as a pandemic or global financial crisis — that causes the larger market selloffs, not something that investors already expect.

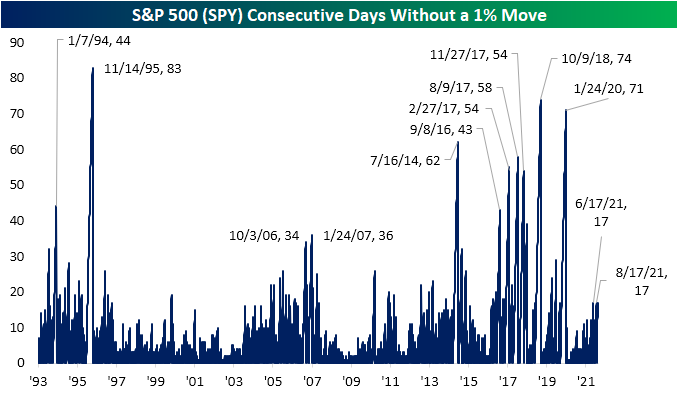

Market pullbacks should be expected, especially since the largest drawdown year-to-date has been 4.2%. The “textbook correction,” in which stocks pull back at least 10%, is natural and healthy market functioning and behavior. As seen in the chart below, the S&P 500 has been in a recent trading lull, going many sessions without a 1% move — but the lull has been nowhere near what we have seen in the last few years.

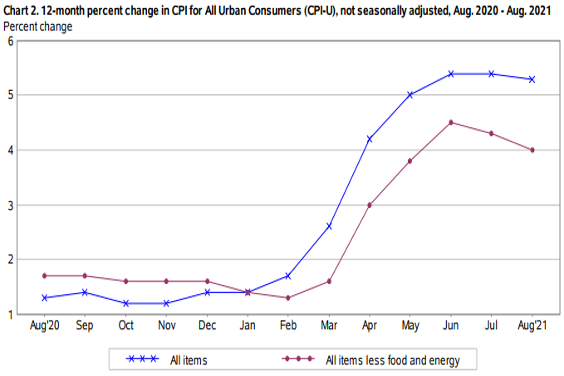

Contributing to the recent market jitters is the current state of inflation and concerns over how to pay for potential additional infrastructure spending. Prices for consumer goods rose less than expected in August, a sign that inflation may be starting to cool. The consumer price index (CPI), which measures a basket of common products as well as various energy goods, increased 5.3% from a year ago. That’s less than the expected increase of 5.4% and a smaller increase month over month. Energy prices accounted for much of the recent inflation increase; energy is up 25% from a year ago, and gasoline prices have surged 42% over the same period.

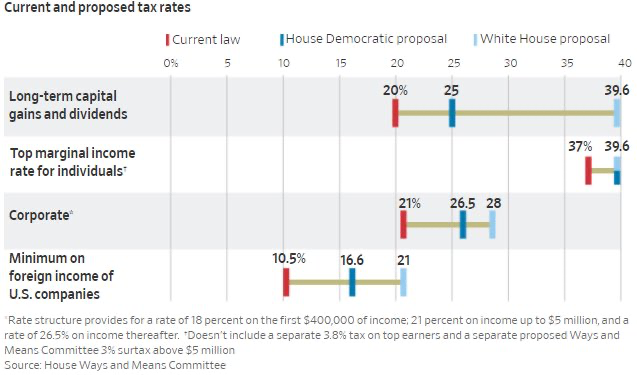

This week, the House Ways and Means Committee released a more detailed overview of potential tax changes to help pay for the proposed infrastructure and expansion of social programs. The highlights of the current plan are as follows:

* Top marginal tax rate increase from 37% to 39.6%; also, a 3% surtax on individuals with adjusted gross income greater than $5 million.

* Capital gains rate increase from 20% to 25% for “certain high-income individuals.”

* Changing the corporate tax rate from a flat tax to a tiered tax rate, with the proposed top rate at 26.5%.

* Estate and gift tax exemptions would drop back to $5 million (plus inflation adjustments), down from the current $11.7 million per person.

* Eliminating Roth conversions for IRAs and workplace plans for married couples earning more than $450,000 (and for individuals earning more than $400,000).

Remember, these are proposed tax changes that still have a long way to go before becoming law. Changes can and will occur as negotiations continue over the infrastructure spending package. In our opinion, concern about changes in estate tax law is a good reason to consult with estate attorneys to discuss the current plan. Similarly, avoiding potential higher capital gains rates may be a good idea if it makes sense in the context of your overall financial plan. It is important to remember that the proposed tax changes are just that: proposals, not laws. We will be ready and proactive if tax law changes occur for capital gains and Roth IRA contributions.

So, what can we learn from all this? The stock market continues to digest mixed economic messages as well as the impact of the Delta variant, inflationary pressures, and the Federal Reserve’s response to tapering, rates and potential tax hikes. It is important not to focus on one data point or one indicator, but to look at the big picture.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: CNBC, The New York Times, Forbes, House Ways and Means Committee, U.S. Bureau of Labor Statistics

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures