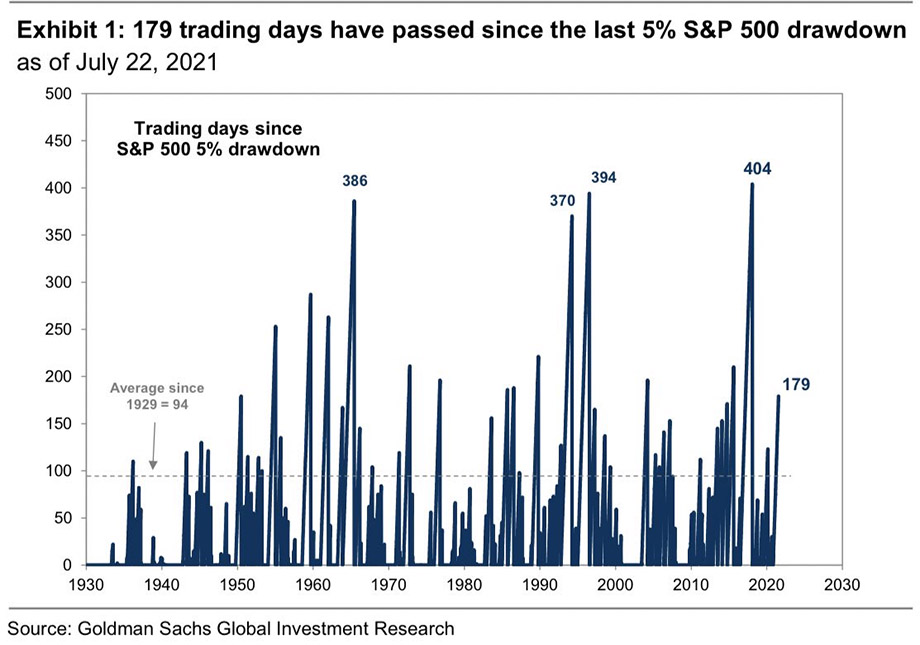

The S&P 500 recovered quickly last week from the brief pullback on Monday, as the spread of the Delta variant, higher inflation and concerns over China’s growth and policy scared the market. It has now been more than 179 trading days since the last 5% drawdown in the S&P 500. This stretch is almost twice the length of the historical average of 94 days between 5% pullbacks in the market, and it now ranks as the 15th-longest period without a 5% decline in the last century. The longest on record was 404 days, ending in February 2018, as seen in the chart below.

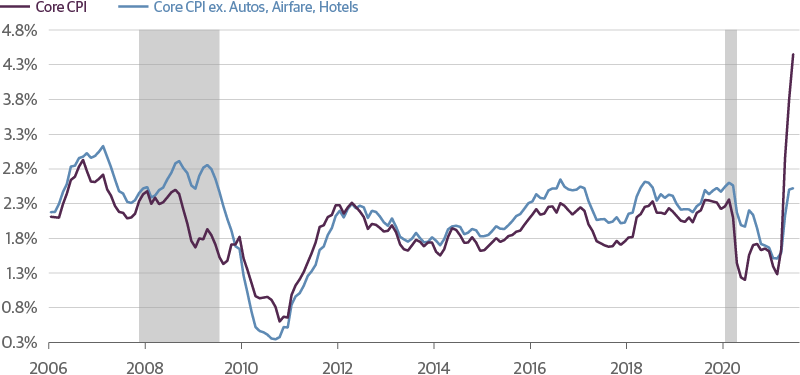

Investors worry that inflation will lead to a market correction, especially after June’s surprise of 5.4% year-over-year inflation. However, if one looks at the underlying causes of the recent run up in inflation, it continues to be driven by a few smaller categories. As seen in the chart below, most of the recent jumps in inflation were due to price increases on new and used autos, car rentals, hotel stays and airfare. Increased prices for car rentals, hotel stays and airfare are in response to the surge in demand for travel after a year of restrictions due to the pandemic. The largest increase was in used cars, which grew at 10.5% over the month, and many economists think that wholesale used car prices have already peaked. Hotel prices are almost above pre-COVID levels. For inflation to remain elevated, however, more widespread price increases will need to factor into Consumer Price Index (CPI) increases. Healthcare and housing are the largest weighted categories within CPI. Healthcare prices were flat month over month, and homeowner rents showed no acceleration in May.

Inflation is not an event; it is a process that has many steps and takes time to unfold. Imbalances in the U.S. economy remain from the global pandemic, leading to significant short-term inflationary pressures. Supply and demand for labor is a perfect example of this imbalance. Demand for labor is strong while supply is limited, thanks in part to early retirement, healthcare concerns and family considerations, along with unemployment insurance payments. This mismatch is creating upward wage pressure. The Federal Reserve does not believe that we are facing a serious threat of long-term inflation, but we are experiencing a temporary period as the economy processes some short-term supply and demand imbalances, such as wage increases.

So, what can we learn from all this? We believe that investors should not overreact to the potential rise in inflation by making sudden and significant changes to portfolios. We continue to closely watch economic reports such as Consumer Price Index (CPI), unemployment and GDP growth. We also continue to monitor the COVID variant’s effect on the global economy and Federal Reserve policy, as well as China and its increased regulations and restrictions.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Goldman Sachs, WSJ, Blackrock, Guggenheim

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures