In many of our weekly emails, we mention the Federal Reserve and the actions it may take to help maintain the economy. If you’re not entirely familiar with the Fed and what it does, you may be wondering why we bring it up so often.

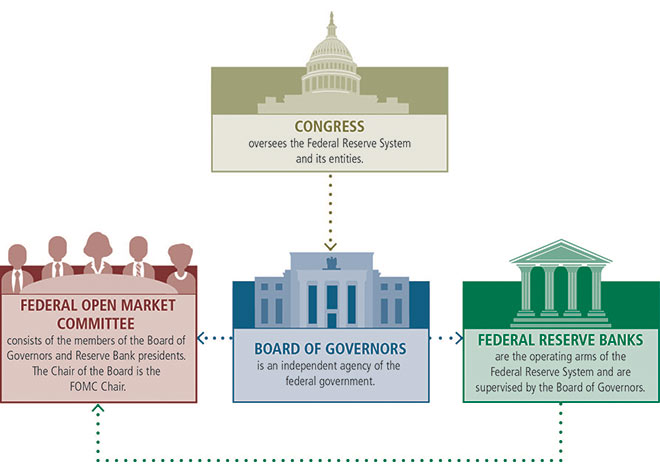

The Federal Reserve includes the Board of Governors, regional Reserve Banks and the Federal Open Market Committee (FOMC). The chair and the Board of Governors are political appointees who are chosen by the president and report directly to Congress. (Jay Powell is the current chair.) The Board of Governors oversees the 12 regional Federal Reserve Banks, one of which is in Dallas.

The Federal Reserve has five main functions:

1. Conducting monetary policy

2. Promoting financial system stability

3. Supervising and regulating financial institutions and activities

4. Promoting consumer protection

5. Fostering payment and settlement system safety and efficiency

Conducting monetary policy and controlling interest rates are the primary functions from a market perspective. Monetary policy refers to actions taken to control the money supply and achieve goals that promote sustainable economic growth, using tools such as:

1. Open market operations: buying and selling of U.S. government securities (i.e., Treasury bonds)

2. Reserve requirements: setting the percentage of deposits that banks are required to hold

3. Interest on reserves: setting the interest rate paid to banks for their reserves that they are holding

4. Discount rate: setting the interest rate charged to banks that borrow money from a Federal Reserve Bank

A big question that came up in the news this week concerns when will the Fed begin to taper its purchases. The Fed uses monetary supply to help control the economy. When the economy is weak, it can purchase Treasury bonds from the marketplace to add liquidity into the system, which in turn helps boost economic activity. If the Fed wants to slow down the economy to prevent overheating, then it reduces its bond purchases, slowing the additional liquidity and putting the brakes on economic growth. If the Fed wants to reduce the money supply, it can sell bonds in the marketplace, which takes money out of the economy.

“Tapering” is a term used to describe the process of gradually stopping asset purchases with no predefined end date or amount. When the Fed begins to taper, it starts the process of buying fewer bonds, which reduces additional money flowing into the economy in hopes of slowing economic growth so that inflation does not overheat. The Fed likes to signal its intentions around tapering well in advance to minimize the impact on the financial markets. Tapering is likely to be a gradual process that will take many months to complete.

Another action that the Fed uses to help control the economy is setting the discount rate. When the economy slows down, the Fed will lower interest rates to help spur economic activity. This encourages more lending, which in turn adds money to the economy. For example, at the start of the pandemic, the Federal Reserve cut the discount rate from 1.75% to 0%, where it sits today. The move was a drastic one, taken to prompt economic growth; the Fed did not want a repeat of the Global Financial Crisis and acted swiftly and appropriately. When the economy is growing rapidly, the Fed may raise interest rates to help slow economic growth, with the hope that inflation does not spike. Typically, raising rates is a more gradual approach, with smaller increases seen on a quarterly basis instead of a large, one-time increase.

The Fed has many other responsibilities, but its actions through interest rate changes and open market operations have the greatest impact on the market and the economy, which is why we hear about them often in the news.

So, what can we learn from all this? We believe that the Federal Reserve will signal to the markets that it is going to begin tapering asset purchases. We hope it will be an orderly process so market volatility will be more limited than at times in the past. At the same time, tapering signals that the Fed will have the flexibility to raise rates — possibly sooner rather than later. Investors should not overreact to market headlines by making sudden and significant changes to portfolios. We continue to watch economic data closely and monitor the COVID variant’s effect on the global economy and Federal Reserve policy, as well as on China and its increased regulations and restrictions.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Federal Reserve Bank of St. Louis, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures