The stock and bond markets continue to hinge on the Federal Reserve’s battle against inflation. From September to October, inflation remained flat, as tracked by Consumer Price Index (CPI). This report came as gasoline prices fell 5% for the month, which in turns means that households have more money to spend.

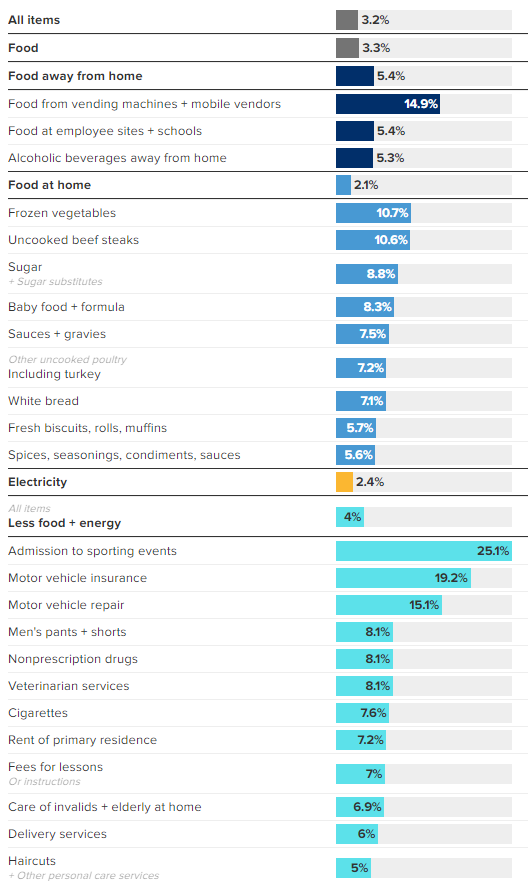

CPI, which measures a broad basket of goods and services and is a key barometer for tracking and measuring inflation, increased 3.2% from a year ago. The chart below shows price changes for core categories year over year.

What’s not in the chart is shelter, which is the average household’s biggest expense. This has accounted for more than 70% of the total year-over-year increase in CPI. Most inflationary pressures still stem from the pandemic and the imbalance between supply and demand.

Inflation Breakdown for October 2023

These are some of the core categories, plus other items with notable year-over-year price changes.

Supply chains were totally thrown off during the pandemic, driving up prices for goods at the same time consumers were flush with cash. Since then, supply chains have returned to normal, but it takes time for prices to ease. The annual level is the lowest in two years but still above the Fed’s 2% tracking level. Both the stock and bond markets are sending signals that the Fed is through raising rates, but the data continues to send conflicting signals.

Last week, Fed Chairman Jerome Powell said the Fed remains unconvinced that it has done enough to get inflation down to the 2% annual rate and won’t hesitate to raise rates if needed. Uncertainty remains over how long the Fed will keep the benchmark rate at its current levels.

After we saw the best week of the year for stocks two weeks ago, the market continued to show strength last week with another strong market return. Following the release of the CPI number on Tuesday, the stock and bond markets rallied. If inflation remains on a sustainable path lower, the Fed may cut rates sooner than expected in 2024.

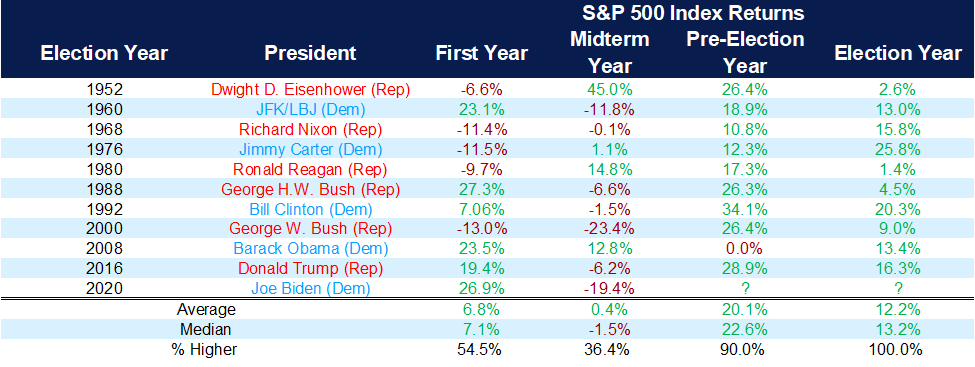

If the Fed were to cut interest rates earlier than expected, we could see the stock market trend higher. With 2024 being an election year, the Fed probably will tread lightly so as not to influence the vote. An interesting side note: For the last 10 new presidents, stocks have been higher during an election year, with an average return of 12.2%.

Stocks Have Never Been Lower in an Election Year Under a New President

S&P 500 performance under new presidents (1950-current)

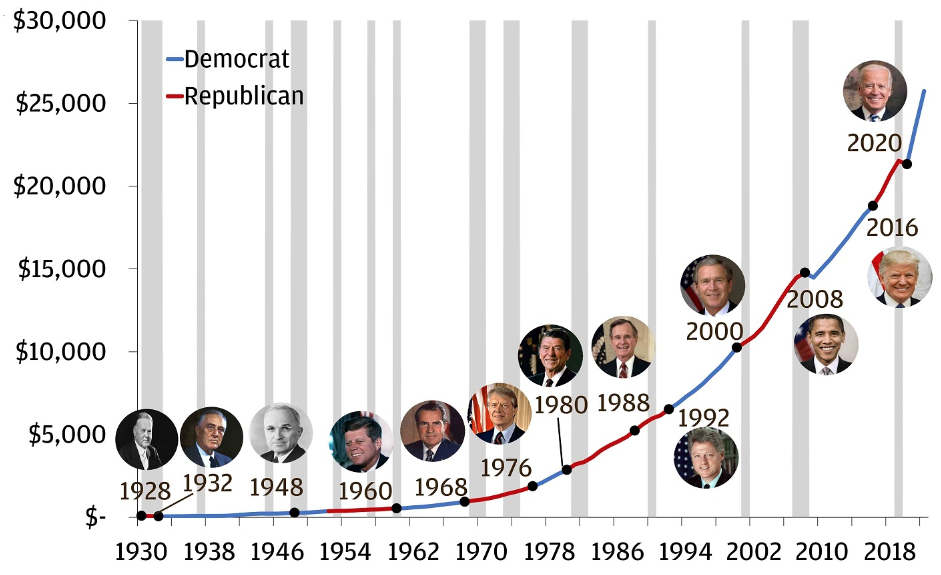

We understand that elections can cause anxiety over who may win and what may happen. Elections can impact the economy and the markets based on each candidate’s proposals, but it is far too early to outline what that may look like. What we must keep in mind is that the economy has continued to grow throughout every presidency in our nation’s history.

Market volatility may increase because we don’t know who will be in the White House, but stocks tend to forge ahead as uncertainty fades. Elections seem like a big deal in the moment, but historically they have had little bearing on what paths the economy and the market ultimately will take.

The U.S. Economy Has Continued to Grow Regardless of Who Is in the White House

U.S. Nominal Gross Domestic Product (GDP), USD billions

We will continue to beat the drum next year to remind our clients that what matters most is the macro economy, not who may or may not win the election. Evidence is becoming clearer that the economy will avoid a hard recession — and may avoid a recession altogether. That does not mean that there are not risks, especially with the conflict in the Middle East and Ukraine, but regardless of which way the election swings, opportunities are always present.

Based on the likely scenario that the Fed is through with rate hikes, the most readily apparent consideration is that yields typically fall soon after. This means that cash will carry reinvestment rate risk. In other words, when the Fed begins to lower rates, money market rates will drop as well. If you are waiting to deploy cash due to higher money market rates, know that it may be too late to put that money to work into either stocks or bonds once the Fed cuts rates.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Carson, CNBC, JP Morgan

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.