As we move into the second quarter of the year, we want to provide a recap of the first quarter and our thoughts on what we see for the months ahead. As is typical with the markets, the first three months of 2023 were anything but dull:

• After raising rates last year by 425 basis points (4.25%), the Federal Reserve raised rates again by 25 basis points in both February and March.

• The money supply, measured by M2, went negative, and quantitative tightening basically went unnoticed.

• The yield curve remains inverted. (Remember, every recession has been preceded by an inverted yield curve, but not every inverted yield curve leads to a recession.)

• Gold prices are near all-time highs.

• Egg prices soared to historic levels.

• The war in Ukraine entered its second year with no apparent end in sight.

• Capping it all off, significant bank failures in both the U.S. and Europe triggered a short sell-off and revived worries of the 2008-2009 financial crisis.

Through all of this, the market was higher for the first quarter, led by the NASDAQ and large-cap technology stocks. Last year’s laggards – technology, consumer discretionary and communication services – turned into first-quarter leaders, while last year’s leaders — energy and utilities — were the laggards.

Money market funds soared with total inflows of $5.1 trillion, far exceeding the pandemic peak of $3.2 trillion. This was a result of the Fed raising rates nine times over the last year as well as a lack of confidence in small and regional banks following the Silicon Valley Bank fallout. We expect to see a dramatic tightening in lending standards enacted this year. Small to mid-size banks are likely to be subject to stricter regulations, such as higher capital and liquidity requirements, periodic stress testing and restrictions on types of investments banks can employ in their bond portfolios (similar to the largest financial institutions).

With stricter lending standards, the strong will get stronger — not just banks, but also in other industries where companies have strong cash flow and fund their own growth.

Looking ahead, the equity environment remains focused on inflation, residual banking turmoil, the Fed and interest rates and the prospect of a recession, both here and abroad. We continue to watch the labor market — which showed strength in March with the unemployment rate near a 50-year low — consumer liquidity constraints, commercial real estate markets and how these factors play out on corporate earnings and ultimately margins.

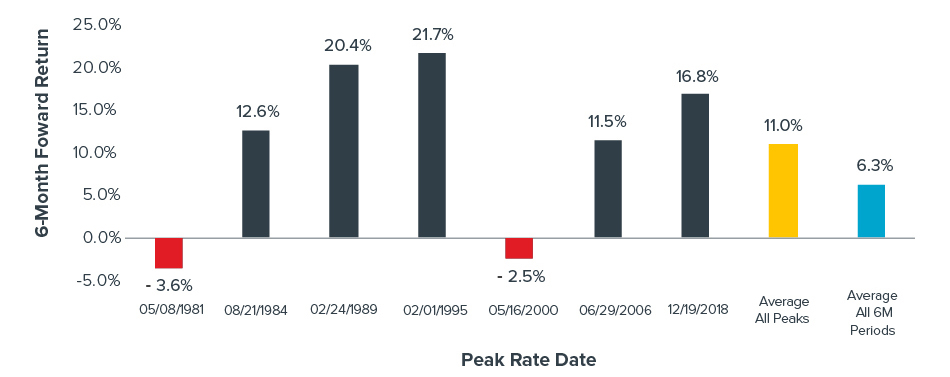

Expectations about the Fed and interest rates have shifted in the wake of the banking crisis, and the market is forecasting that we may be close to peak rates for the current cycle. If that is the case, equities could benefit. The chart below shows that in the six-month periods after federal funds have peaked, stocks gained an average of 11%. In the seven such cycles going back to 1981, five were positive and losses were relatively small in the two periods where stocks were negative.

Russell 1000 6-Month Forward Returns Following Peak Rates

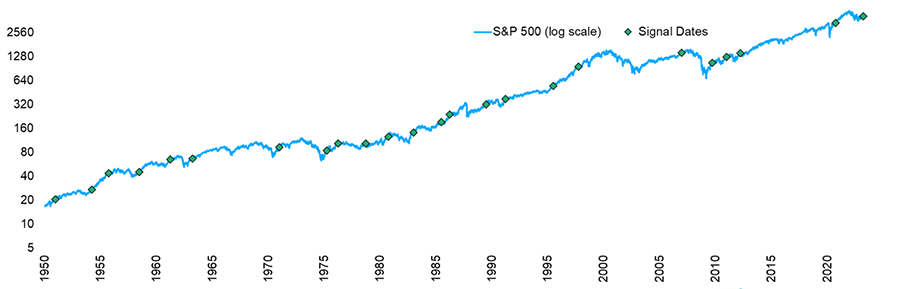

Stocks have had two consecutive quarters of strong returns. History shows that consecutive 5% quarters rarely happen in the middle of a bear market. More often than not, they happen at the start of a new bull market. As the chart below shows, the rare signal suggests the potential for more strength. Two quarters later, stocks have been higher 21 out of the past 23 times after this bullish signal.

Back-to-Back 5% Quarterly Gains Rarely Lead to New Bear Markets

Consecutive 5% Quarterly Gains for the S&P 500

We expect volatility to continue as overall market sentiment is historically low. The consumer remains strong, despite increased credit card debt and decreased savings levels. For now, the positives outweigh the negatives in the current market. The Fed seems to be nearly through raising rates, inflation continues to fall, global manufacturing is rebounding, China continues to reopen, and employment remains strong. The key for investors is to remain calm and look past the turbulence — and be ready to act when opportunities arise.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: BofA Merrill, Carson, Horizon

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.