Over the last few years, liquidity has been a major driver in the stock market. In a liquid market — one that is not dominated by selling — the bid price and ask price are close to each other. As a market becomes more illiquid, such as during a sell-off like we saw last month, the spread between the bid and ask prices grows — meaning prices become less stable and transparent.

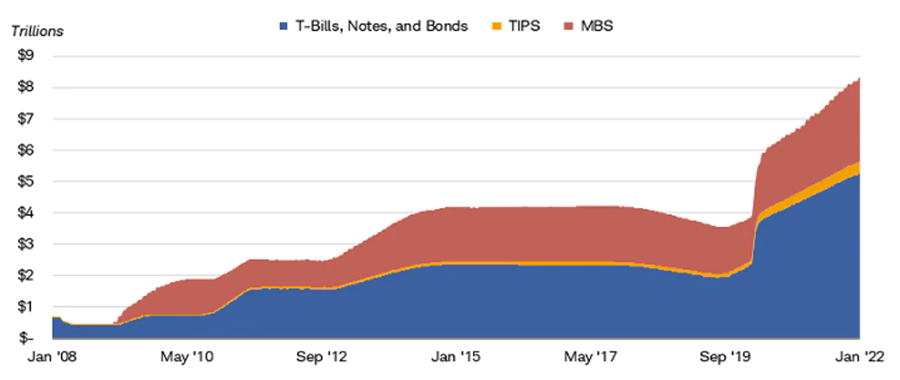

As we have previously written, the Federal Reserve has been buying bonds in an effort to inject liquidity into the market. When the Fed buys bonds, it increases its balance sheet — a list of its assets (such as government securities and loans) and liabilities (including currency in circulation). As seen in the chart below, the balance sheet has reached an all-time high.

The Fed’s balance sheet has ballooned to more than $8 trillion

The Fed’s goals include setting monetary policy that stabilizes the nation’s financial system, especially during times of high volatility, and allowing the economy to grow without generating inflation. After a challenging January in which volatility surged, stocks and bonds sold off and major indexes exceeded 10% drawdowns, the Fed now is reducing its bond purchases and soon will begin raising rates.

The Fed’s balance-sheet reduction should not be a near-term issue, as interest rates remain low and servicing the debt remains manageable. However, the speed at which the Fed raises rates will have an impact on the equity markets. (The Fed has not yet outlined a clear plan for how many times it plans to raise rates and how it plans to reduce its balance sheet over time.)

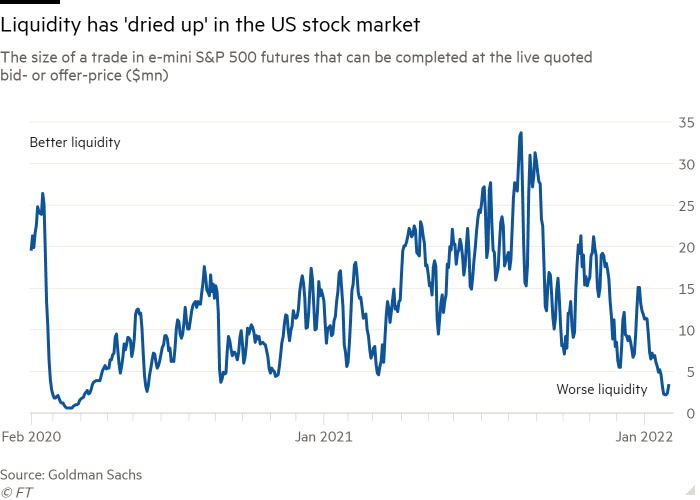

As the Fed injects less money into the economy to slow down inflation, liquidity is being reduced, which can lead to outsized market moves. In the last few weeks, the huge swings in U.S. stocks like Meta (Facebook), PayPal, Netflix and Snap have illustrated what can happen when liquidity dries up. As seen in the chart below, liquidity in U.S. stocks has fallen to levels last seen during the COVID-19 sell-off two years ago.

Lower levels of liquidity exacerbate market swings and make it harder for investors to execute buy and sell orders at a desired price. One measure of equity market liquidity is the market depth of S&P 500 E-mini futures, which investors use to gain exposure to the U.S. stock market. The E-mini S&P 500 is a futures contract that represents one-fifth of the value of a standard S&P 500 contract. The value of the full-sized S&P 500 contract is too large for most small traders, so the E-mini is used instead for speculation and hedging.

Typically, the volume traded in E-mini contracts is many times larger than the full contract — in other words, it is very liquid. Normal volume is roughly $50 million of value at any given time in the E-mini contracts, while today that number stands closer to $5 million, or 1/10th the size of normal liquidity.

So, what can we learn from all this? As we continue to gain clarity from the Federal Reserve on inflation and interest rates, volatility will reduce — and liquidity will return to the markets. Many market dynamics and economic indicators suggest that a strong economy remains possible. Strength in corporate earnings, productivity and innovation continue to drive profit margins higher for most companies in the S&P 500. Market corrections are normal, as nothing goes up in a straight line.

Investing is a disciplined process, done over time. It’s important to remember that panic is not an investing strategy. Neither are “get in” or “get out” — those sentiments are just gambling on moments in time.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: FT, Bloomberg, Investopedia, Goldman Sachs

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures