With a week left until the June 1 debt-ceiling deadline, the president and congressional leaders have been negotiating to raise the ceiling and enact some hopeful budget reforms. As we all know, Congress often waits until right before a deadline to take action, but that doesn’t mean there won’t be angst and potential volatility in the markets as we get closer to the deadline.

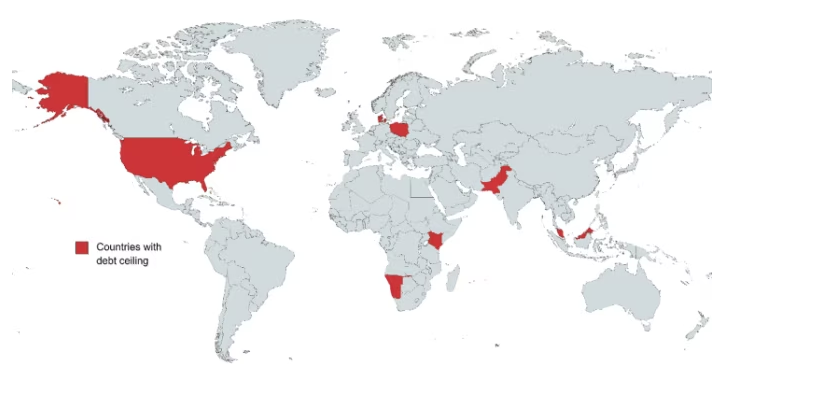

A default or funding delay in the U.S. Treasury market would have global impacts. As the map below indicates, few nations have a debt ceiling similar to the United States. Our Treasury market is the deepest and most liquid of any nation in the world and a central component of the global financial system. Over the past 22 years, the U.S. has needed to increase the debt ceiling 22 times. Denmark, the only other developed country with a debt ceiling, has increased only once, and it did so out of precaution, not necessity.

We knew coming into 2023 that the two parties would have a standoff over the debt ceiling. We have a divided government and deteriorating fiscal environment. Since January, when the debt ceiling was first breached, the U.S. Treasury has been using extraordinary measures to avoid breaching the debt ceiling.

Spending has increased this year due to higher interest costs and larger payments tied to inflation; those of you who are on Social Security can attest to the nice increase in your monthly payment. At the same time, tax revenues have fallen 6% over the last year, causing the debt ceiling date to be moved up from late July or early August.

What does each party want from the negotiations?

House Republicans are calling for a cap on discretionary (nonessential) spending, rescinding unspent COVID monies and energy-permitting reform. In exchange for those items, they are willing to raise the debt ceiling. Democrats are calling for “clean” legislation, an increase in the debt ceiling without any policy provisions or conditions attached. They do not want spending cuts, especially to Medicare or Social Security, and neither side politically can afford to cut those two government provisions.

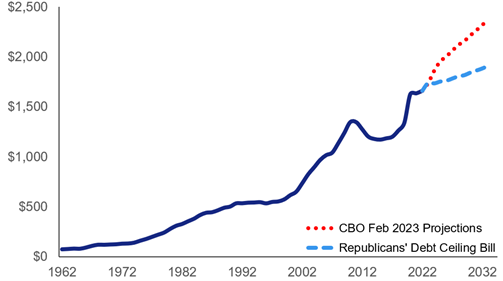

Republicans have passed a bill out of the House that would raise the debt ceiling but would also mandate $4.8 trillion in spending cuts. As of now, this bill does not have the votes to pass the Senate. The most likely outcome is a cap on discretionary spending and pulling back in unspent COVID dollars. The biggest discretionary spending item is defense spending. The White House has proposed keeping this flat from fiscal 2023 to 2024 and then a 1% increase in 2025. The chart below shows the impact of proposed curbs on discretionary spending in dollar terms.

Discretionary Spending

FY, Billions of dollars

As we get closer to the deadline, most economists and political talking heads are anticipating this turning into a two-step process. The first step would provide a short-term debt ceiling increase. The second step would fill in details and would be paired with another increase in the debt ceiling to get past the 2024 presidential election. While it feels like we are in unchartered territory and Congress has never been this acrimonious, we have been here before. As a matter of fact, Congress has been able to come to a resolution 78 times in the past 63 years.

The political debate is about how to raise the debt ceiling, not whether to raise the debt ceiling.

The actual threat of a default of the U.S. debt is extremely low. It is important to know that the deadline is not the same as the default date. The U.S. Treasury is expected to have a small cushion of funds on June 1 that should provide several additional days of breathing room.

On June 15, the Treasury department has a large tax collection from quarterly payments. This may be more akin to a government shutdown, where the Treasury would have to prioritize other government spending but would have enough funds for Medicare, Social Security, defense, etc. We are entering a period of fiscal restraint and austerity compared to the last few years, as we have become accustomed to the environment of fiscal stimulus and cutting taxes.

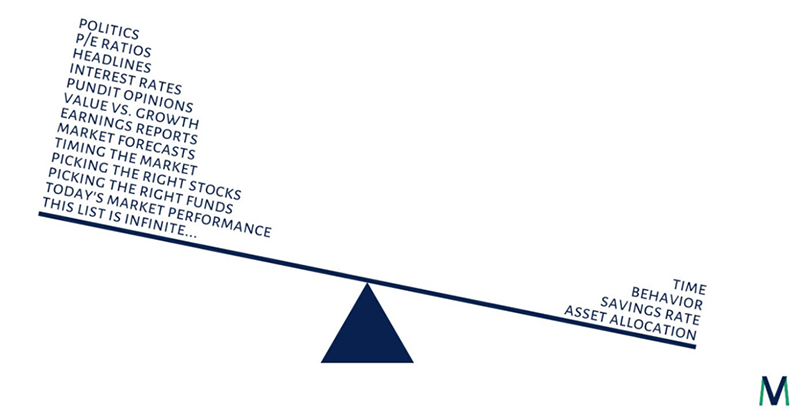

It is more important than ever to focus on what we can control at times like these. We shared this illustration last week, but it is worth repeating. What drives market returns is the right side of the seesaw: time in the market, controlling your behavior, savings rate and asset allocation.

What Drives Investment Returns

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Baird, Fidelity, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.