Last Friday, news of a COVID-19 variant identified in South Africa and new travel restrictions sent markets tumbling and injected volatility into the markets. The Dow Jones Index slid 900 points to suffer its worst day since October 2020. The news was exacerbated in the stock markets, as the Friday after Thanksgiving is typically a low-volume trading day and a shorter trading day due to the holiday. Oil prices fell more than 12% in one day, with news of potential lockdowns across the globe, though President Biden reiterated that the U.S. will not initiate economic lockdowns or new travel restrictions.

The market has continued its sell-off this week as Moderna and Regeneron separately commented on the effectiveness of the current vaccines against the new variant. At the same time, Fed Chairman Jerome Powell told the Senate that he expects tapering could wrap up a few months sooner than anticipated and that it is time to stop describing inflation as “transitory,” opening the possibility for the Fed to raise rates in early 2022.

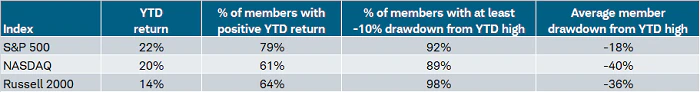

The chart below reflects the overall market returns through Nov. 26. While the markets have had a strong year, most underlying holdings are trading in a correction mode. This further supports that the underlying market may not be as expensive as many people fear.

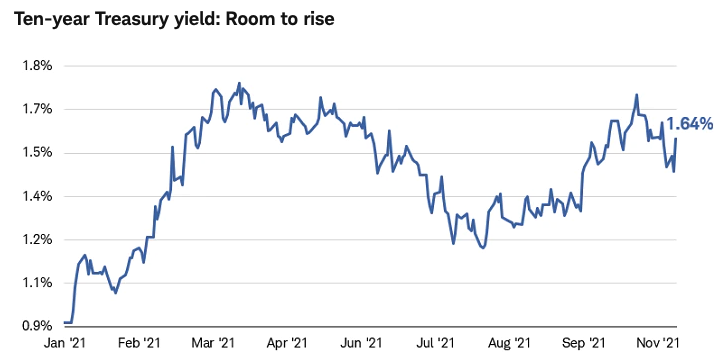

It hasn’t been the smoothest of sailing for fixed income investors in 2021. Bond yields have ridden waves of optimism and pessimism about the economic outlook for most of the year. The chart below reflects the year’s big swings in the 10-year Treasury. As we near the end of the year, short-term yields have moved up in anticipation of tightening monetary policy — while the 10-year Treasury has fallen back from the levels seen in October, despite inflation.

With more discussion of inflation — and more economists predicting that rates will rise next year — we recently made a portfolio reallocation within our fixed income portion of the portfolio:

1. We are shortening the duration of the fixed income portion of the portfolio. As a refresher, duration is a measure of how long it takes for a bond to repay the principal using both income and principal. In an environment of rising interest rates, we are hopeful that a shorter duration will protect against falling principal compared to longer-duration bonds.

2. We are maintaining similar credit quality within fixed income but adding a short-duration position to hedge against rising rates. We removed our longer-duration investment grade corporate bond position.

3. We also increased the weighting in our strategic income holding to produce additional income in a low interest rate environment.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought-out, looking at where we see the economy and rates heading.

We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy. We strategically have new cash on the sidelines and buy in for those clients on down days or dips in the market, as one does in a 401(k) every other week. We speak with our clients regularly about staying the course, not listening to the economic noise and trading memo stocks.

So, what can we learn from all this? Hoping that an outcome will or will not occur is not a strategy. In light of new COVID variants, we think investors need to continue to be ready to ride the rollercoaster for years to come. With the most recent quarter’s record earnings, the overall valuation of the market has come down. That does not mean we won’t experience dips and corrections, but when they happen, the plan is to stay the course and consider those opportunities as buying chances — not a time to panic and sell.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and in having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: CNBC, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures