We are excited for 2022 and are looking forward to a great year ahead. It’s hard to believe we are nearly two years into the pandemic. It has been a balancing act on a global scale as governments and central banks gauged how much fiscal and monetary stimulus was needed to boost economies without creating runaway inflation.

We see many positives for the financial markets heading into 2022:

1. Global growth continues to be positive.

2. Monetary and fiscal policy are still supportive of growth, even in the face of tapering and possible interest rate hikes in 2022.

3. Congress recently passed legislation to raise the debt ceiling for all of 2022.

4. There is potential for peak inflation and lower inflation for the second half of 2022.

5. The easing of supply chain issues should help both emerging and developed international markets.

6. Consumer spending is strong, and balance sheet savings rates are higher.

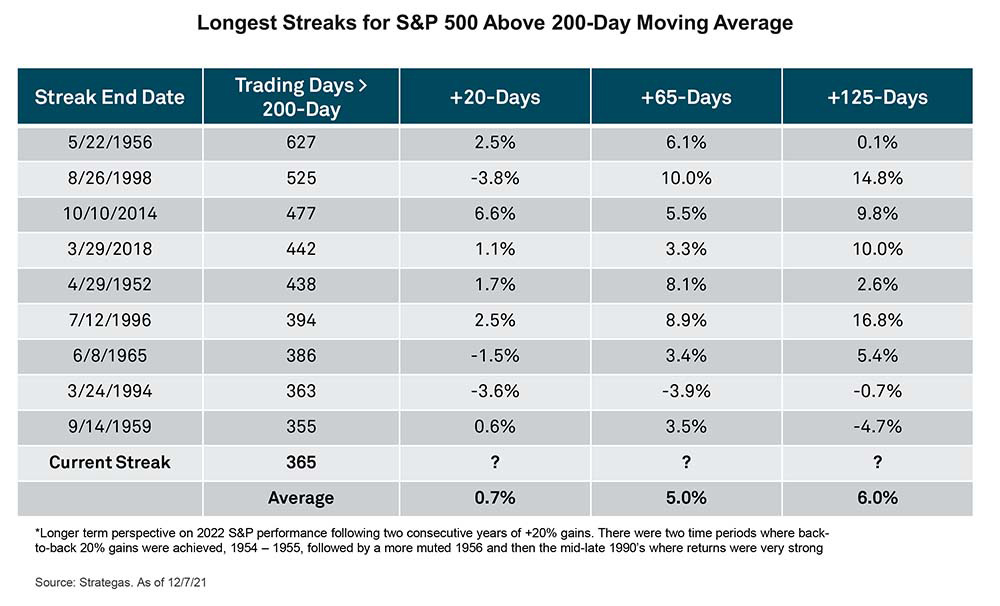

The S&P 500 has traded above the 200-day moving average for all of 2021. The chart below suggests that when the S&P 500 is above its 200-day moving average, forward returns are often favorable.

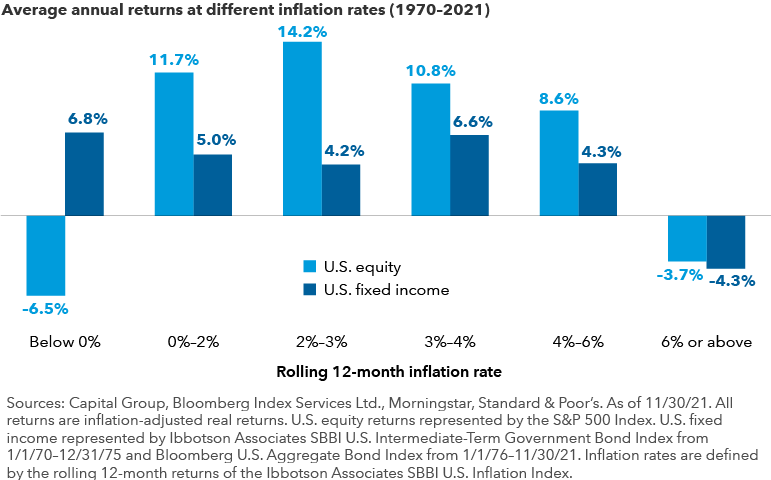

Clearly, inflation and its effect on the stock market are on the top of everyone’s mind. Remember that some inflation can be healthy for companies because it allows them to raise prices and increase profitability. Also, as seen in the chart below, stocks and bonds have generally provided solid returns, even during times of higher inflation. It is during the extremes that the markets often tend to struggle, but as inflation moderates, stocks and bonds can have strong years.

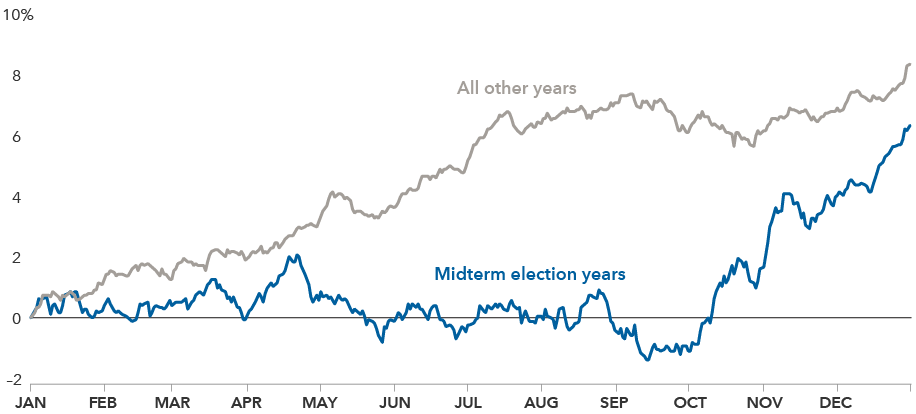

Political uncertainty often has a noticeable short-term effect on the markets. An analysis of more than 90 years of equity returns reveals that stocks tend to have lower average returns and higher volatility for the first several months of midterm election years. The trend often reverses, and markets have tended to return to their normal trajectory. Remember, the numbers below are just averages; it is important not to try to time the market. Elections generally create a lot of noise, so it is important to look past the short-term highs and lows and focus on the long-term picture instead.

S&P 500 Index average returns since 1931

The markets and the global economy are not without risks. History shows us that the biggest risks in a typical year are hiding in plain sight, not suddenly appearing out of nowhere. Risk appears when there is a high degree of confidence among market participants expecting a specific outcome that doesn’t pan out. If we look to identify the unexpected, we see the following as potential risks to the global markets in 2022:

1. Supply chain shortages turn into gluts: Whether it’s semiconductors, used cars or a variety of products, any potential supply glut in 2022 may lead to a fall in inflation. Excess inventory would promote price cuts and pose risks to industries that have thrived on pricing boosts from shortages.

2. Rate hikes slower than expected: Surging inflation has led the Fed to anticipate three rate hikes in 2022. If inflation eases, the expectations for the number of rate hikes may change as well.

3. China: The World Bank cut its forecasts for China’s economy in 2022 after the nation’s continued attempts to restrict business, break up large technology companies and remove bitcoin mining.

4. COVID outbreaks and new strains: Investors may have grown confident in trading rotation in and out of stocks depending on the seasonality and COVID flare-ups. If the current and future waves have less impact on the overall economy, the stocks that have led us out of the economic doldrums may not have the same effect going forward.

5. Geopolitical surprises: The biggest worry could be a military conflict, whether that is China and Taiwan, an invasion of Ukraine by Russia or even a regional conflict in the Middle East.

History doesn’t always repeat itself, but similarities often exist. While inflation on a year-over-year basis is high, this is not the runaway inflation of the 1970s. Today’s inflation is more akin to the 1920s and 1950s, when we witnessed booms in productivity and innovation and the rebuilding of an economy boosted by a new generation of household spending, along with new infrastructure spending. The markets may experience elevated volatility in the coming year as the above risks test the markets. We will continue to keep you informed and invested through the ups and downs of 2022.

So, what can we learn from all this? We are hopeful that 2022 will be a turning point in the global pandemic and that policymakers will wean economies and markets off fiscal and monetary stimulus. Vaccine manufacturing continues to ramp up, and new therapeutics to fight COVID continue to be available in the U.S. and abroad. Inflationary pressures should ease but still settle at a level higher than the recent past. We believe that diversification and the discipline to stay invested over the long term are more important than ever. We are optimistic for a successful 2022!

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value. As we say each week, it is important to stay the course, focusing on the long-term goal and not on one specific data point or indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Capital Group, Charles Schwab, BNY Mellon

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures