The S&P 500 saw its biggest weekly gain since 2020 last week. The Federal Reserve announced the first interest rate hike since 2018, a 25-basis point increase in its target range for the federal funds rate, to a range of .25% to .50%. The fed-funds rate is an overnight rate on lending between banks that influences other consumer and business borrowing costs through the economy, including rates on mortgages, credit cards, savings accounts, car loans and corporate debt. Raising rates typically restrains spending, while cutting rates encourages borrowing.

Fed Chair Jerome Powell had signaled that a rate hike was coming, and the market was focused on the Fed’s guidance on the outlook for the economy, inflation and the future path of policy rates. In an effort to slow inflation, the Fed has penciled in six more increases by year end, the most aggressive pace in more than 15 years. The committee also sees three more rate hikes in 2023, with short-term rates ultimately between 2.5% and 3%.

The Fed’s economic projections are painting a scenario of a soft landing for the economy: inflation retreating while unemployment stays low and economic growth slows to a more long-term sustainable growth rate of 2% to 2.5%. The Fed is normalizing its policy as the economy no longer needs the pandemic-induced stimulus, and it also signaled that it would start reducing its balance sheet, marking the start of quantitative tightening.

“The committee is determined to take the measures necessary to restore price stability. The U.S. economy is very strong and well-positioned to handle tighter monetary policy.” — Jerome Powell

Fed officials face three important questions as they consider their next moves:

• How quickly will it need to raise rates to a “neutral” level?

• Has the “neutral” level increased as rising inflation sends down borrowing costs?

• When will the Fed need to raise rates above neutral to deliberately slow growth?

Powell signaled greater concern that higher inflation might persist due to a hot job market with record job openings and wages increasing at their fastest pace in years. The central bank ended a long-running asset purchase stimulus program last week. Fed officials are facing the prospect of even higher inflation due to escalating sanctions by the West against Russia risking higher energy and commodity prices, combined with the new pandemic lockdowns in China further harming global supply chains.

Here are some of the effects we anticipate as the Fed embarks on raising rates:

Mortgages: While the federal funds rate doesn’t directly impact mortgage rates, they often move in the same manner. Despite mortgage rates moving higher, the current environment is still attractive if you’re looking to get a new mortgage or refinance your existing one.

Home Equity Line of Credit (HELOC): Typically linked to prime rate, the costs of a HELOC will move higher as the Fed raises rates. Those with HELOCs should expect to see their payments continue to rise in the near term.

Savings accounts and CDs: Rising interest rates mean that banks will offer higher returns on their savings and money market rates. It may take time for banks to raise rates to the level of current fed funds rates; banks normally act quicker in cutting rates.

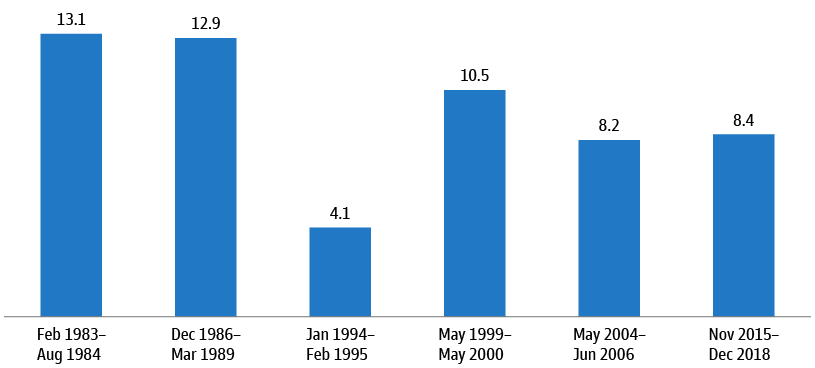

Equity markets: The stock market has been a big beneficiary of the Fed’s willingness to keep rates low. In the last few months, the market has been pricing in higher interest rates. The S&P 500 has historically delivered positive returns over the past six Fed hiking cycles, averaging a 9.5% annualized return, as seen in the chart below.

S&P 500 Annualized Total Return During Previous Fed Hiking Cycles (%)

So, what can we learn from all this? While the Fed has finally announced that it will raise rates to combat inflation, rates remain low by historical standards. The key message from the Fed is that it is focused on fighting inflation and is prepared to hike short-term interest rates steadily while reducing the balance sheet to attain its goals.

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. As we say each week, it is important to stay the course and focus on the long-term goal, not on one specific data point or indicator. In markets and moments like these, it is essential to stick to the financial plan. Remember, first and foremost, that panic is not an investing strategy. Neither are “get in” or “get out” — those are just gambling on moments in time. Investing is about following a disciplined process over time.

At the end of the day, investors will be well-served to remove emotion from their investment decisions, and remember that over a longer time horizon, markets tend to rise. Market corrections are normal, as nothing goes up in a straight line. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: CNBC, Goldman Sachs

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.