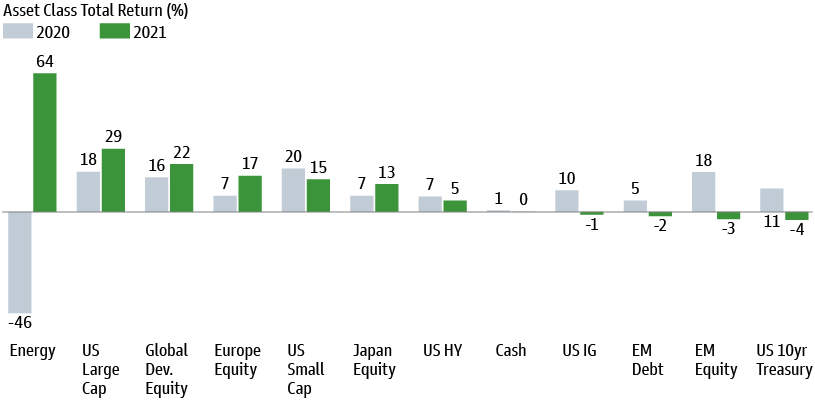

In all, 2021 was a solid year for the financial markets. The economy’s ability to adapt to the pandemic, the vaccine rollout, additional financial stimulus and easy monetary policy all supported strong performance. Growth in large-cap U.S. equities was primarily driven by gains among the S&P 500’s largest tech holdings. Severe supply-chain bottlenecks and a surge in energy prices supported a strong commodity performance. Small-cap U.S. equities trailed their large-cap counterparts but still produced returns greater than their 20-year average of 11%.

Outside the U.S., equities in developed markets had another strong year. Emerging markets, on the other hand, were hurt after a correction in the Chinese stock market and continued lockdown measures. Finally, U.S. fixed income decreased as long-term interest rates ended the year higher than where they started.

The Chinese stock market had a correction in 2021, and questions remain about the Chinese economy. The property market downturn, triggered by the collapse of Evergrande, is a large drag on China’s economic growth. In the past, downside growth risks in China have been quickly countered by monetary and fiscal stimulus. This time may be different as signals point toward Chinese leaders being worried about excessive leverage in the property sector. With China’s 2022 growth projections being around 5%, this may take some pressure off global inflation.

In 2022, the central narrative will be how markets react to the Federal Reserve and other major central banks transitioning away from an extraordinary 18-month period of stimulus. Return and income-seekers will need to navigate a backdrop of favorable but moderating growth, high valuations, low and rising yields, and ongoing COVID-related question marks — in particular, an uncertain path for inflation.

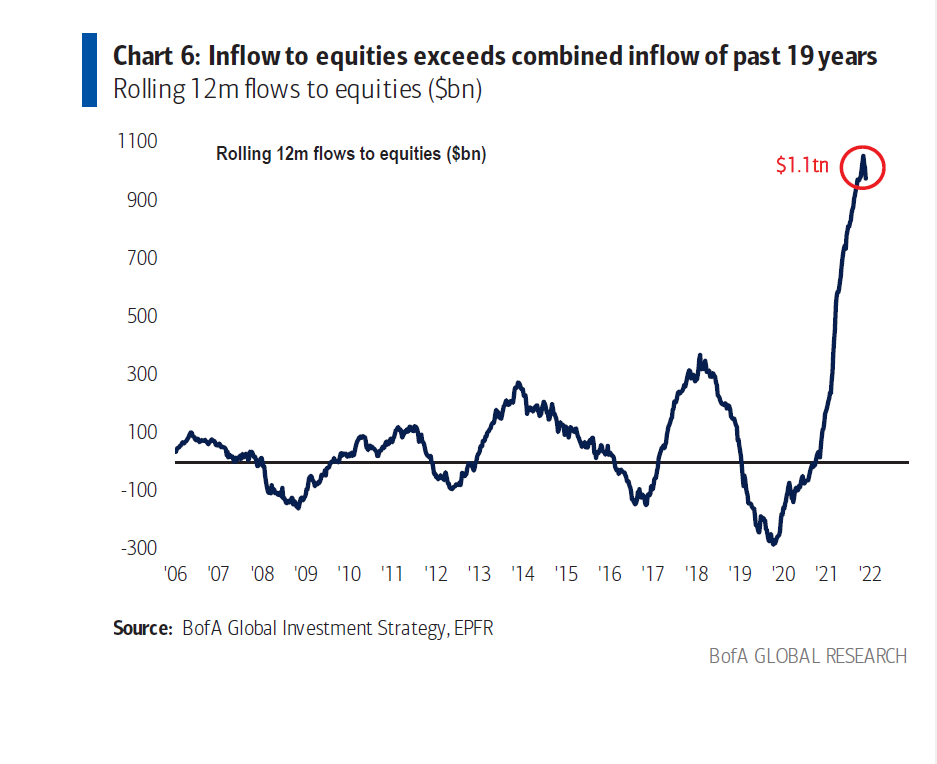

The U.S. economy is poised for a year of moderating but above-trend economic growth. Robust household income and accumulated savings leave the consumer in a strong position heading into the year. Businesses have record levels of cash on hand, which may lead to record levels of investment. Unemployment is at 4.2%, and wages are up. Excess cash has been moving into the equity markets, and in 2021, inflows into equities were more than the past 19 years combined.

Inflation remains the primary focus for most investors. Moderating demand, rebalancing demand from goods to services and healing the supply side should allow inflation to rates to reduce in the second half of the year. Wage inflation and strong labor demand are the key risks to this scenario. At the same time, we are keeping a close watch on fiscal policy. For now, President Biden’s Build Back Better plan is on ice. If this plan were to be resurrected, we would watch closely and keep you informed every step of the way.

So, what can we learn from all this? We are hopeful that 2022 will be a turning point in the global pandemic and that policy makers will wean economies and markets off fiscal and monetary stimulus. Vaccine manufacturing continues to ramp up, and new therapeutics to fight COVID continue to be available in the U.S. and abroad. Inflationary pressures should ease but still settle at an elevated level than the recent past. We believe that diversification and the discipline to stay invested over the long-term are more important than ever. We are optimistic for a successful 2022!

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance.

The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value. As we say each week, it is important to stay the course. and focus on the long-term goal, not on one specific data point or indicator.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: BofA Global Investment Strategy, Blackrock, Bloomberg, JP Morgan, Russell Investments

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures