We are in the homestretch for 2022. It is the perfect time to review some year-end planning strategies to ensure your wealth plan reflects changes in your circumstances or goals, the current tax environment and the economic landscape. The end of the year is an important time for making financial decisions that can have an impact in the year ahead — and for years to come.

First, a quick look back at 2022. From a market perspective, this has been a year that won’t be forgotten soon. Here are a few high-level takeaways:

• Bear markets happen. This will not be the last bear market we encounter. The key is to stay invested. Survive the bear market to reap the benefits of the bull markets that follow.

• Things can change quickly. For most of the last decade, we had a zero inflation and zero interest rate environment, but the economy slammed on the brakes — and rates rose drastically. For investors, 2021 was one of the best years and 2022 was one of the worst. However, bull markets can appear just as quickly as a bear markets.

• We went from TINA to TARA. For many years, there was no alternative to stocks (known as TINA, or There is No Alternative). Now, we are seeing TARA (There Are Reasonable Alternatives) with higher interest rates, bonds provide attractive opportunities and money market rates are soon to be over 4%.

• Investing is not easy. We are coming off an incredible decade for the stock market, yet it’s easy for investors to focus on how bad the last 10 months feel. Is that feeling worse than a good 10 years? Greed and fear are timeless. As billionaire investor Seth Klarman commented, “The stock market is the story of cycles and the human behavior that is responsible for overactions in both directions.”

As we prepare to put this year behind us, we recommend that you review the checklist below for planning strategies to consider and discuss.

Income Tax Strategies

Traditional year-end planning focuses on deferring income to a future year and accelerating deductions into the current year.

1. If you anticipate your marginal income tax bracket to increase, you may consider accelerating income into 2022 and deferring deductions to 2023.

2. If you anticipate being in a lower tax bracket next year:

• Defer income to postpone paying the tax and have that income at a lower bracket, if possible.

• Bunch your medical expenses in the current year to meet the percentage of your adjusted gross income to claim those deductions if you itemize on your tax return.

• Make your January mortgage payment in December so you can deduct the interest on this year’s return.

Tax-related Investment Strategies

1. Tax loss harvesting is the strategy of selling securities at a loss to offset a capital gain liability, either for today or in the future.

• Harvest losses by selling taxable investments. You must wait at least 31 days before buying back a holding sold for a loss to avoid the IRS wash-sale rule.

• Harvest gains by selling taxable investments if you have a tax loss carry forward.

2. Ensure that you have satisfied your required minimum distributions (RMD).

• If you fail to take your RMD, this may result in a 50% penalty.

• If you own an inherited IRA, a RMD may be required separately for that account as well.

Retirement Planning Strategies

1. Maximize your IRA contributions. You may be able to deduct annual contributions of up to $6,000 to your traditional IRA and $6,000 to your spouse’s IRA ($7,000 if over the age of 50).

2. Make a Roth IRA contribution if under the applicable income limits.

3. Consider increasing or maximizing your 401(k) contribution. Boosting contributions to your 401(k) can lower your adjusted gross income while increasing your retirement savings.

4. Consider making contributions to a Roth 401(k) if your plan allows.

5. Consider setting up a Roth IRA for each of your children who have earned income during the year.

Gifting Strategies

1. Consider making gifts up to $16,000 per person as allowed under the federal annual gift tax exclusion. You can give up to $16,000 this year to as many people as you want without triggering gift taxes. Payments made directly to educational and/or medical institutions on behalf of your intended beneficiary do not count towards your annual exclusion amount or against your lifetime estate tax exclusion.

2. Create a donor advised fund for an immediate income tax deduction and provide immediate and future benefits to charity over time.

3. If you already have a donor advised fund or want to donate to a charity, consider gifting appreciated assets that have been held longer than one year to get the fair market value income tax deduction while avoiding income tax on the appreciation.

4. If over the age of 70½, consider making a direct transfer from an IRA to a public charity. The distribution is excluded from gross income, and you can give up to $100,000 as a tax-free gift from your IRA that may fully satisfy RMD requirements.

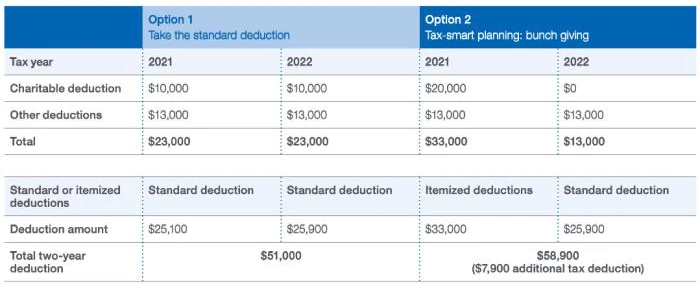

5. Consider combining multiple years of charitable giving into a single year to exceed the standard deduction threshold. This is called “bunching.” The chart below shows how the bunching strategy can reduce taxes if executed properly.

Hypothetical example of a married couple with no children.

Wrapping up 2022 and Planning for 2023

1. Discuss major life events with CD Wealth Management to confirm you have clarity in your current situation.

2. Communicate with your CPA to provide capital gains and investment income information for a more accurate year-end projection.

3. Check your Health Savings Account (HSA) contributions for 2022. If you qualify, you can contribute up to $3,600 (individual) or $7,200 (family) and an additional $1,000 catch up if over the age of 50.

4. Double-check your beneficiary designations for retirement plans, IRAs, Roth IRAs, annuities, life insurance policies, etc.

5. If you do not already have identity theft protection, consider purchasing a service to help protect you and your family.

The end of the year is a perfect time to review your financial planning needs. This includes reviewing the investment portfolio, assessing year-end tax planning opportunities, reviewing retirement goals, and managing your legacy plans. The checklist above includes just some of the items that may apply to you and your family. We are happy to meet to discuss any of the above to ensure that you remain on track with your financial goals.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: BNY Mellon, Baird, CNBC, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.