The past 60 days have seen an unprecedented move in the tax-free, municipal bond markets. In late March, we saw the municipal bond market* and tax-free bonds yielding 4 to 5 times higher than a 10-year U.S. Treasury bond. So, why the dislocation, what caused the panic and what are we doing to take advantage of this opportunity?

Historically bonds, or fixed income, provide solid diversification from equities. As investors age, often they shift additional dollars to bonds for capital preservation as well as income. We call it “sleep at night money” in the municipal bond market. Investments, that while are not guaranteed, provide much lower risk and allow the investor peace of mind. However, the last 60 days have not quite followed this playbook.

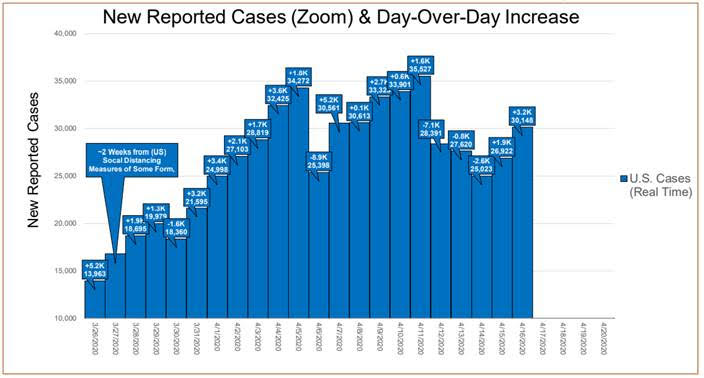

In March, as the COVID-19 pandemic took hold on the financial markets, we saw panic set in the bond markets as well. Selling pressures from investors liquidating their bond funds and ETFs cause historic levels of redemptions. Investors were selling bonds at any cost to have cash. Unfortunately, the bond market does not work the exact same way as the stock market. There are thousands of bonds in the market, many from the same issuer, with different maturities, and some more liquid than others. When a bond investor goes to sell a bond, the price received depends on the buyer on the other side and what they are willing to pay.

If you are not paying attention and just want to sell, a bond may be priced at $95 or $100 on your statement, but you may only get 60 or 70 cents on the dollar if there is no demand to buy your bonds.

This is what we saw in March. Panic selling by bond investors and the result was poor pricing and trade execution for those sellers, resulting in rock-bottom prices to virtually anyone willing to buy. We realize that there is more headline risk right now in the bond market, as Mitch McConnell recently suggested bankruptcy was a route for financially strapped states to consider.

Fortunately, the Federal Reserve took serious action to help settle the stock and bond markets through both The Coronavirus Aid, Relief and Economic Security (CARES) Act as well as reopening the Money Market Liquidity Facility. The CARES Act authorized the U.S. Treasury to direct $150 billion to state, local, tribal and territorial governments to cover necessary expenditures incurred due to the pandemic not covered in their budgets. The legislation also provides liquidity benefits by authorizing $454 billion of direct loans and loan guarantees from the Treasury to corporations and municipalities. They are also considering direct bond purchases in the primary and secondary markets. Since these actions, we have seen the fixed income markets settle down, however, prices are still not back to pre-pandemic levels and we are now receiving questions from our clients on our thoughts on the municipal markets and the risk that exists today.

We believe that while the economic shock of the coronavirus is severe, the investment grade municipal bond market still provides a safe haven to individual investors. There are a number of factors that should help municipal bonds survive this economic downturn:

1. The economy is reopening.

2. Municipal bonds tend to finance long term projects.

3. Municipalities have the ability to raise taxes as well as tap into reserves to overcome shortfalls.

4. Many bonds that we purchase are tied to infrastructure, like utilities, school districts, toll roads.

5. Municipalities have the flexibility to adjust budgets quickly through reduced costs as well as the ability to furlough employees.

6. The CARES Act provides additional resources to municipalities to purchase bonds as well as additional borrowing capabilities.

7. Future potential higher tax rates to counter influx of funding from the Federal Reserve and Government which will increase demand for municipal bonds to shelter additional income from higher taxes.

While municipal issuers will experience short term declines in tax revenues from stay at home orders and decreased consumer demand, we believe that the downgrade risk of bonds is significantly greater than default risk. Historically, the default risk in municipal bonds is less than 1% of all bonds. For perspective, the par value of the S&P Municipal Bond Index is $2.321 trillion. The par value of bonds defaulted as of April 2020, was $21 billion, of which $16 billion is attributed to Puerto Rico, a default risk of less than .03%.

We continue to actively buy individual municipal bonds and employ the same strategy we have for many years.

We believe in buying investment grade individual tax-free bonds, studying the underlying credit quality, looking at the revenue source for the bonds and monitoring the credit quality.

Also, an important difference to keep in mind, is that unlike corporate bonds, where if the corporation declares bankruptcy, then all their bonds are bankrupt, this is not the case in municipal bonds. Most recently when Detroit had issues, there were water bonds issued by Detroit that had no issue. Some bonds also have insurance as another source of security. That is why we stress looking at each bond and what the funding source is to understand the underlying risks.

In summary, we continue to believe that the bond market offers value. The headline risk will remain until the states open up and remain open. As always, we will actively monitor the portfolios and make changes as needed.

We appreciate your continued trust in CD Wealth Management.

*Municipal bonds are debt obligations of a state or local government entity. The funds may support general government needs or special projects. Safety is based on the viability of the issuing municipality and the community in general.

_______________

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.