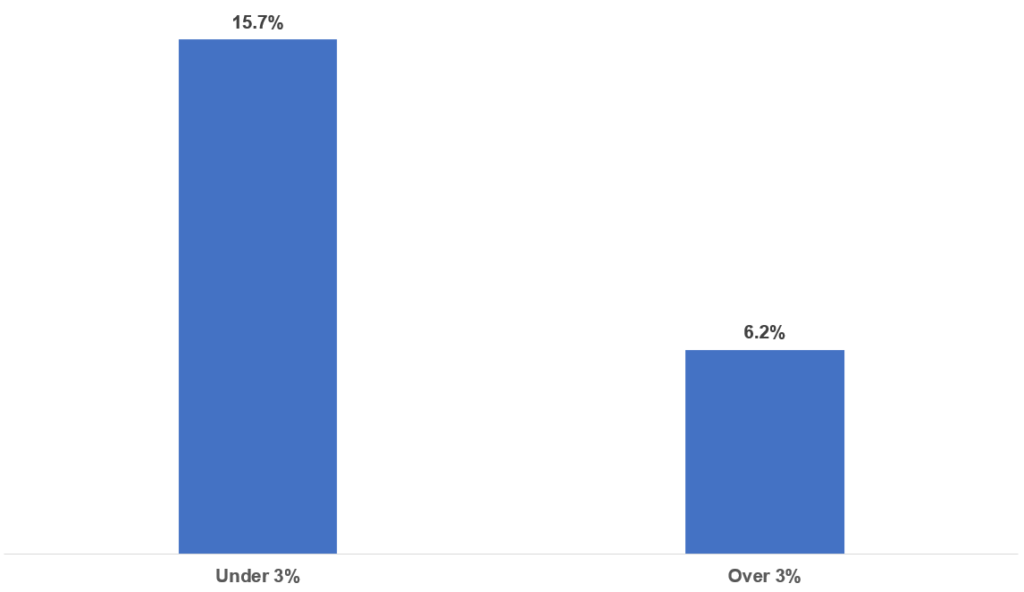

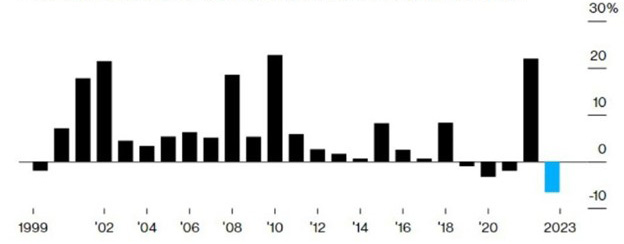

While we may hear about bonds or fixed income in the news, they typically don’t draw as much attention with retail investors because they are not as well understood or as alluring as stocks. While stocks fell for the third week in a row, bond yields moved higher. In just the last month, 10-year Treasury yields have gone up over 50 basis points (0.5%), reaching their highest levels since 2007. Yields across the globe are at their highest levels since 2008.

The Federal Reserve bank controls short-term rates. We have often heard about how many times the Fed has raised rates over the last year and a half. With the higher rates, we earn more interest on our cash, as money market rates are now over 5%. But what is driving long-term rates higher?

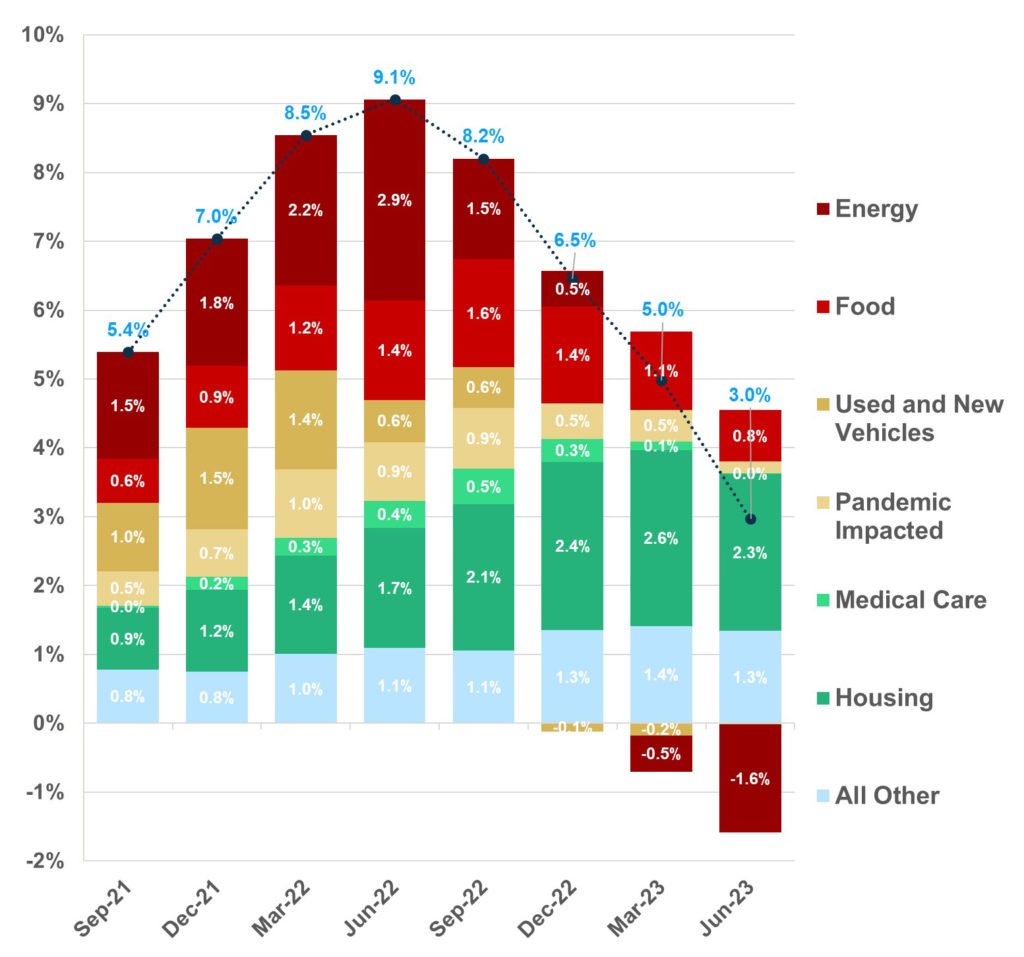

Inflation

Inflation has been front and center since the recovery from the pandemic. As we wrote last week, year-over-year inflation continues to come down compared to prices, but items generally cost more than they did than a few years ago. While the trend remains one of cooling and expectations are that prices should continue to fall, the Fed continues its rhetoric of higher rates for a longer time — and there still is the possibility of one or two more rate hikes.

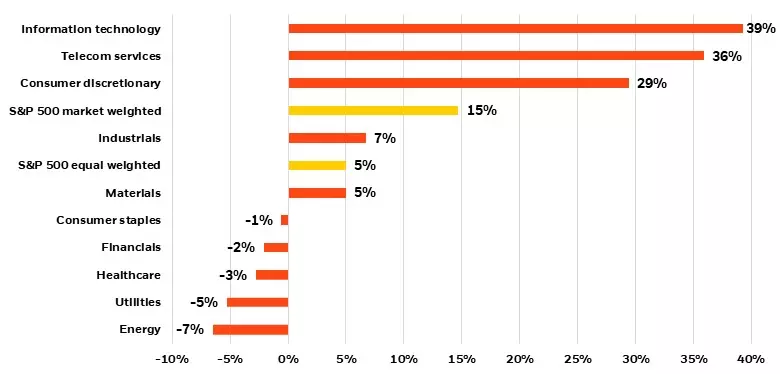

Growth

We have been waiting for a recession for more than a year. The economy has survived rate hikes of more than 525 basis points (5.25). At the same time, most people who want a job can find one, and the unemployment rate is near historical lows at 3.5%. The consumer is still eager to spend, and credit card debt broke the $1 trillion mark for the first time.

The housing market is showing signs of stabilizing, even with 30-year mortgage rates reaching levels not seen for many years. The infrastructure bill passed last year has hopes of revitalizing spending in infrastructure and manufacturing. Artificial intelligence is expected to change the way we live and work for the better, and the U.S. GDP continued to grow at an annual rate of 2.4% in the second quarter.

Uncertainty

Investors tend to require more yield or compensation for locking up money over a longer time versus short-term periods of time. For bonds, that means demanding a higher yield for bonds that mature in 10 years than those that mature in two years. When things are more uncertain, investors demand even higher yields. A few events recently have added to bond anxiety, and thus higher yields:

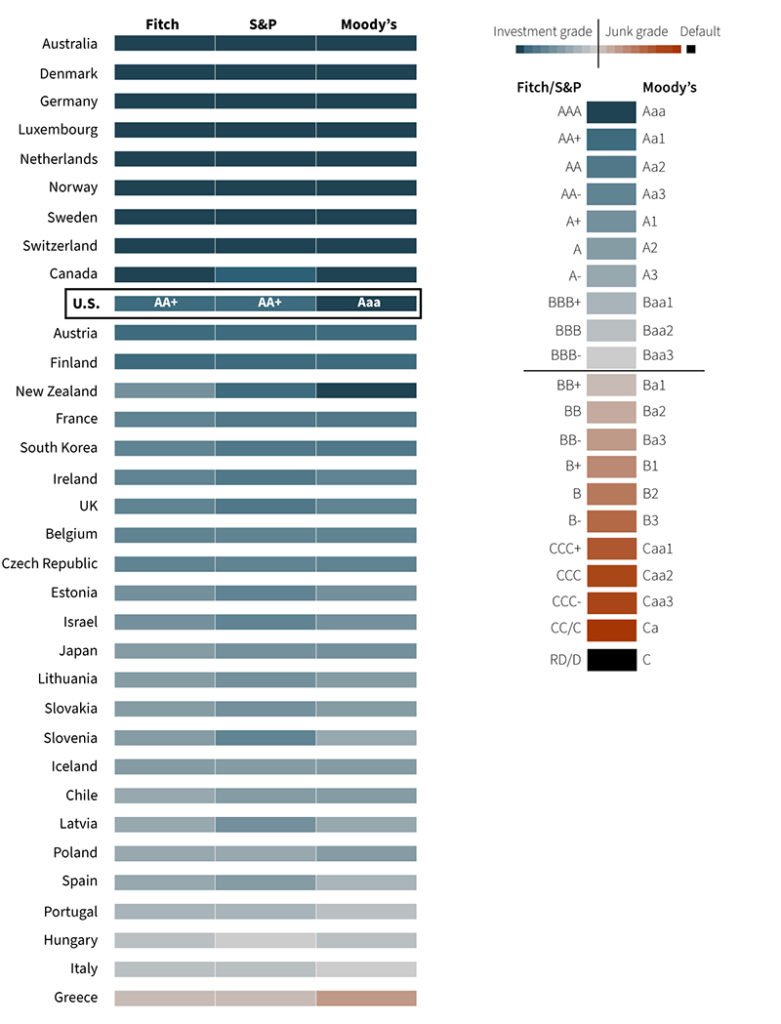

• Fitch downgraded the credit rating of U.S. Government debt by one notch, from AAA to AA+.

• At the same time, the U.S. government is issuing more debt than expected to pay for spending, due to a combination of lower tax revenues and higher interest costs from higher interest rates.

• The Bank of Japan raised rates on its 10-year bond to 1.0%. The Bank of Japan is a large buyer of U.S. Treasuries, and with higher rates being offered in Japan, it may choose to shift its buying to its own bonds.

A combination of better growth and uncertainty seems likely to be behind the higher rates. A more resilient economy could mean that the Fed plans to keep interest rates higher for longer, even if it doesn’t raise rates again.

Higher bond yields mean that bonds offer more income and protection than they did a month ago.

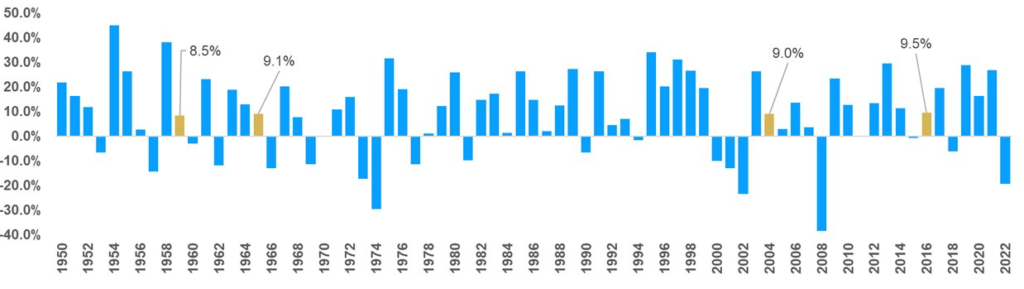

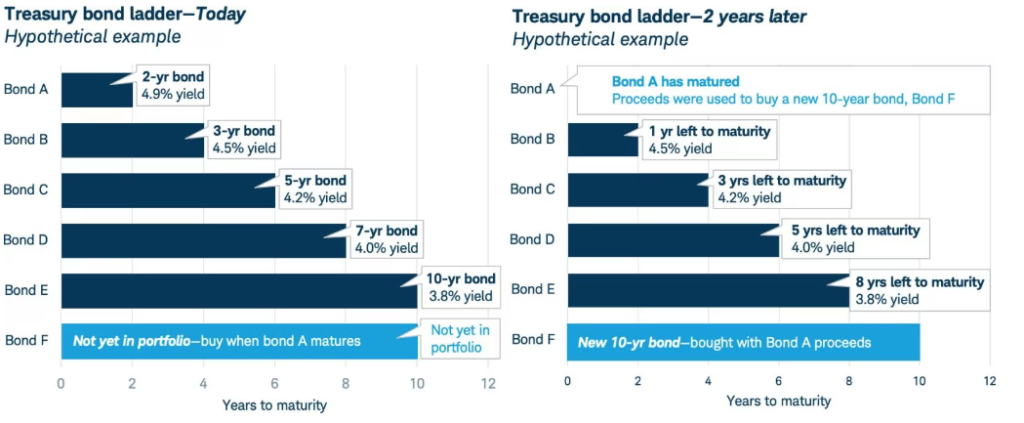

With yields near the peak, this may provide an opportunity for investors to extend the duration (think of maturity) of their fixed income portfolio to lock in some of the highest rates we have seen since 2007. One way to accomplish this is a laddered bond portfolio of Treasuries.

A bond ladder, illustrated below, refers to purchasing bonds in a stepladder fashion with consecutive maturities to reduce credit risk, interest rate risk and volatility in a portfolio. For example, one may purchase an even amount of bonds maturing in increasing spans of time. As the bonds mature, you replace them in the next step of the ladder. If rates go down, you want to extend the bond ladder farther into the future. If you are worried rates will rise, you would want to shorten the bond ladder.

Most economists are not expecting the Fed to raise interest rates much further than where they are today, with the Fed Funds rate at 5.25-5.50%. With inflation on the decline, there is discussion of disinflation starting to rear its head, especially with vehicle and shelter prices easing further. With the government issuing more supply of Treasuries to cover a rising deficit and fund the tax shortage, longer-term bond yields continue to rise and decrease the spread between the short-term Treasuries and longer-term Treasuries.

Higher long-term bond yields mean investors expect the Fed to keep rates on the higher side for a longer time, especially with the strong recent run of economic data. Expectations for future growth are shifting higher as the economy continues to prove its resilience. Ultimately, the bond market is signaling that rates may have to be higher than we have been used to over the past decade, which can be a good thing for investors seeking income.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

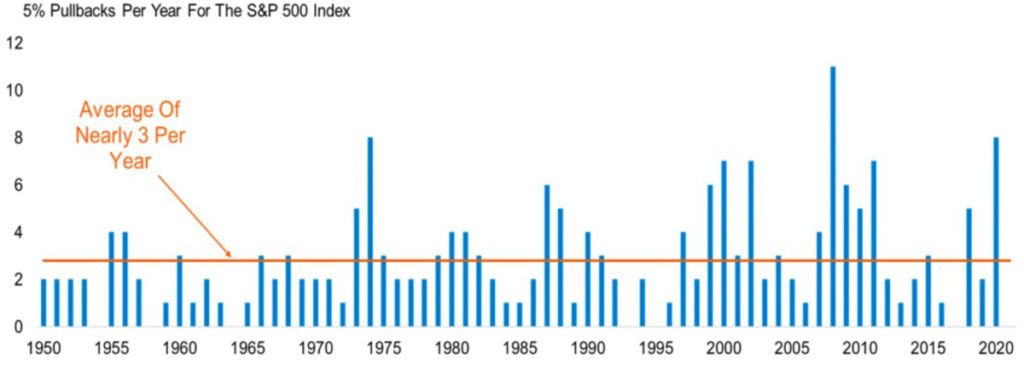

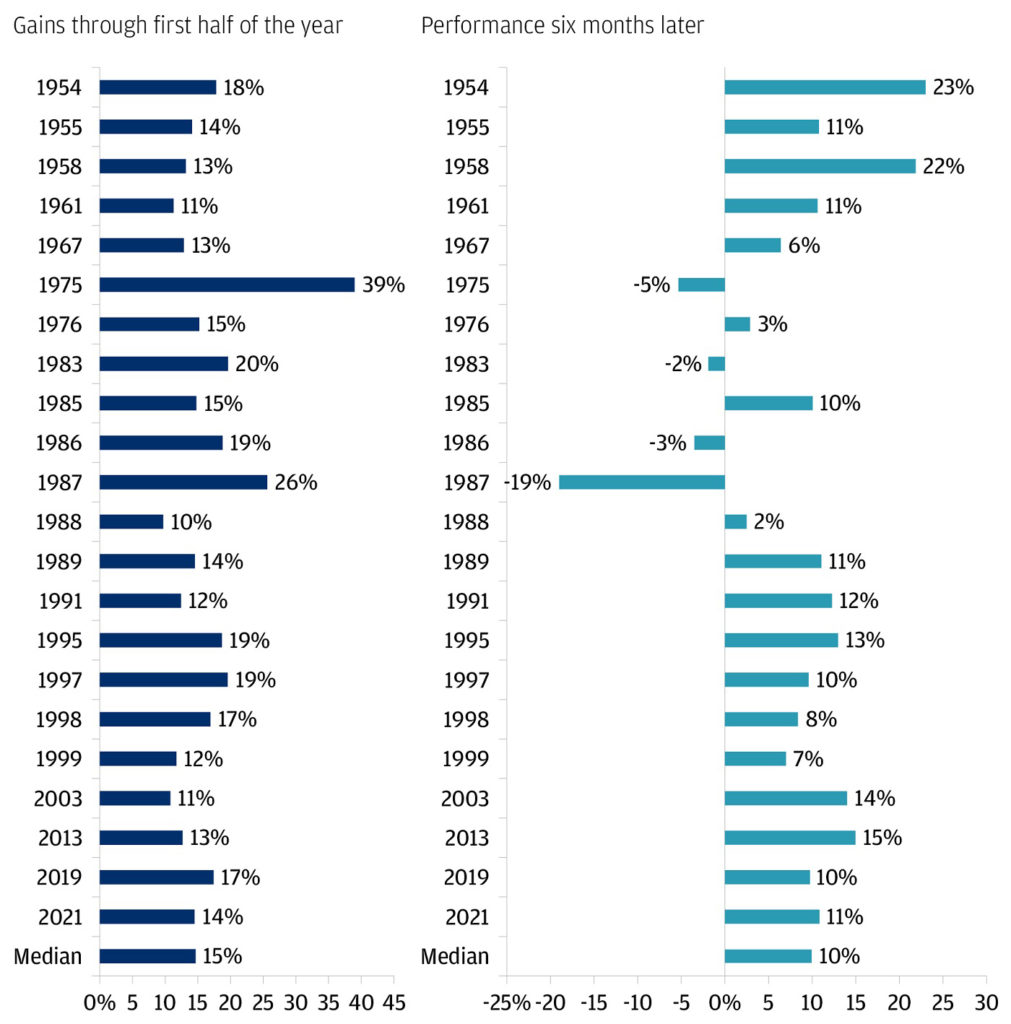

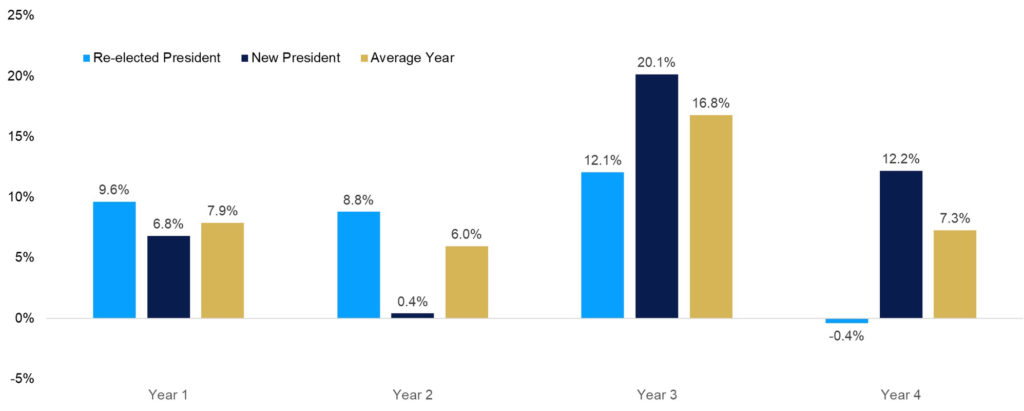

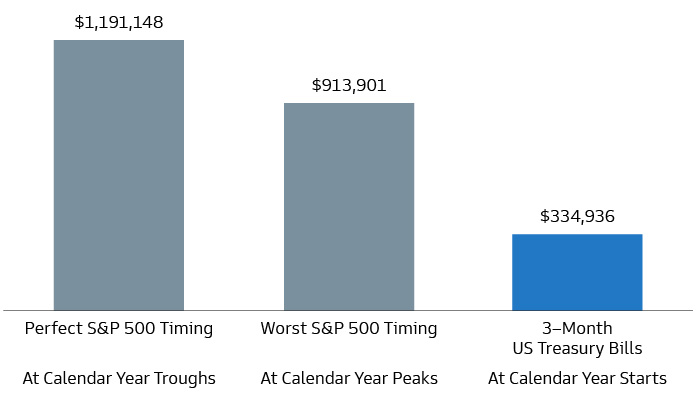

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

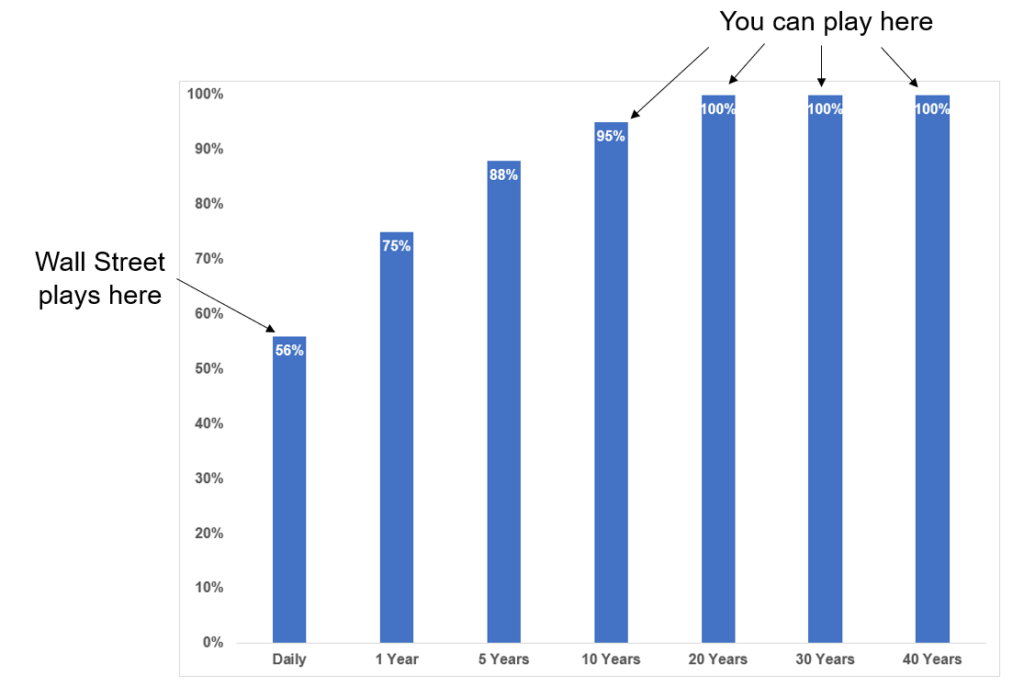

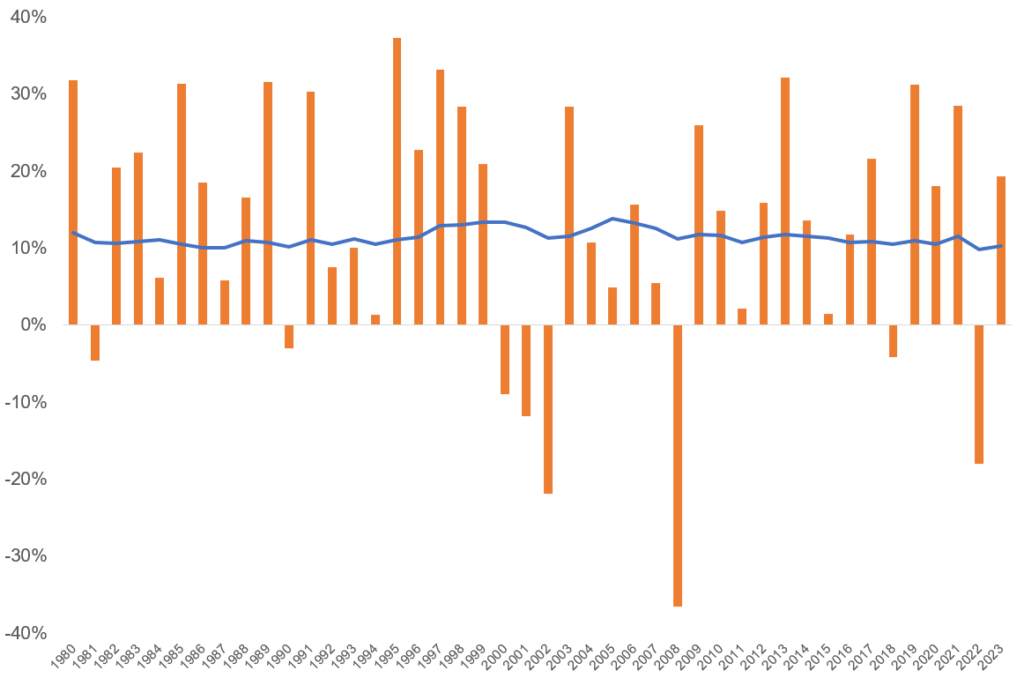

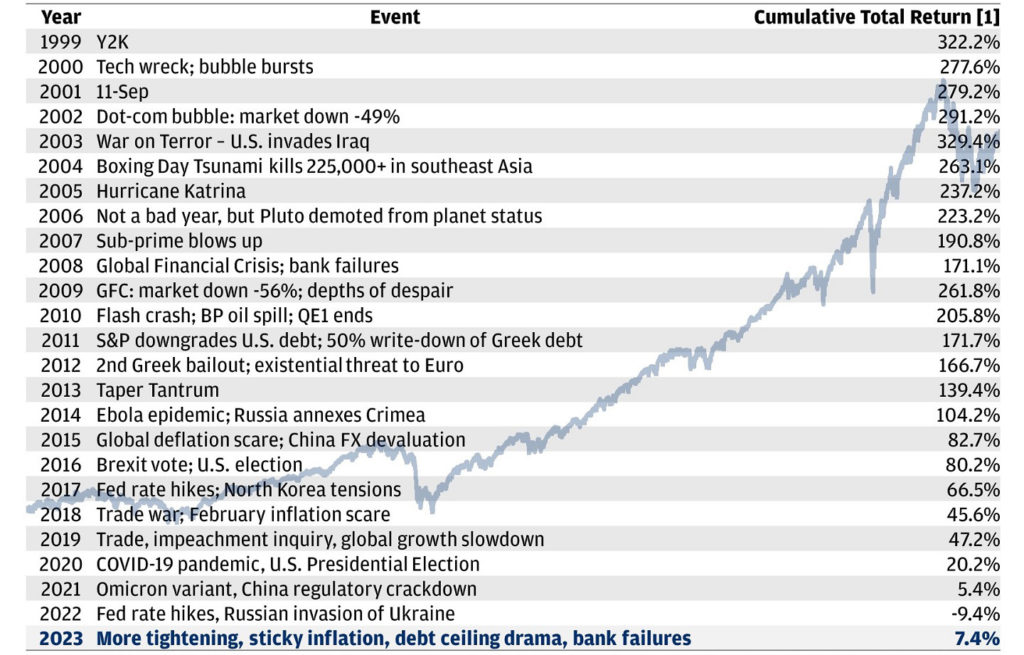

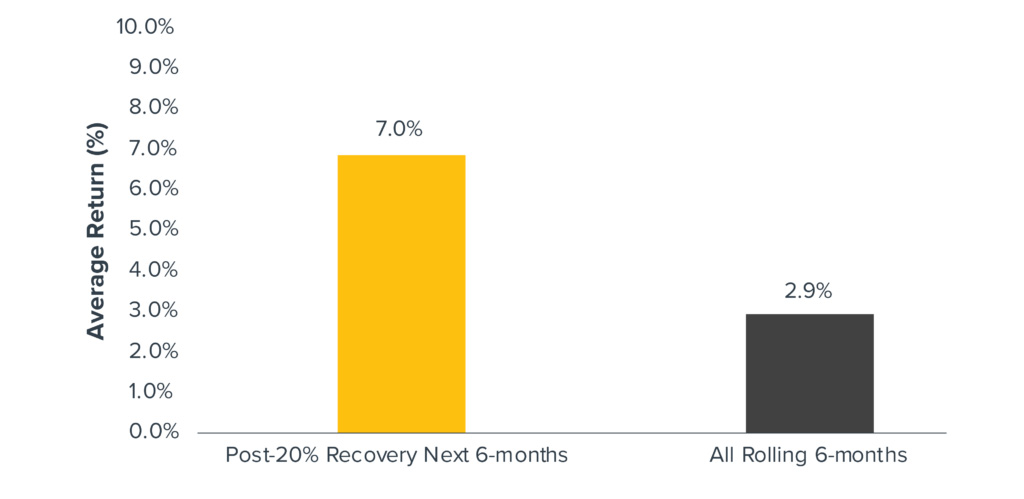

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: JP Morgan, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.