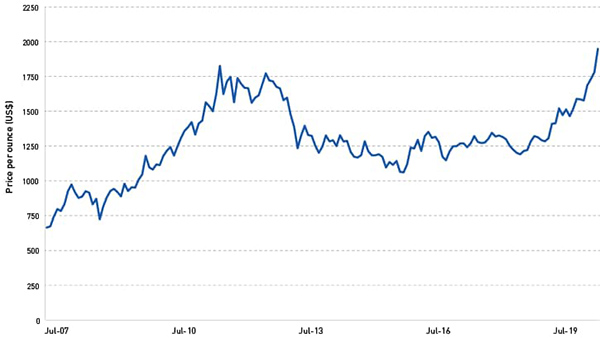

Following the global financial crisis of 2008 and 2009, and the Euro crisis of early 2010s, investors made large bets on gold as a hedge against rising inflation. As the risk of inflation remained low and the risk of the Euro currency disunion faded, gold prices eventually fell by almost 50 percent. This was in spite of aggressive fiscal policy and increase in public debt outstanding. Sound familiar?

Investors are concerned about many of the same issues today (as seen by the recent surge in gold prices to all-time highs in the chart below): fear of growing inequality, capital destruction, declining productivity, large expansion of monetary policy and rising debt levels. Gold has seen a large shift on the demand side through a rally in Gold Exchange Traded Fund, GLD, driven by investor buying. Another factor helping the rally in gold prices is the fact that China’s gross domestic product (GDP) is quickly converging to U.S. levels, and that they could become the largest economy in the world.

Gold’s rise has largely paralleled a historic decline in the U.S. dollar, which has fallen nearly 10 percent compared to a basket of its peers since mid-March. Central banks and governments around the world have spent or committed more than $20 trillion in financial support for the global economy since the pandemic outbreak, putting additional downward pressure on currencies and increasing the value of gold. With the virus now affecting the U.S. more than most major economies, our outlook has weakened and become more uncertain, relative to other countries. As other countries have a better handle on the virus, they also have seen a greater confidence in the Euro compared to the dollar.

The 10-year Treasury has fallen close to .50 percent in recent weeks. As bond yields continue to contract, the price of gold has increased, as precious metals and bond yields often display an inverse relationship. The Fed will be very resistant to negative interest rates and for good reason. The Fed believes that negative rates are not effective, and the countries that have gone negative have had more severe challenges and created new financial market distortions. Therefore, it brings to question, how much lower can yields go from here? However, as real rates continue to move lower and investors continue to purchase TIPS (Treasury Inflation Protection Securities) for fear of future inflation, gold prices can continue to move higher.

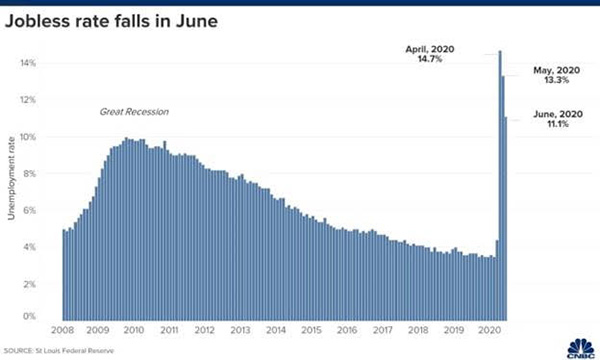

Higher debt, though, can be a drag on economic activity which keeps demand in check and prevents inflation from accelerating. If inflation does eventually accelerate, it would likely be several years from now, when the unemployment rate has returned to a much lower level. At the same time, the U.S. Federal Reserve would have to relax its 2 percent inflation target and agree to finance a portion of government spending through additional money creation. More than likely, the huge Fed spending is preventing deflation right now, not creating massive inflation.

What can we learn from all this? The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals. For now, inflation is not a near-term concern, but an area of focus in the future.

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.