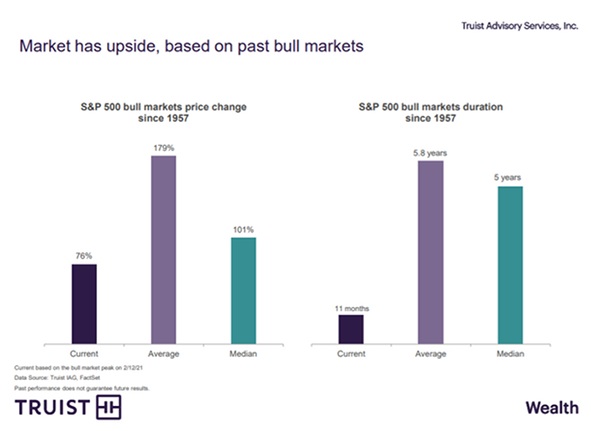

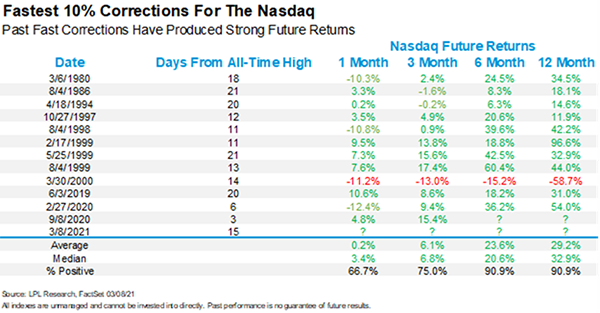

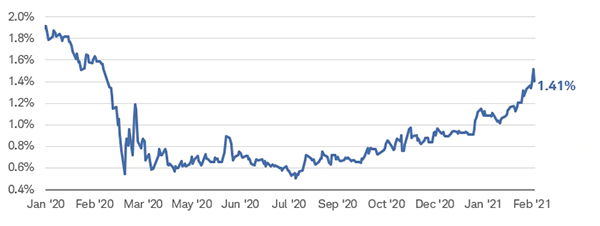

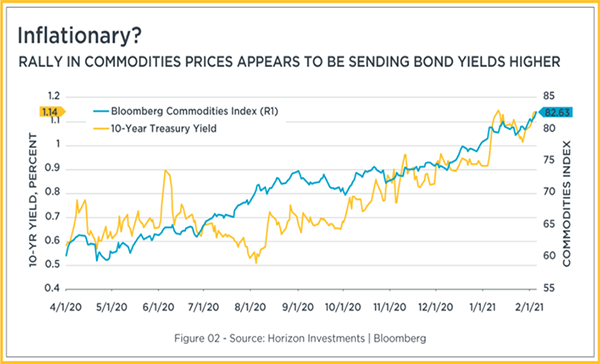

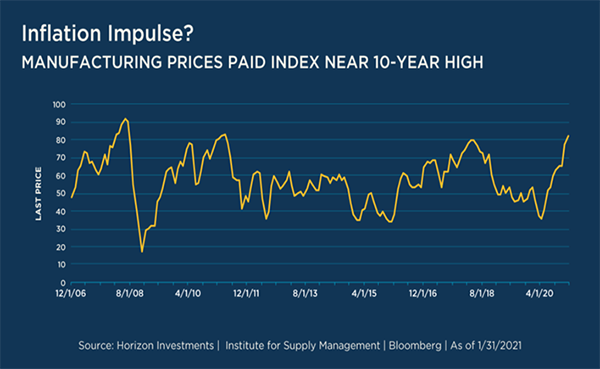

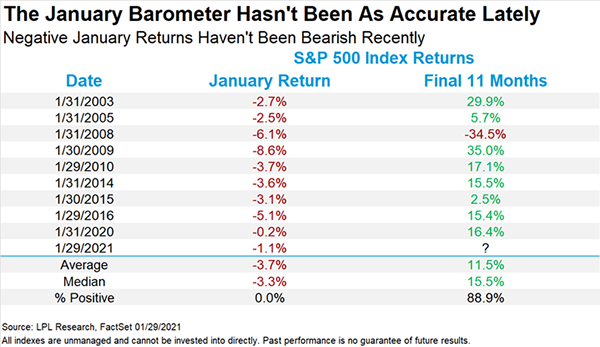

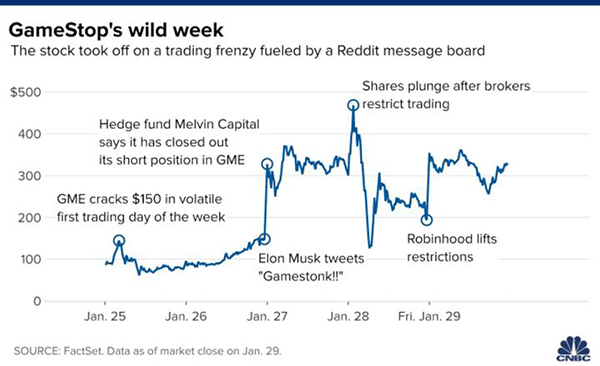

As we near the end of the first quarter of 2021, we’d like to review where we’ve been and let you know where we are headed with the portfolio. The year started the same way 2020 ended: with the stock market continuing its upward momentum, led by large-cap stocks — specifically, technology companies. Then Bitcoin caught the public’s attention, as did GameStop mania. The 10-year Treasury has increased from 0.9% to 1.6%, and the NASDAQ experienced a correction, albeit a very brief one.

We are in the process of reallocating and rebalancing the portfolios to account for the economic recovery and the economic lifecycle of the U.S. and the world. We are making the following changes:

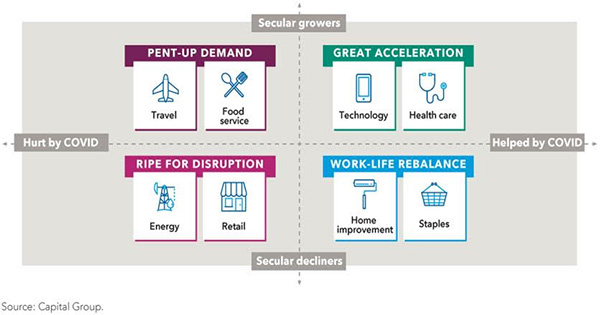

1. After increasing our technology position in 2020 to align the portfolio with the technological boom that resulted from the pandemic, we are reducing our exposure in technology to a market-weight level. Looking at the long term, we continue to believe strongly in the technology sector and will continue to have a strong weighting. As more people have access to the vaccine, however, the economy continues to reopen and broaden. Travel is increasing, people are eating out more, and stocks that were out of favor last year are becoming more relevant this year.

2. International equities remain less expensive on a price-to-earnings multiple basis, compared to the U.S. stock market, and we are adding to our current position. We believe that small- and mid-cap stocks will benefit from the economic reopening, and we are increasing our current allocation. At the same time, we are increasing our allocation to higher dividend-yielding companies that have a broad exposure to the overall economy in sectors like financials, energy and industrials.

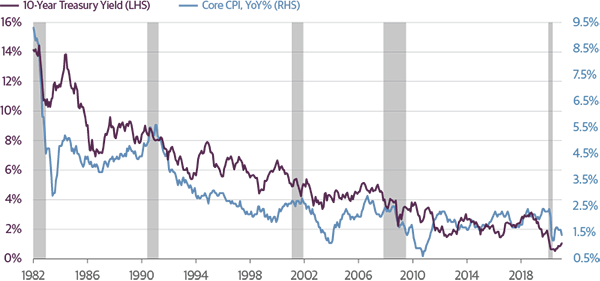

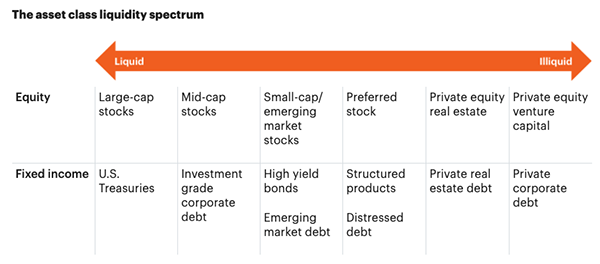

3. From a fixed-income perspective, we are reducing our current weighting in high-quality corporate bonds and adding a strategic income fund that provides diversification to different asset classes within fixed income. As interest rates rise, certain fixed-income segments invest in bonds that rise with higher rates and provide increased flexibility within the portfolio.

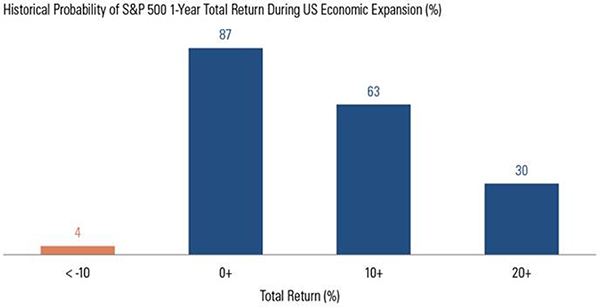

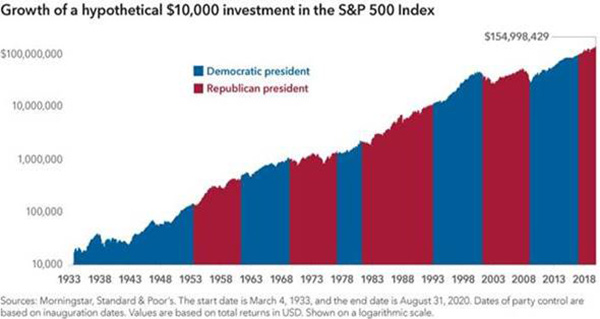

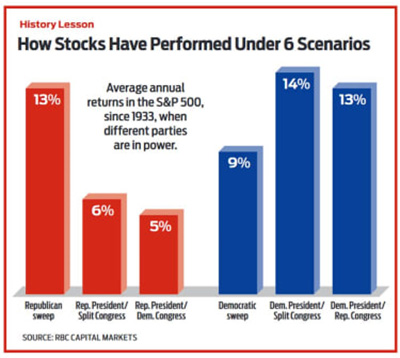

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought-out, looking at where the economy is heading. We are not guessing or timing the market. We are anticipating and moving to those areas of strength in the economy and in the stock market.

We strategically have new cash on the sidelines and buy in for those clients on down days or dips in the market – like one does in a 401K every other week. We speak with our clients regularly about staying the course and not listening to the economic noise.

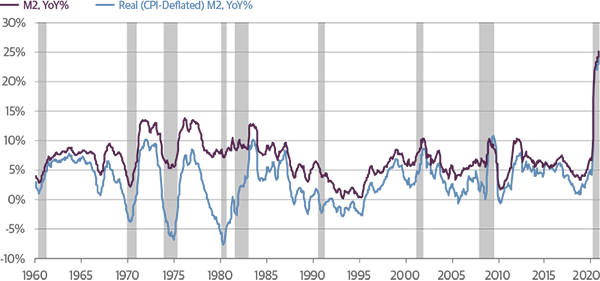

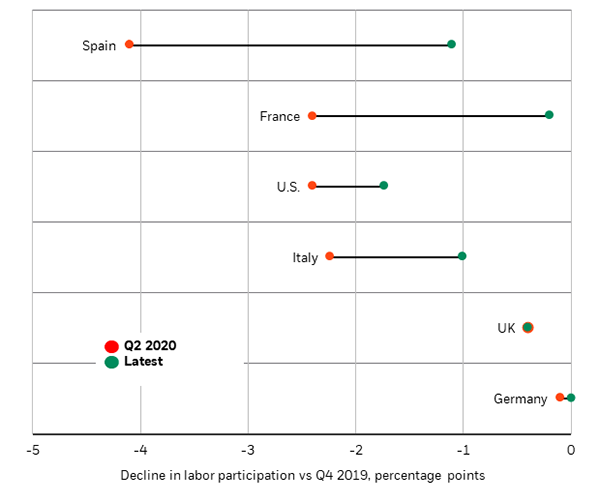

In the short term, the outlook for the global economy continues to improve – specifically, with the recent passage of a $1.9 trillion stimulus package and millions receiving their vaccinations. The Federal Reserve has stated on many occasions that it plans to allow mild inflation to increase and reach above 2% for the foreseeable future — and it is unlikely to raise short-term interest rates in the near future.

So, what can we learn from all this? From an investment perspective, we use these trends to help with the strategic and tactical asset allocation and where we see the portfolio heading over the next 5-7 years, with short-term adjustments along the way. We are not trying to time the market. We continue to view more risk being out of the market than in the market. Riding out future market volatility in addition to having a diversified portfolio means staying the course.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. With regards to investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of market volatility. Long-term fundamentals are what matter.

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures