Last week, the Federal Reserve raised the Federal Funds Rate by another 75 basis points (.75%) for the third consecutive meeting. The current range is 3.00% to 3.25%. The Fed expects the Federal Funds Rate to reach 4.50%, implying another 125 basis points (1.25%) of tightening through interest rate hikes. Chairman Jerome Powell hinted that the goal of taming inflation is likely to induce a recession: “Reducing inflation will likely require a sustained period of below-trend economic growth. No one knows whether this process will lead to a recession or, if so, how significant the recession will be.”

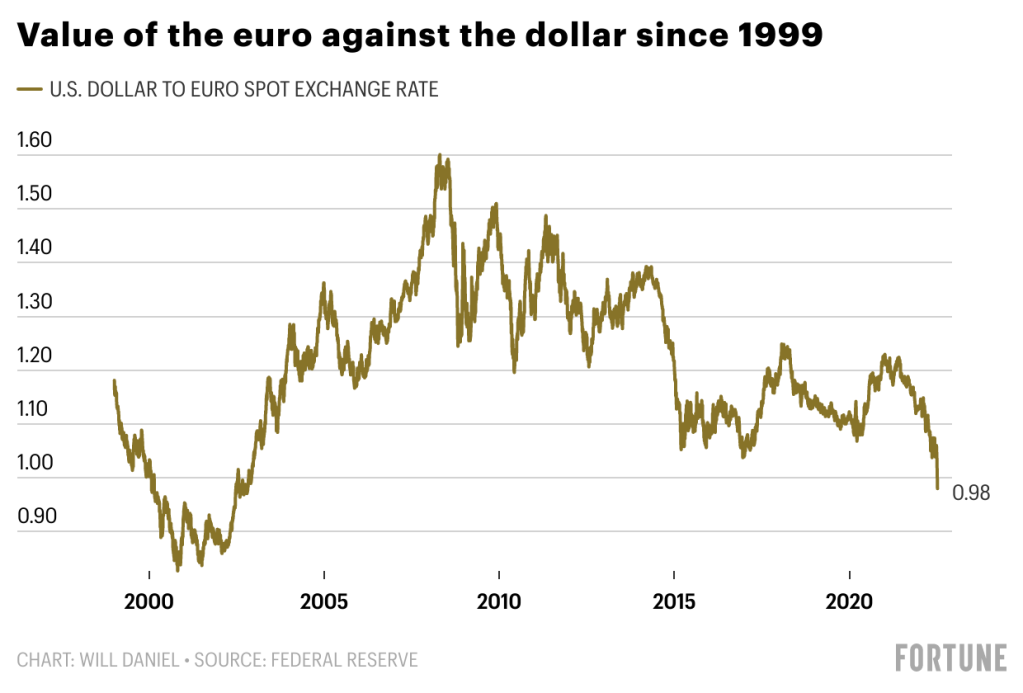

At the same time, the Bank of England, Sweden’s central bank, Bank of Canada and European Central Bank have all raised rates by a minimum of 50 basis points (.50%) in the last few weeks. The global outlook is driven by the impact of central bank actions, as well as war in the Ukraine and lockdowns in China.

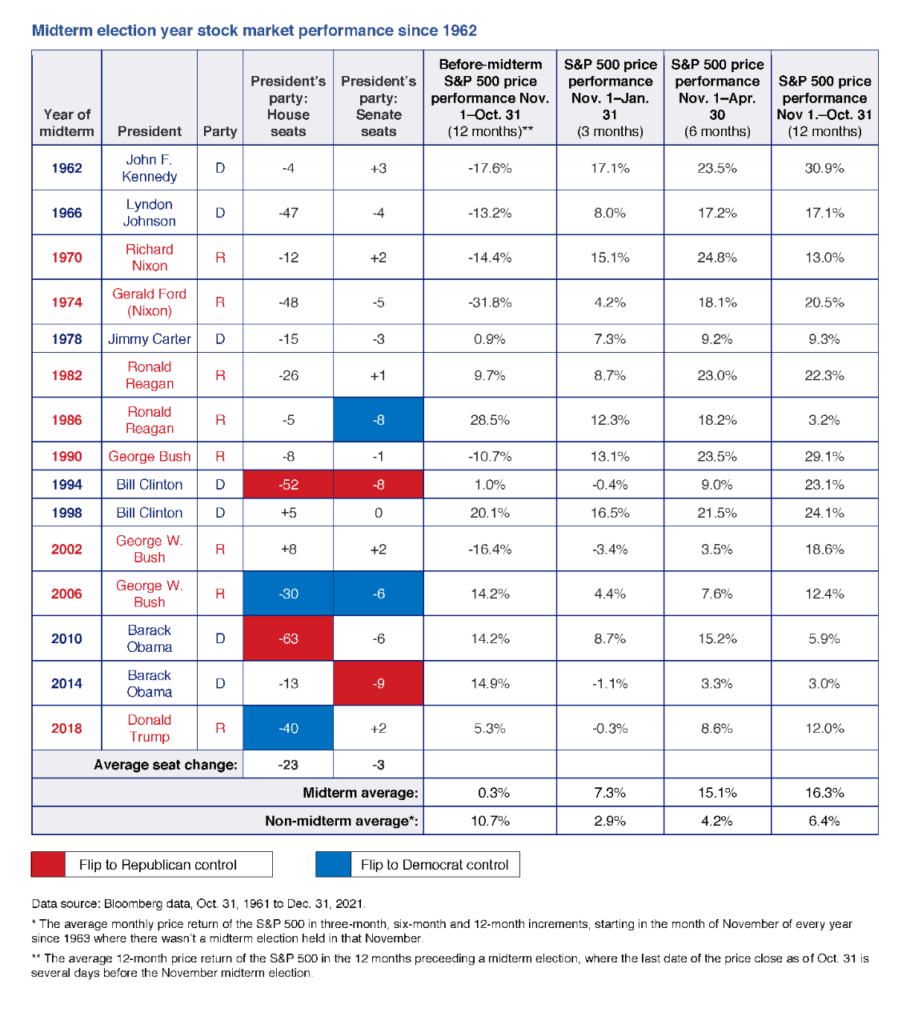

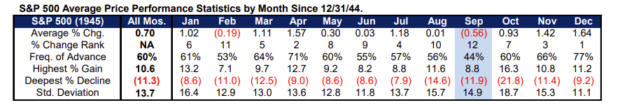

Powell’s comments pushed stocks sharply lower and sent the U.S. dollar to a 20-year high. (See our previous article: What Does a Stronger U.S. Dollar Mean for You?) Last Friday, stocks closed at their lowest levels since the pandemic in 2020. Stocks have struggled since an unexpectedly hot inflation report in August shocked investors who were looking for price relief. On top of the recent inflation report and the Fed raising rates again, September historically has been the worst month in the stock market, dating back to 1897. Since 1944, only two months have averaged negative returns, with September averaging down .56%, as shown in the chart below.

Theories abound as to why this is the case. It is generally believed that investors come back from summer vacation and want to sell holdings to lock in gains for the year, while others speculate that September marks the beginning of the period when mutual fund companies start to pay distributions, which triggers tax-loss selling. October has seen the largest decline in terms of percentage — think of the crash of 1987 — but historically has been a strong month on average, returning almost 1%.

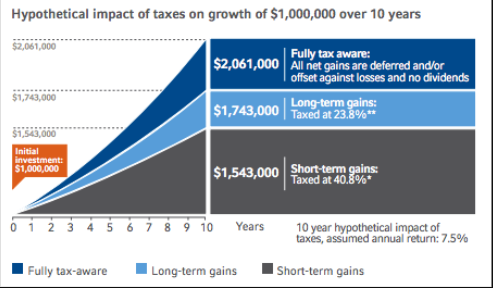

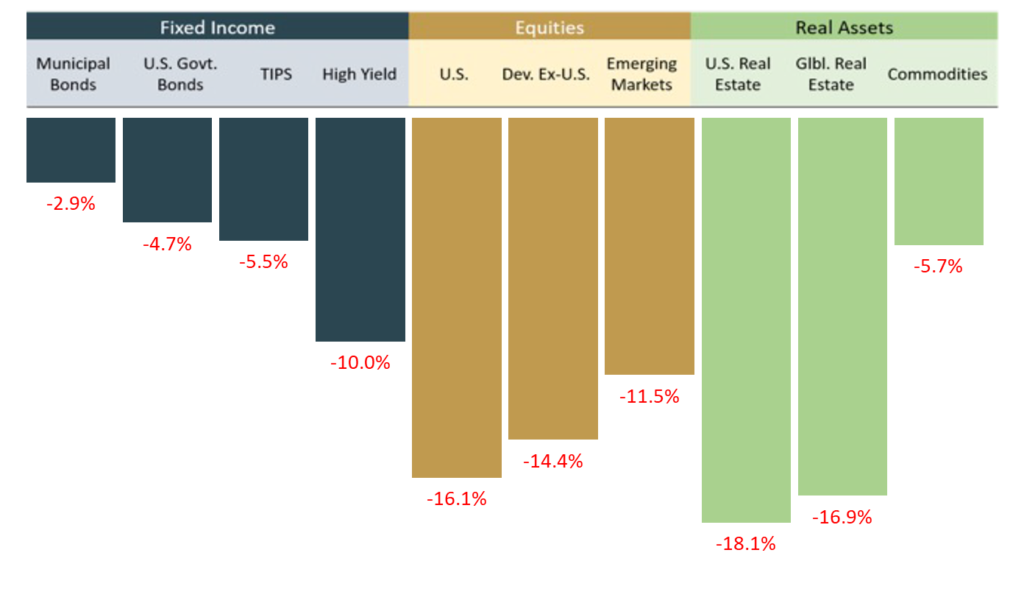

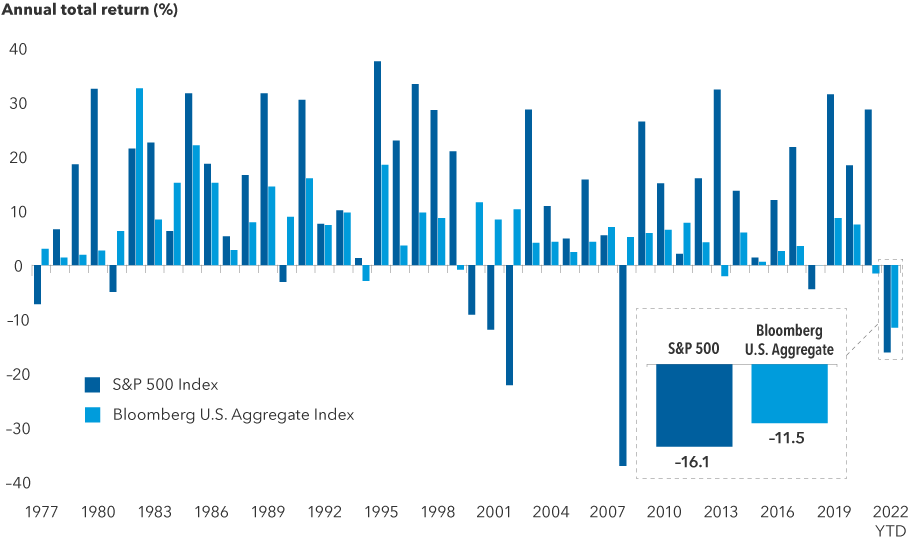

Historically, when stocks have decreased in value, the bond market has been there to offer a “buffer” or help mitigate downside risk. As the chart shows below, in each instance that the S&P 500 has decreased, going back to 1977, bonds have increased. However, that has not been the case this year. Through the end of August, the S&P 500 and the Bloomberg U.S. Aggregate Bond Index are down double digits. Over the last many years, the stock market has been the primary source of returns as money market and bond yields have been close to 0%. These conditions are sometimes called “TINA,” an acronym for “There Is No Alternative.”

We are moving from TINA to TARA — There Are Reasonable Alternatives. With the Fed Funds rate at 3% and the 2-year Treasury bond over 4%, savers can earn more money on their cash alternatives, and investors do not have to reach for excess yield either in the stock market or through lower credit risk in the bond market.

The Fed has made it abundantly clear that it is willing to sacrifice growth for lower inflation. Growth expectations were revised lower for this year and next. The Fed’s new forecast for 2023 Gross Domestic Product (GDP) is 1.2%, with an unemployment rate of 4.4%. The Fed needs both GDP to decline and the unemployment rate to increase for inflation to return to its 2% target level. This is because if the overall output of the economy is increasing, price increases may follow as demand outpaces supply. If GDP is declining, corporate profits are less, and demand is decreasing — which in turn may lead to price decreases.

Much of the most recent inflation increase has been attributed to wage growth. If unemployment increases, then the upward pressure on wages may subside, bringing inflationary pressures down. The economy will be better off the sooner the unemployment rate reaches the “natural rate of employment,” which is the rate that is neither too low and inflationary nor too high and recessionary. At the same time, for the economy to turn the corner, demand and growth need to subside to help with inflationary pressure.

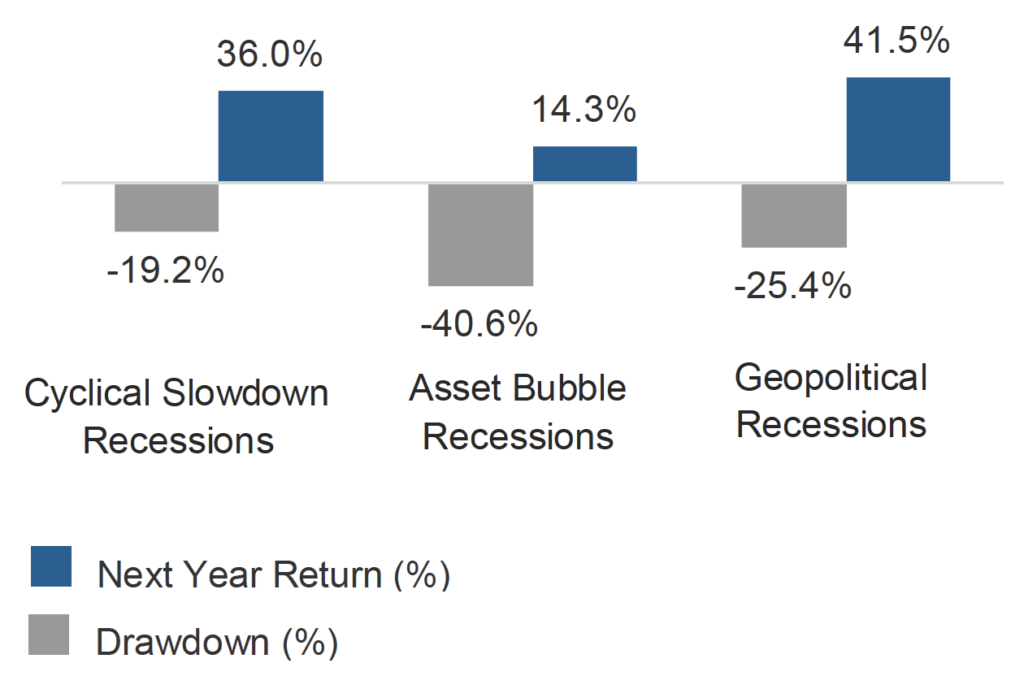

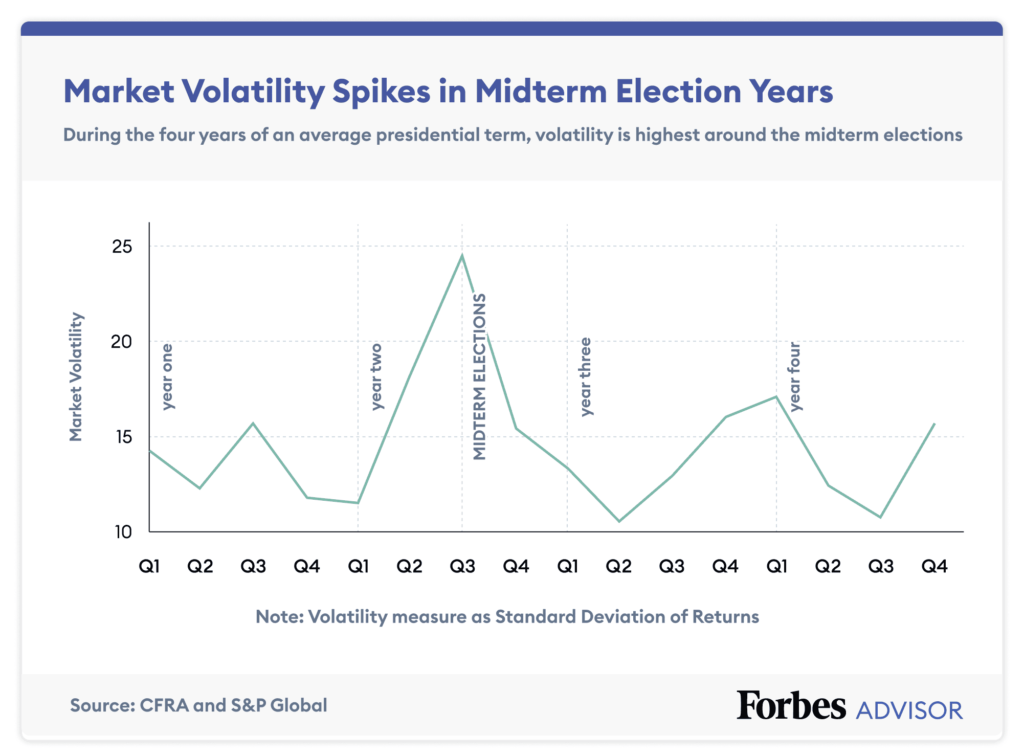

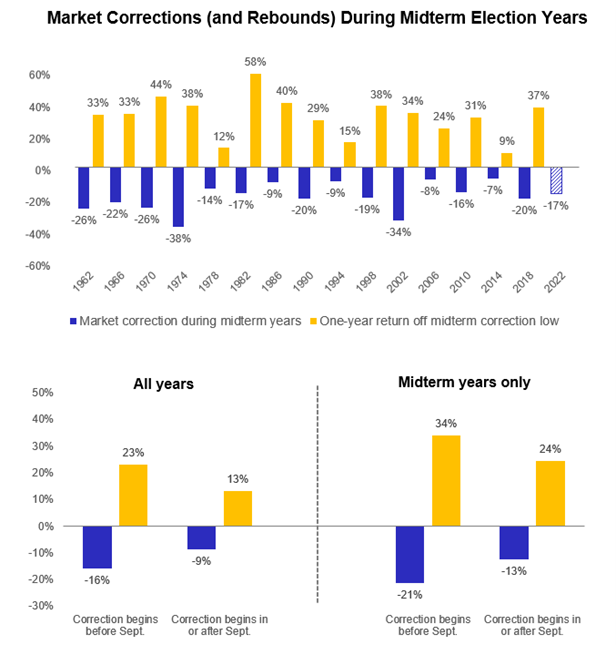

Should inflation begin to recede through a soft labor market and slowing GDP, markets may rebound on prospects for an end to the aggressive rate hikes of 2022. We will need to see several months of evidence that services inflation and wage inflation are trending down. It is critical to remain forward-looking and invested. The fourth quarter is historically the strongest quarter of the year. Missing out on the market rebound, when the largest up days typically occur in a bear market, can be detrimental to the long-term plan that has been constructed for both the good and bad times.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

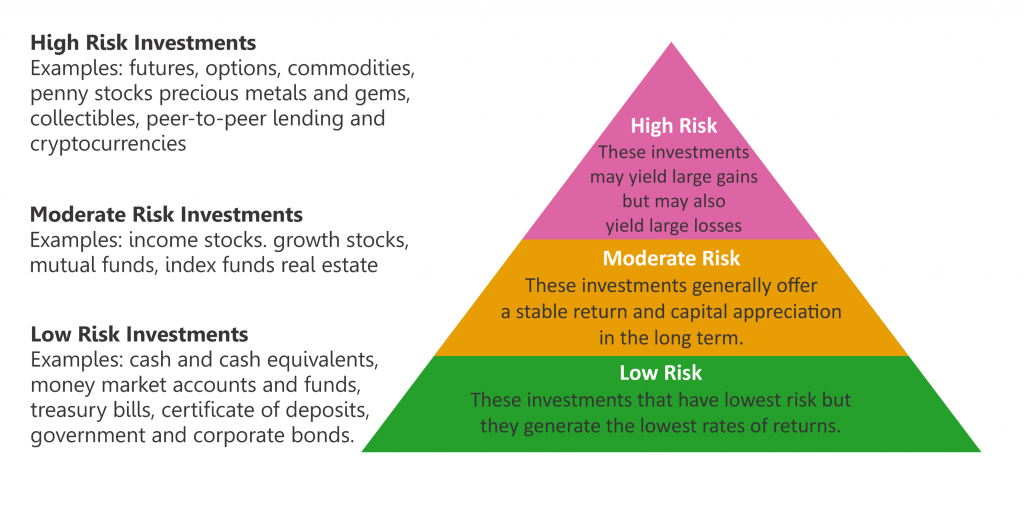

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

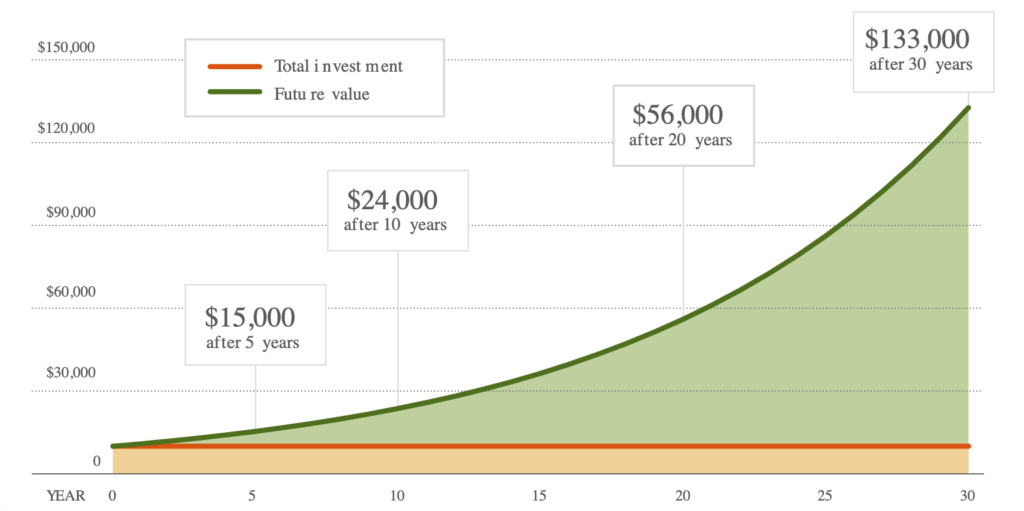

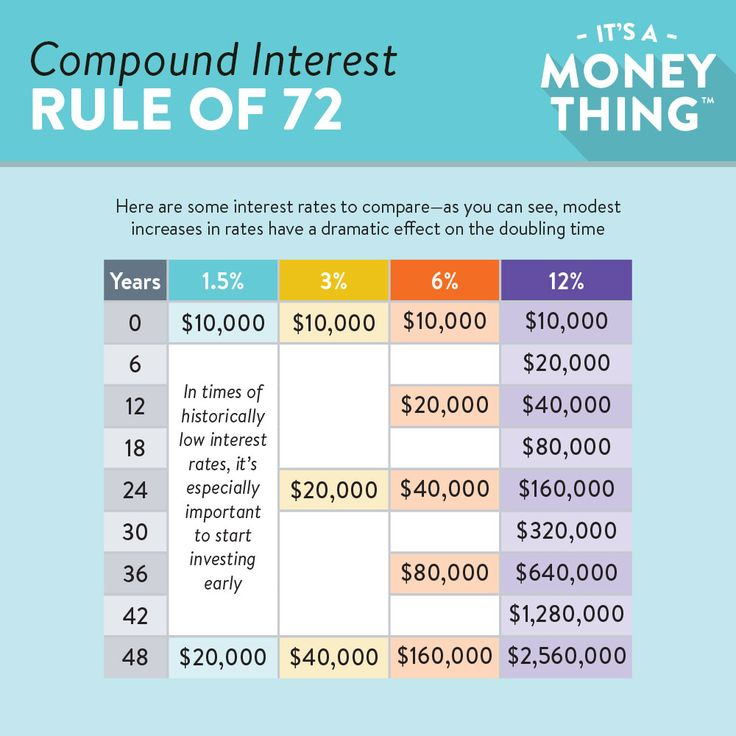

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: American Funds, CFRA BMO, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.