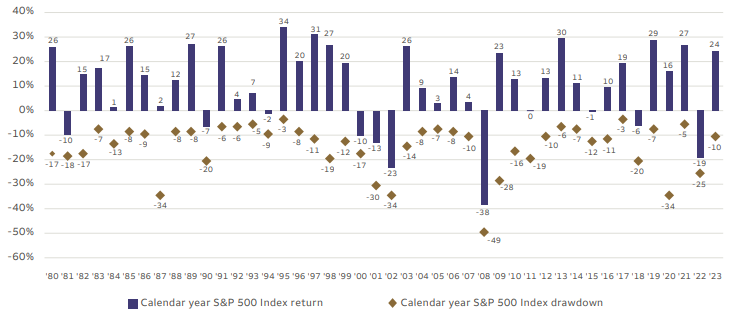

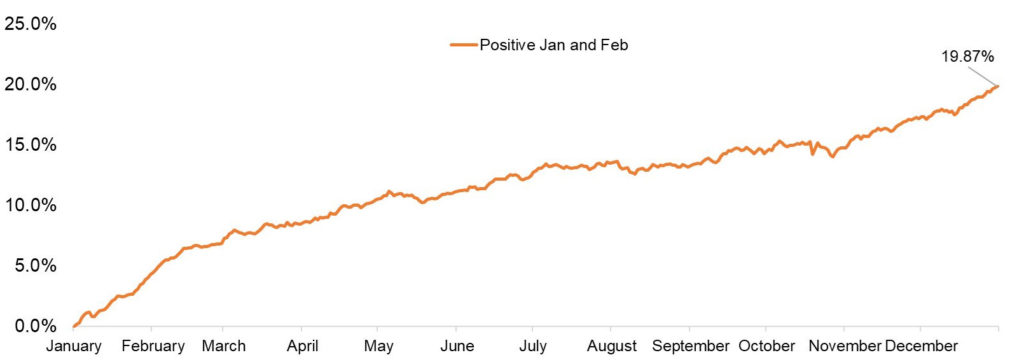

As we head toward Memorial Day — the unofficial start to summer — the stock market is near all-time highs. After pulling back in early April, stocks bounced back quickly. The S&P 500 and the NASDAQ rose to all-time highs last week, and the Dow Jones Industrial Average closed above 40,000 for the first time. In just the last seven years, the Dow has climbed from 20,000 to 40,000 points.

Dow Jones Industrial Average

Milestones since 2016

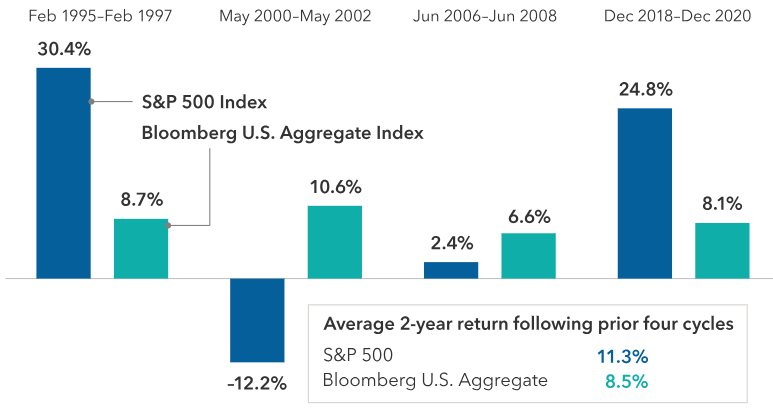

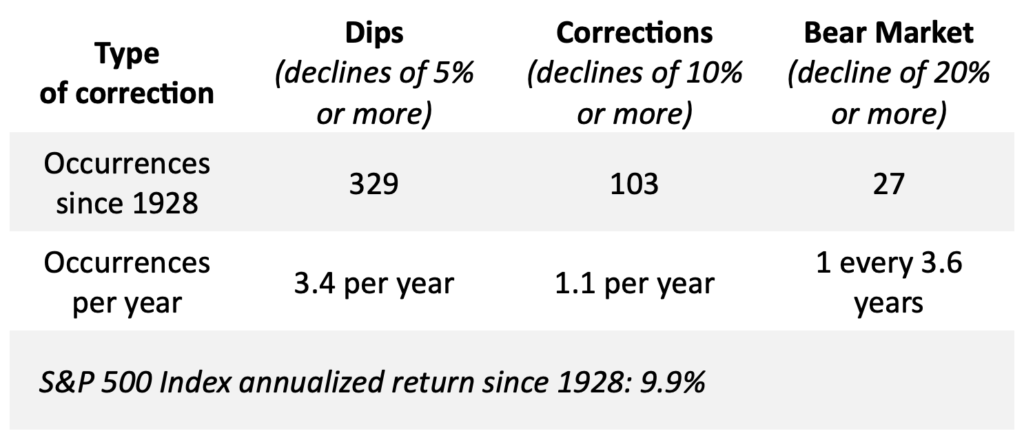

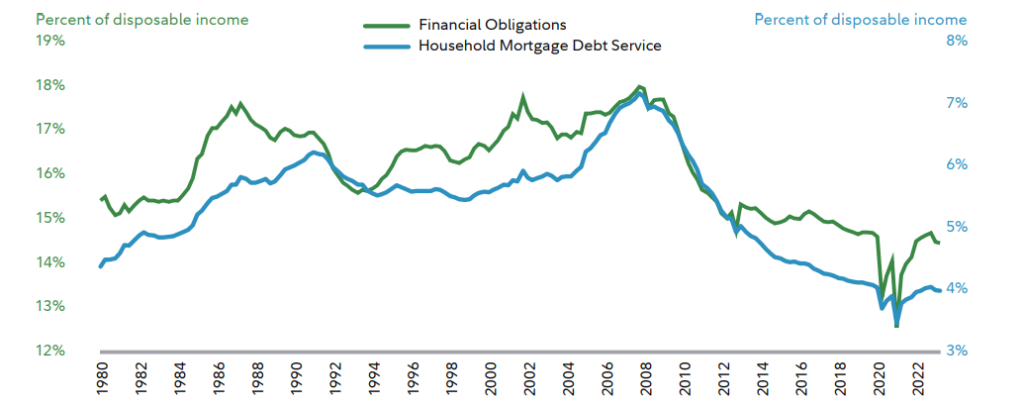

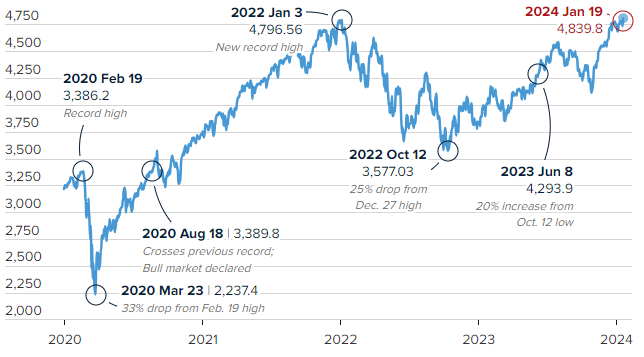

This climb includes a near-bear market in the fourth quarter of 2018, the pandemic in 2020 and the soaring interest rates that ensued, the bear market of 2022, wars in Ukraine and the Middle East and inflation not seen since the 1980s!

The Dow first closed above 20,000 in early 2017, following large corporate tax cuts passed by Congress. The Dow was about to breach 30,0000 in early 2020, but then the pandemic happened, and the Dow fell 38% from the February peak all the way down to 18,213. By November 2020, the Dow had closed above 30,000 for the first time — and 872 days later, the Dow crossed 40,000 for the first time.

What Does Dow 40,000 Mean?

The Dow is still considered America’s index and still represents Main Street America. While the S&P 500 is more representative of the overall stock market, the Dow dates back to 1896 and is still quoted as one of the major stock indexes to follow. It’s also a reminder that when it comes to investing, patience is the key — and has been rewarded in the past.

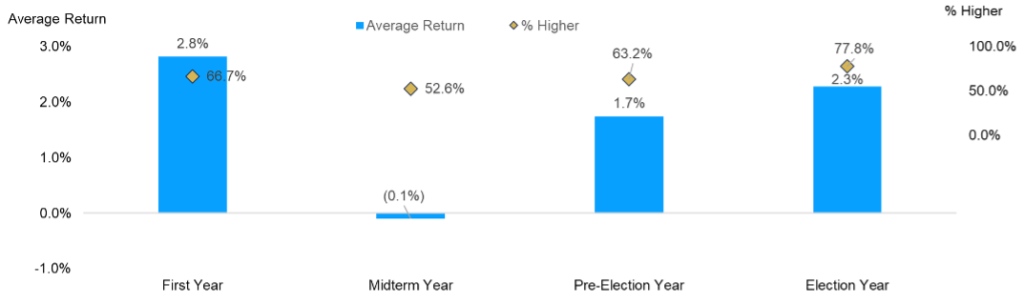

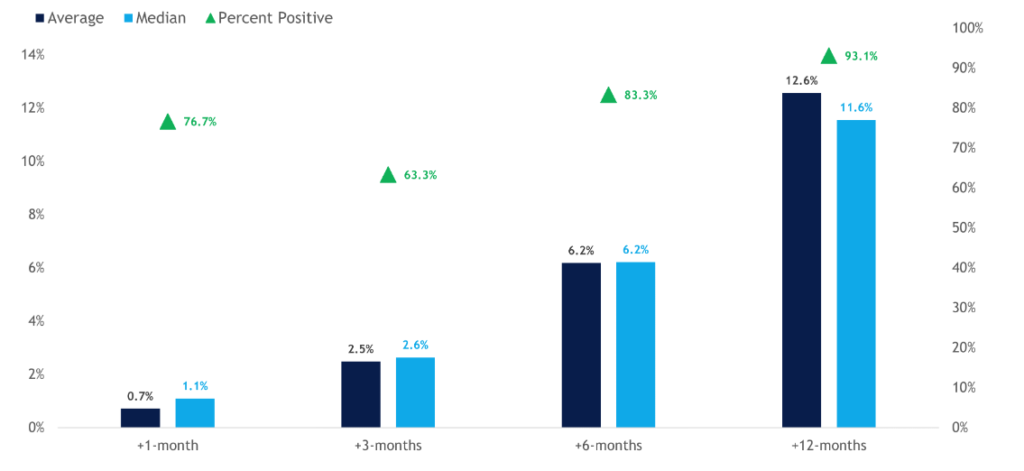

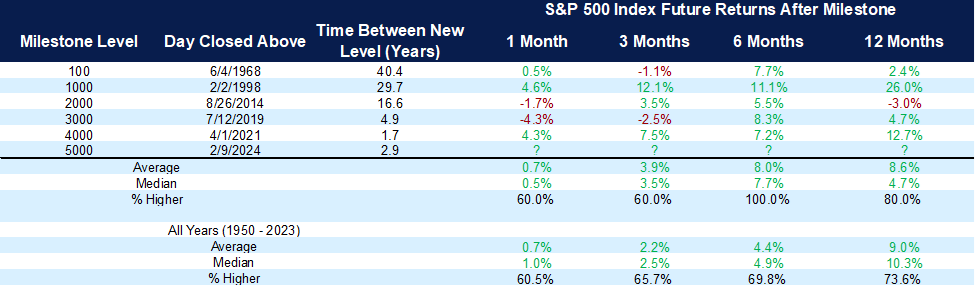

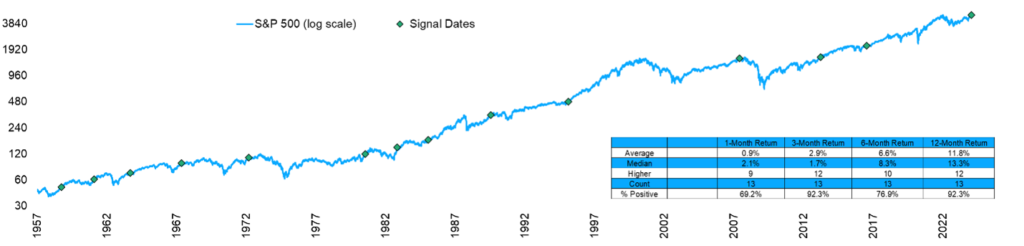

According to Carson Wealth, this was the 1,414th new all-time high for the Dow since 1900. New highs often lead to more new highs, as the average return one year after a new high has been 7.8%, with gains seen 70% of the time. For some additional perspective, the average return for the Dow since 1900 has been up 7.4% with gains 65% of the time.

Don’t Fear New All-Time Highs

Dow returns after new all-time highs

Dow 40,000 does not guarantee higher returns going forward. While we are positive about the future and the economy, we are not Pollyannish, and we do maintain some concerns.

Equity valuations and geopolitical risks remain at the top of our list. There is no denying that such risks are heightened as the world faces two wars and U.S.-China relations remain strained. It is important to remember that the underlying economic fundamentals in the U.S. remain strong, which is key during periods of heightened tension.

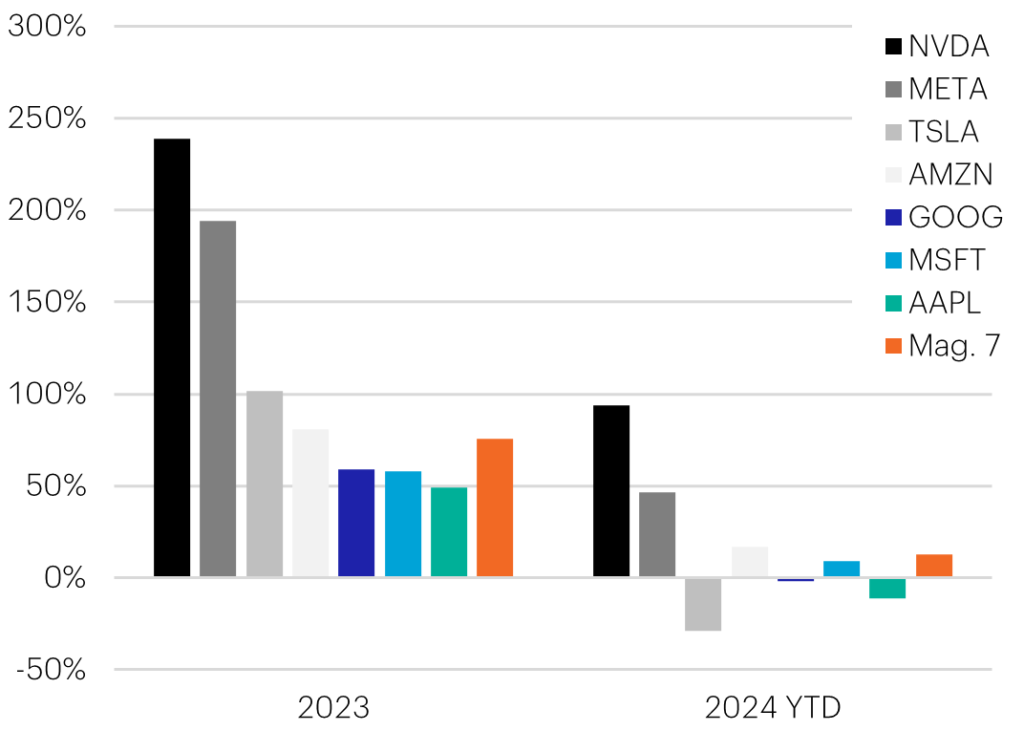

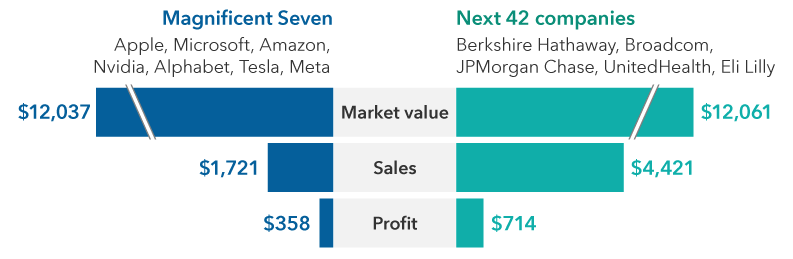

Last year, we saw price expansion in the stock market, led by the Magnificent Seven, and that has continued the first half of this year. We need to see earnings expand and keep pace to justify the current market multiple.

Analysts are projecting 11% earnings growth in 2024, along with 5.5% revenue growth. While the forward P/E for the market is over 20 (the 10-year average is 17.8) and some would consider the market overvalued, the forward P/E will come down and may justify the current stock prices if earnings continue to grow as expected.

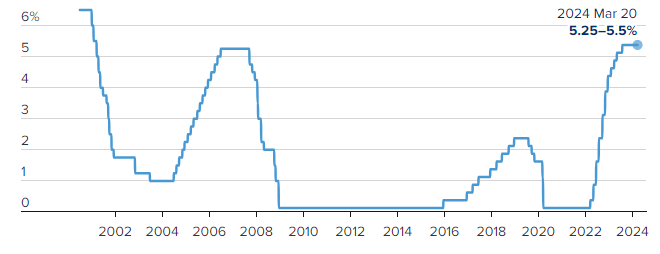

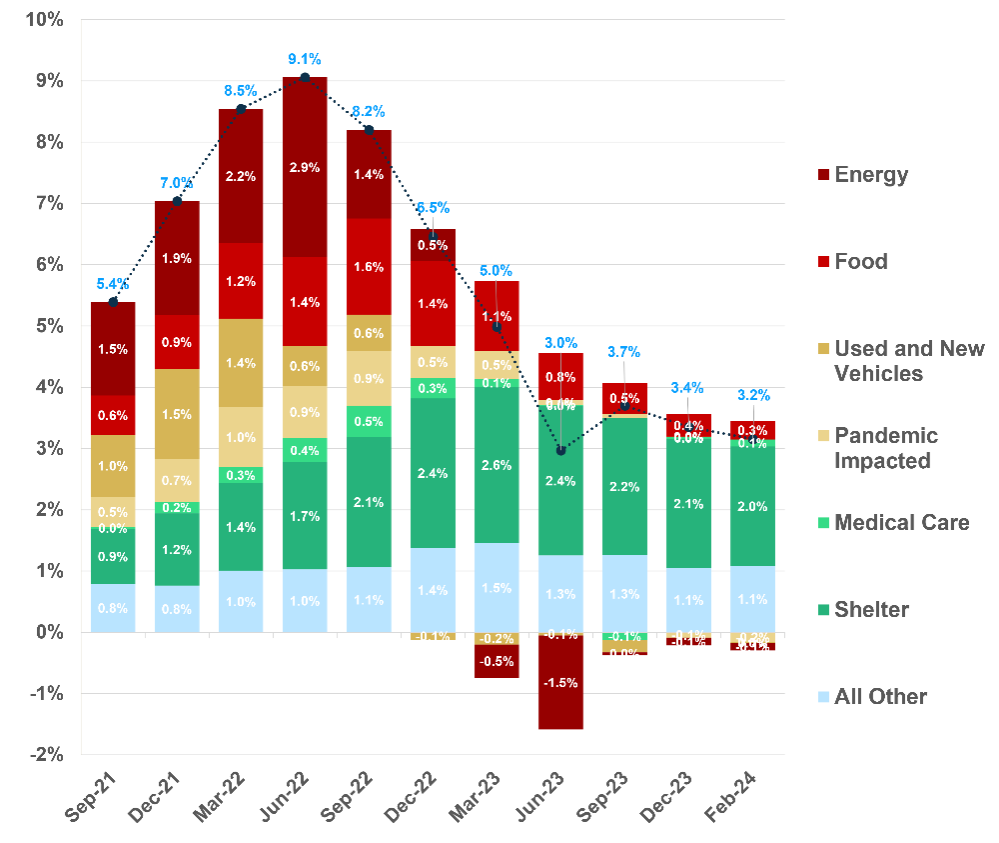

The prospect of lower inflation data also spurred the market last week to reach all-time highs. Fed Chairman Jerome Powell recently reiterated that inflation data has yet to make Fed members confident that they can cut rates, but more positive movement is likely if data continue to show signs of price easing.

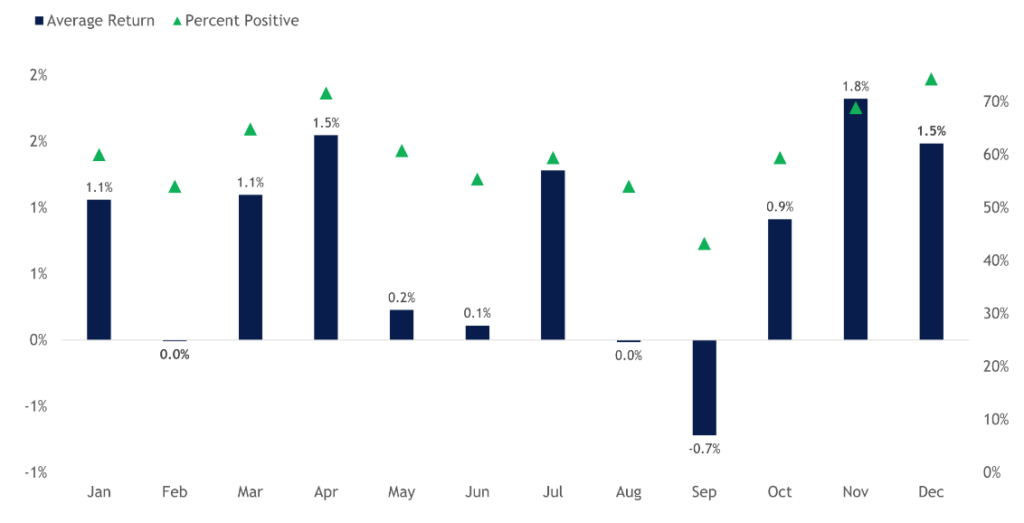

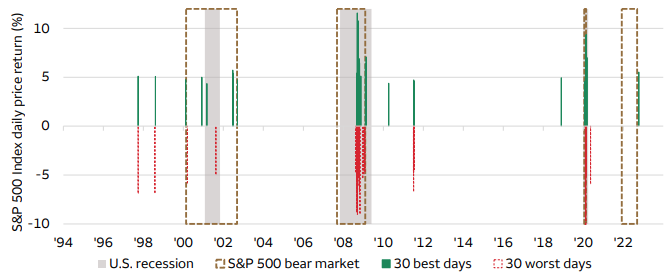

Our stance has long been that investing is not about timing the market but time in the market. That means not looking to play the market based on inflation data from month to month, who may win the presidential election or worries about war overseas. Please keep this in mind the next time you read scary headlines or hear an economist predicting gloom and doom.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

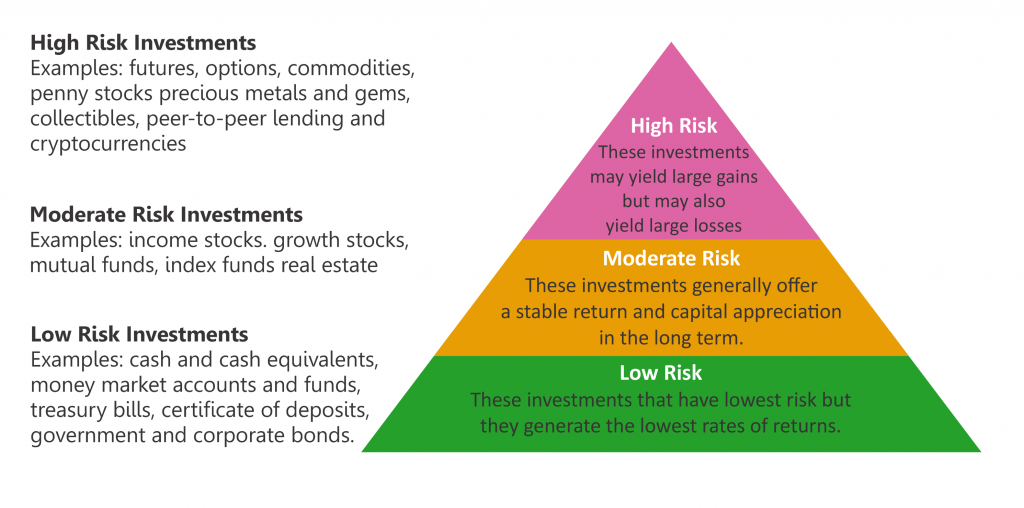

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: CityNational Rochdale, Carson, CBNC

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.