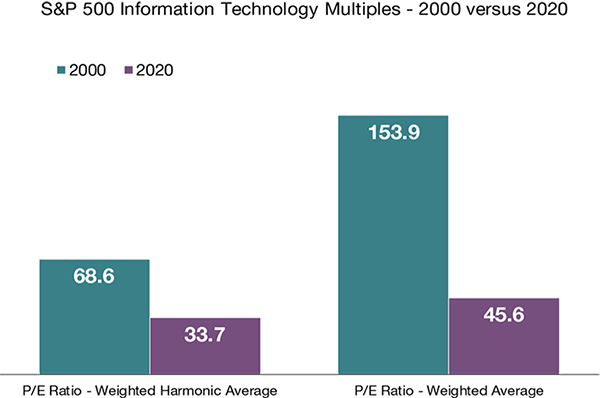

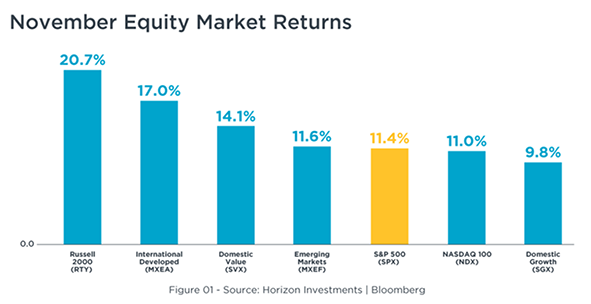

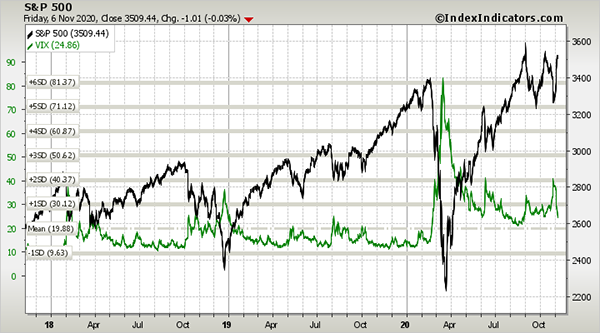

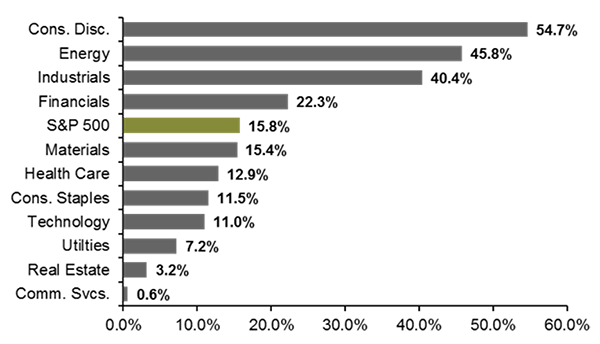

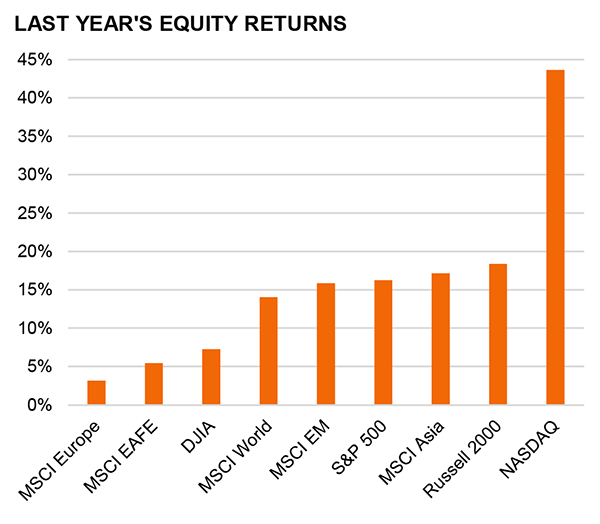

What a year 2020 was! For investors, 2020 offered good opportunities and returns — if you stayed for the ride. It was the first year since 1938 that the S&P 500 returned more than 15% while volatility was greater than 30%. The COVID-19 pandemic led to rapid losses in February and March, followed by an unprecedented recovery as both monetary and fiscal policy came to the rescue. The initial rebound in the market was led by technology stocks, more specifically, the stay-at-home stocks. At the end of the year, cyclical and small-cap stocks drove the market higher.

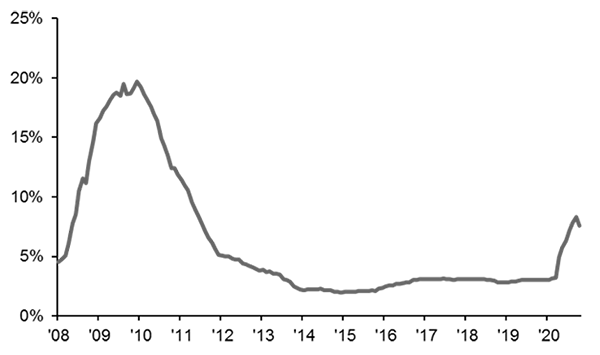

The Fed acted quickly and aggressively to address liquidity needs in the fixed income and bond markets, lowering the Federal Funds rates from 1.75% to zero in response to the global pandemic. The bond markets remained resilient with the help of the CARES act and the additional funds provided for state and local governments. Because of the quick action, bond default rates remained low and did not exacerbate the economic problems.

Compared to the stock market, the oil market more accurately reflected the economic reality. Crude oil fell more than 20% on the year as the pandemic caused a decline in global energy demand. Later in the year, production cuts from OPEC helped stabilize the price of oil. Gold, often considered a safe-haven asset, rose more than 20% on the year, as investors sought safety following the market decline and concerns of inflation arising with the level of increased national debt.

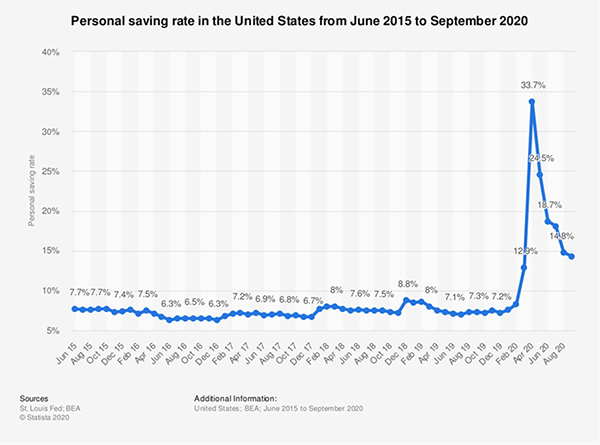

The economy experienced a real rollercoaster, with the biggest quarterly contraction on record in Q2, followed by the largest quarterly gain in Q3. After the shutdown in April and May, consumer saving reached the highest levels ever. Consumer spending shifted during the year as spending habits favored online shopping over brick-and-mortar stores. With the resurgence of COVID cases this winter, consumer spending has moderated going into 2021.

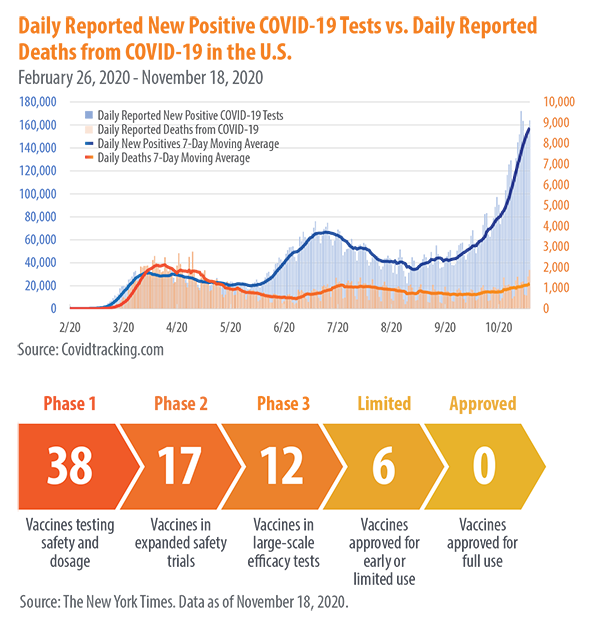

For 2021, growth expectations are high. We continue to highlight the following reasons why we feel the market may keep driving higher in 2021:

1. The health of the global economy and the rollout of vaccinations worldwide.

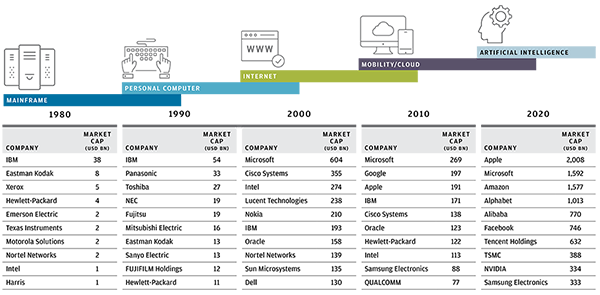

2. Technological acceleration in the world, brought about by the COVID-19 outbreak.

3. The Federal Reserve working on the premise of targeted inflation of 2% with the outlook of low interest rates for several years.

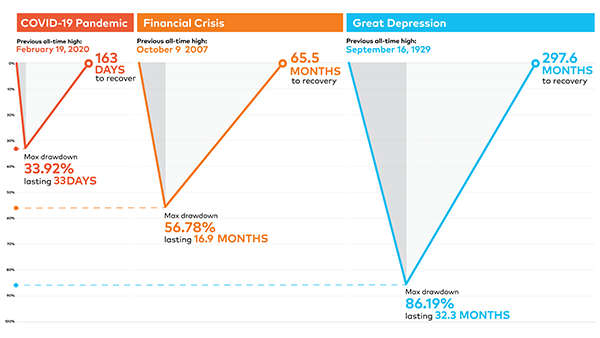

4. The government acting quicker than in past pandemics, leading to faster market recoveries.

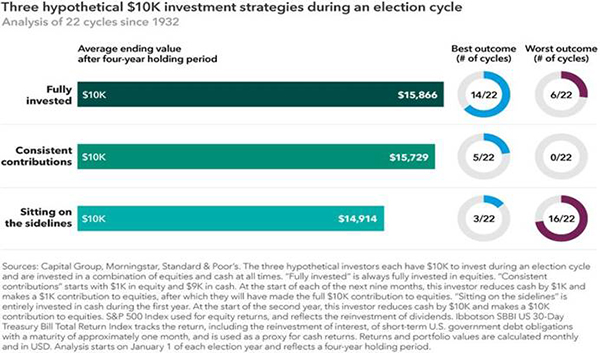

5. The amount of cash on the sidelines waiting to be deployed on sizable market retractions.

6. The consumer savings level, which is significantly elevated compared to pre-pandemic levels.

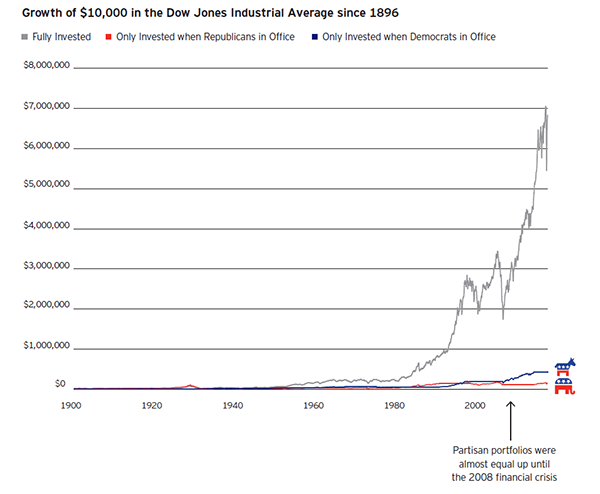

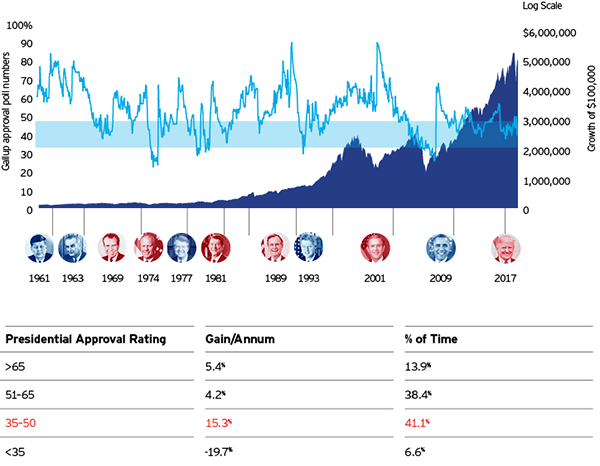

So, what can we learn from all this? A new year almost always brings new surprises. From an investment perspective, we use the above insights to help with the strategic and tactical asset allocation and where we see the portfolio heading over the next five to seven years, with short-term adjustments along the way. We are not trying to time the market, but we will try to take advantage when we see where the market is heading. Having a well-balanced, diversified portfolio and a financial plan are keys to successful investing. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of market volatility. Long-term fundamentals are what matter.

Sources: FS Investments, FactSet

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The MSCI AC (All Country) Asia ex Japan Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of Asia, excluding Japan. The Dow Jones Industrial Average is a popular indicator of the stock market based on the average closing prices of 30 active U.S. stocks representative of the overall economy. S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. It is not possible to invest directly in an index.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.