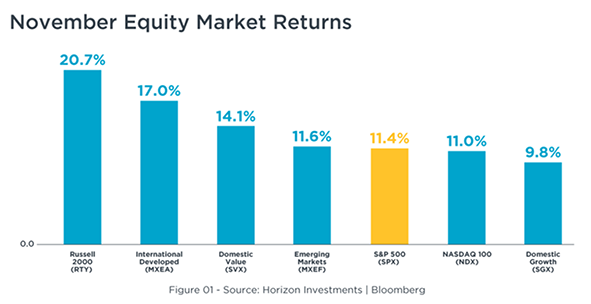

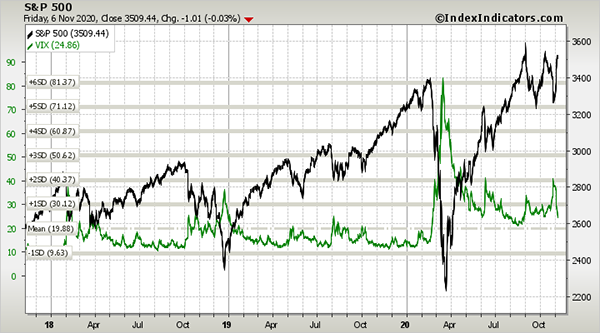

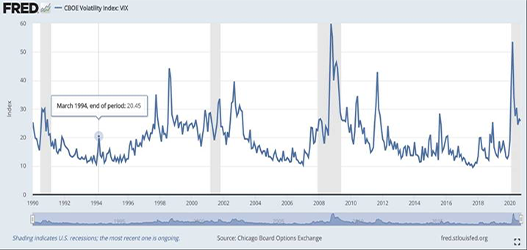

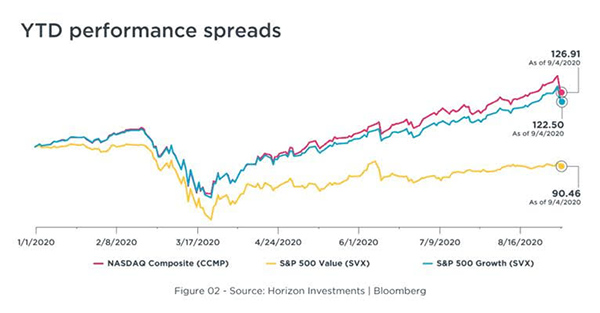

As we near the end of 2020, we look back on the stock market’s wild ride. The year began with positive equity returns, followed by a global pandemic that sent the market into a drop not seen since the Great Recession and then a strong recovery, led by technology stocks from the “stay at home economy.” Throughout the year, we made the following changes to our risk managed portfolios:

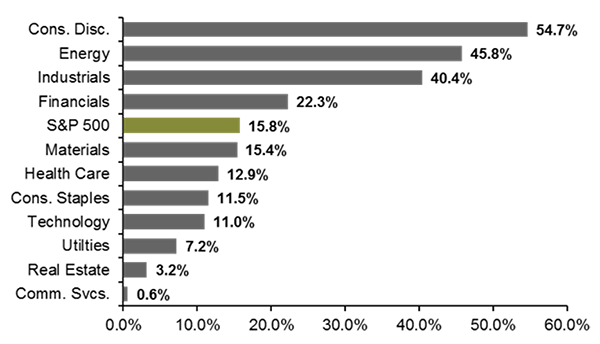

1. In early February, we significantly reduced energy exposure, and in late March, we increased large-cap exposure, through additional exposure to technology and healthcare. We funded the changes by selling out of small- and mid-cap stocks, as well as real estate. We anticipated that small- and mid-cap stocks would take longer to recover from the economic shock caused by COVID, while technology and healthcare would benefit from the stay-at-home economy. At the same time, for fixed income, we sold emerging market debt and added to our U.S. bond portfolio through additional exposure to high-quality corporate bonds.

2. We have continued throughout the year to be active and nimble in this market, and in May, we reduced our exposure to higher-dividend stocks. We used the proceeds from the sale to increase our exposure to healthcare in the portfolio.

3. In July, we removed the remaining higher dividend-yielding exposure. We moved the monies into equities that instead focus on dividend appreciation. The index tracks the performance of stocks of companies with a record of growing their dividends year over year.

4. In November, upon the announcement of a vaccine being available, we decided to add back small- and mid-cap growth stocks that would benefit from the reopening of the economy, and we swapped out of our position in global infrastructure.

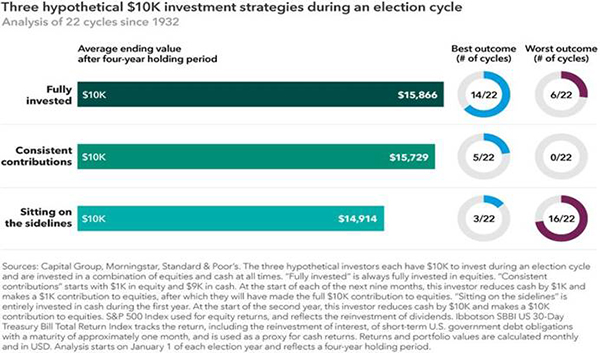

Our focus remains on long-term investing with strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought-out, looking at where we see the economy moving. To use a hockey analogy from Hall of Famer Wayne Gretzky, we skate to where the puck is going, not to where it already has been. We are not guessing or timing the market. We are anticipating and moving to those areas of strength.

We strategically have new cash on the sidelines and buy in for those clients on down days or dips in the market, similar to what people do in their 401(k)s every other week. We speak with our clients regularly about staying the course and not listening to the economic noise, as we feel the markets will come back over time.

Looking into 2021 and beyond, we see the following trends:

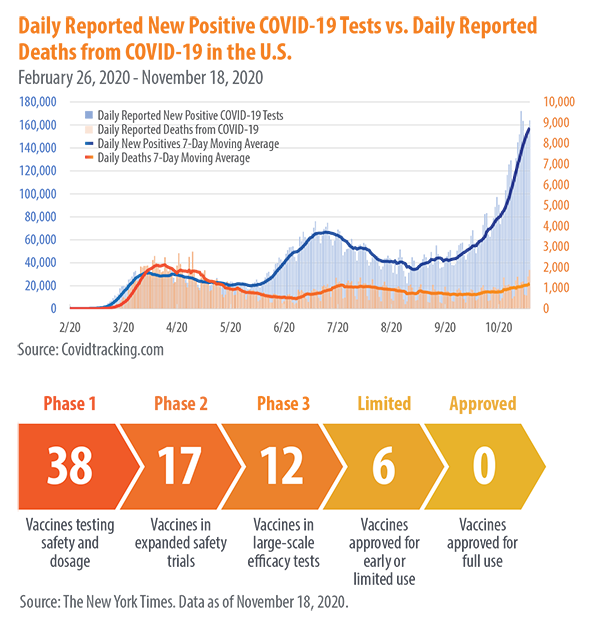

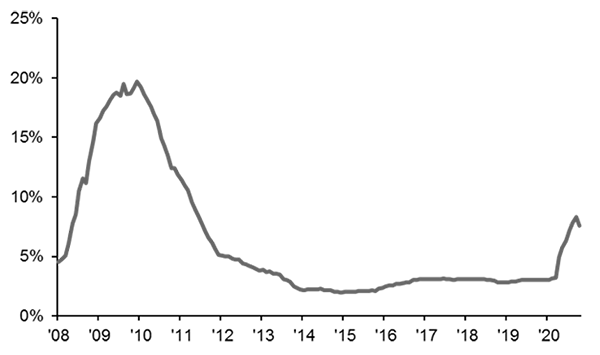

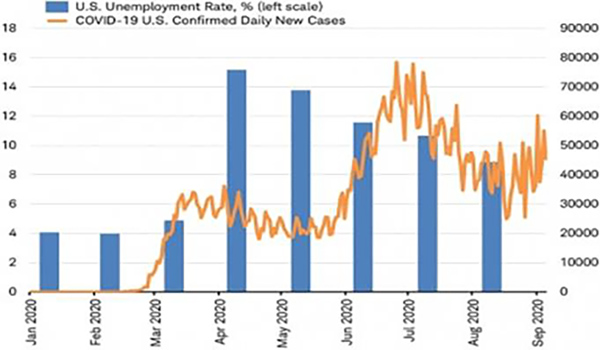

* In the short term, the outlook for the global economy hinges on health outcomes, specifically when the vaccine will roll out and how long it will take before economies return to their pre-pandemic levels. Social activities have been curtailed, and job losses in service sectors have been scarring, but the permanent job losses are likely to be limited.

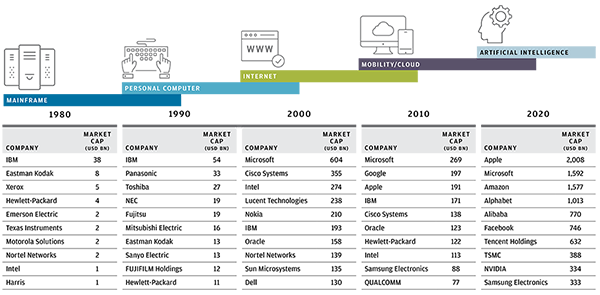

* Work automation and digital technologies have been accelerated by COVID-19. People are relocating from the cities to the suburbs as more people work from home, and this is likely to continue in the post-pandemic world.

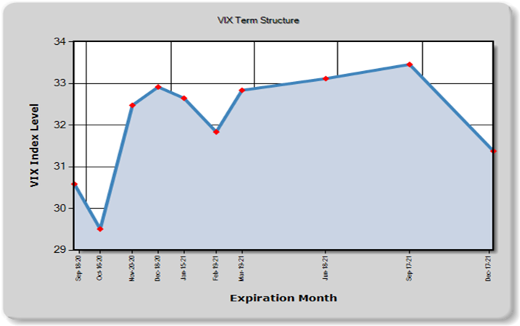

* The crisis responses by the government and Federal Reserve have been faster and more direct, and they are unlikely to be reversed quickly. For example, interest rates are projected to remain close to zero for years to come, whereas in the past, the Fed would be quicker to raise short-term rates as the economy ramps up.

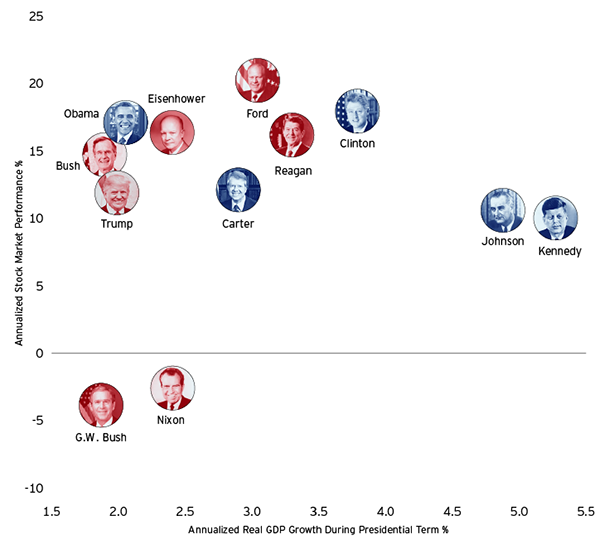

So, what can we learn from all this? From an investment perspective, we use these trends to help with the strategic and tactical asset allocation and where we see the portfolio heading over the next five to seven years, with short-term adjustments along the way. We are not trying to time the market, but we will try to take advantage when we see where the puck is going. As we near the end of 2020, we view more risk in being out of the market than in being in the market. Our plan is to ride out future market volatility, have a diversified portfolio and stay the course.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. With regards to investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals – regardless of market volatility. Long-term fundamentals are what matter.

_____

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management.