The clock started ticking last week on the drama surrounding the debt ceiling. The United States hit the $31.4 trillion debt ceiling on Jan. 19, triggering the Treasury Department to start taking extraordinary measures to prevent a default. Although the crisis probably is five to six months away, concern about whether a deeply divided Congress can find a path to raise the debt ceiling will be a critical issue this summer.

What is the debt ceiling?

Established by Congress, the debt ceiling is the maximum amount of money the federal government can borrow to finance obligations that lawmakers and presidents have already approved. It was originally created more than 100 years ago, and it has been modified more than 100 times since World War II alone. Though its original purpose was to make it easier for the federal government to borrow money, the debt ceiling has become a political battleground as a way for Congress to restrict the growth of borrowing. Increasing the debt ceiling does not authorize new spending commitments; it allows the government to meet its existing obligations.

What would happen if the United States were to default on its debt?

If the government were no longer able to borrow, it would not have enough money to pay its bills, including interest on the national debt. It would probably have to delay payments or default on some of its commitments, potentially affecting Social Security payments and federal workers’ salaries. Thankfully, this has never happened, so no one knows exactly how the Treasury would handle the situation. In a letter to Congress, Treasury Secretary Janet Yellin wrote that the department would begin employing “extraordinary measures” to help delay the point at which the nation might default on its debt.

What are “extraordinary measures”?

The Treasury has employed measures more than a dozen times in past debt-ceiling battles to prevent a default by allowing lawmakers more time to increase or suspend the limit. These measures include suspending new investments in various retirement accounts for government employees. These funds count against the debt limit and would therefore reduce the amount of outstanding debt subject to the limit, providing the agency with additional capacity to continue funding the government’s operations. No retirees would be affected ultimately, though, as the funds would be made whole once the debt ceiling was agreed upon.

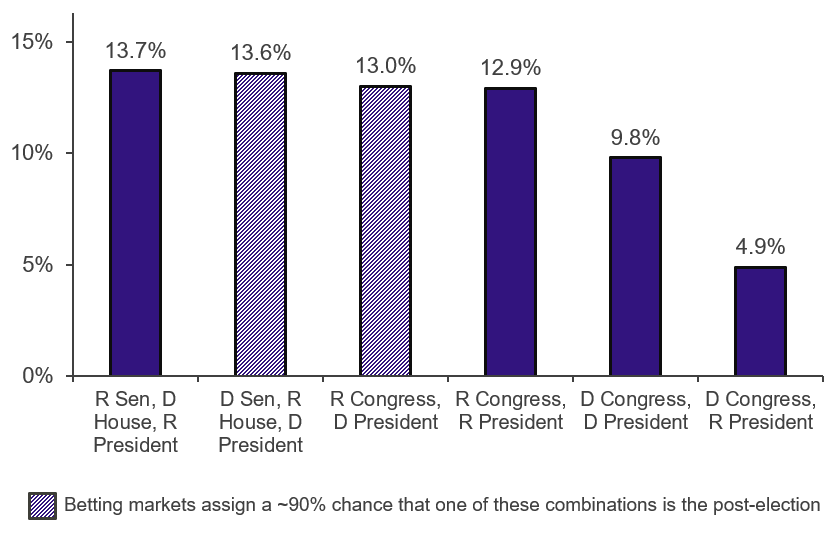

Will Congress raise the debt ceiling?

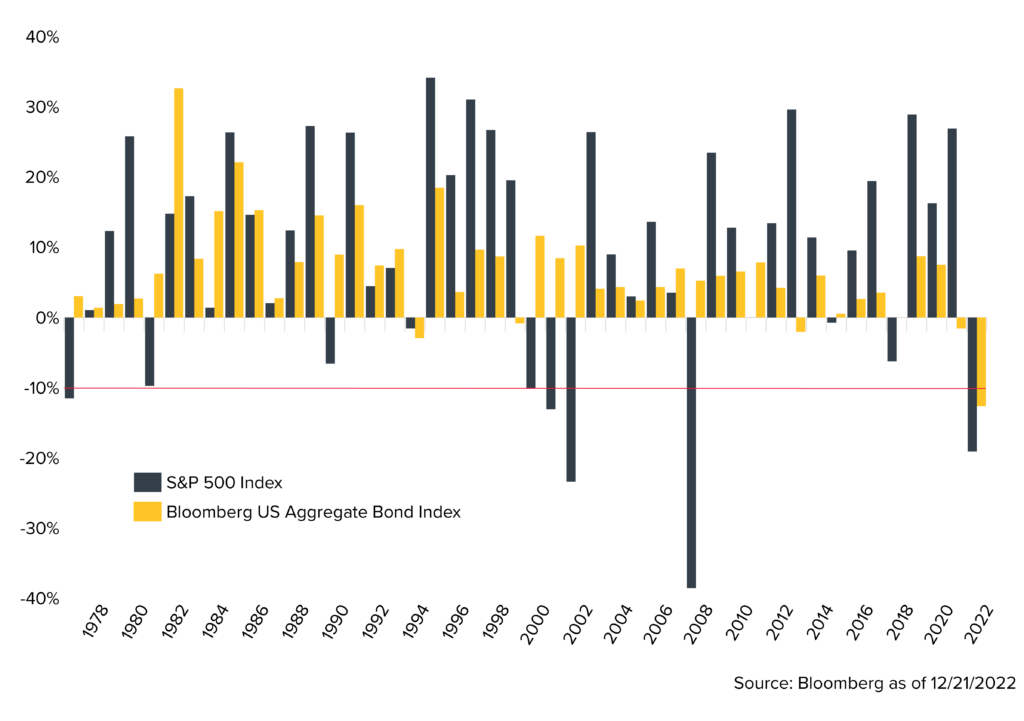

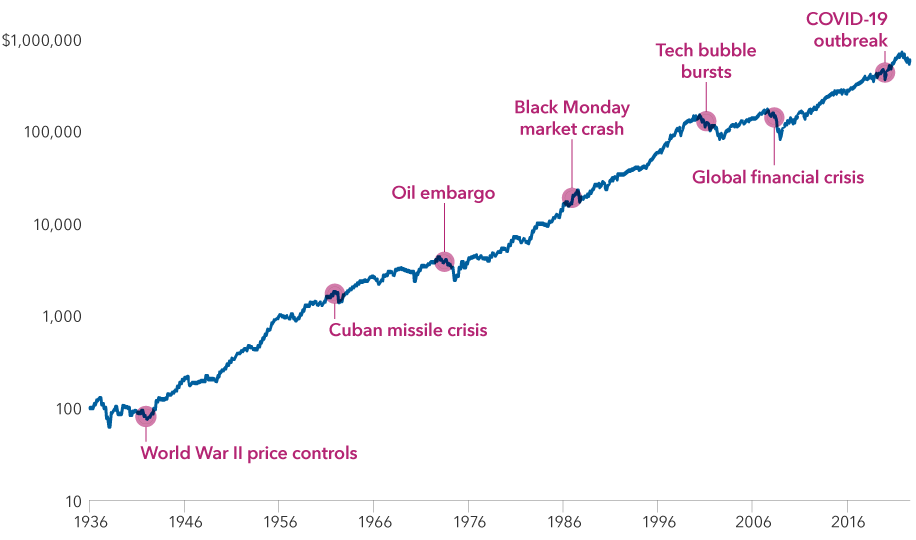

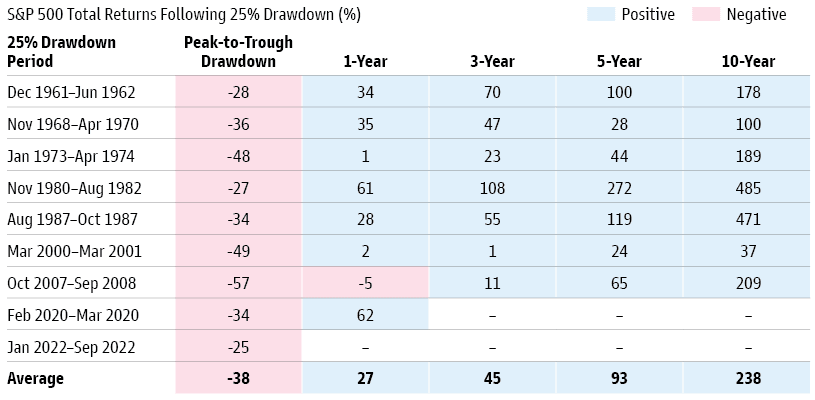

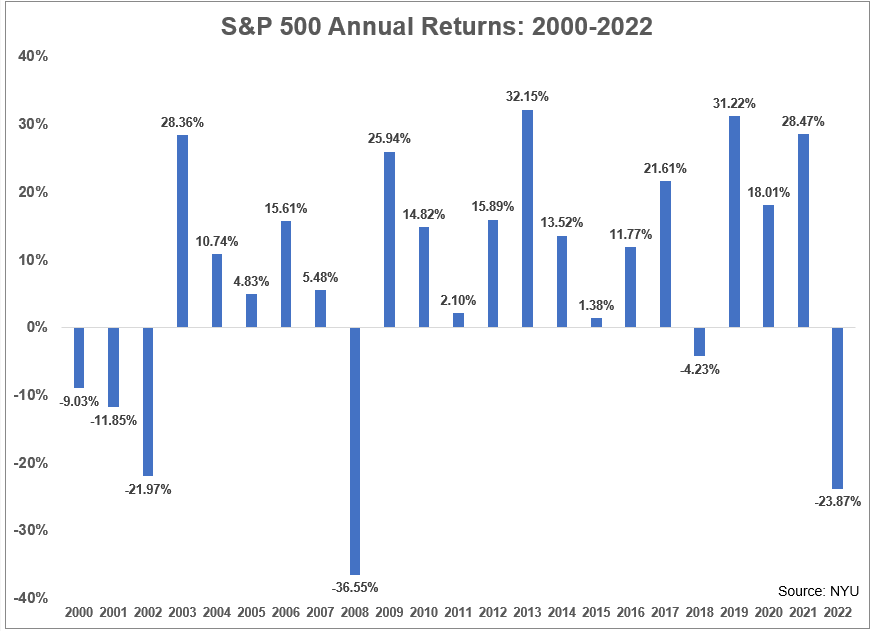

The closest the United States ever came to default was the summer of 2011, when Standard & Poor’s downgraded the U.S. credit rating for the first time ever and the S&P 500 fell by more than 16%. Congress eventually reached a compromise in early August, raising the debt limit just days before the country would have defaulted. Those conditions are similar politically to what we have today with a Democrat in the White House, Democrats holding a slight majority in the Senate and Republicans holding a slight majority in the House. The drama will play out over the next several months, but ultimately the two parties will have to negotiate a solution. Currently, neither party is in a rush to begin working on a deal.

What is the potential impact on the markets?

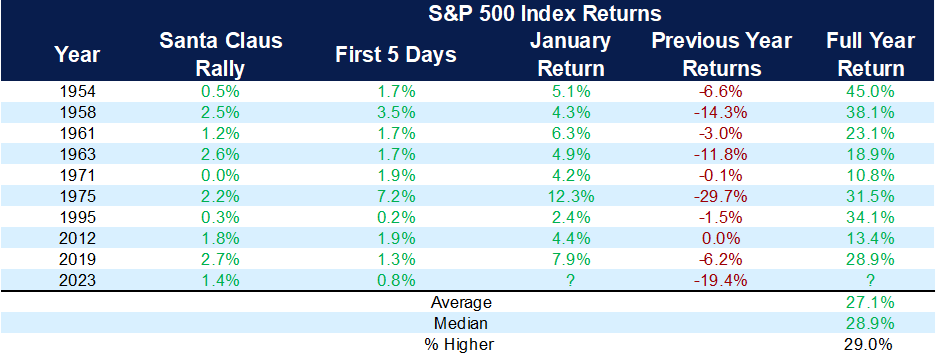

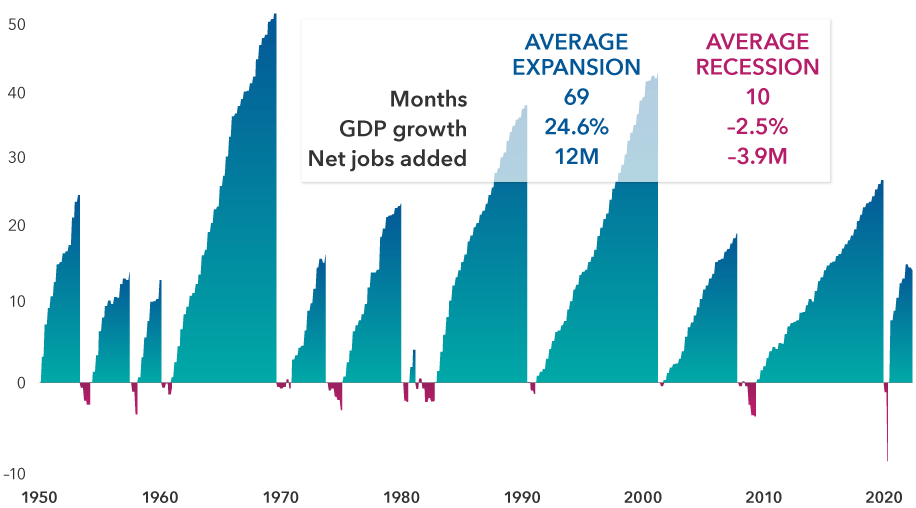

The stock market historically has not reacted until the default deadline is much closer. In 2011, the market downturn started about a month before the deadline and accelerated as the deadline approached. Market volatility increased as the deadline drew closer. At this point, we are five to six months away from a potential crisis point, so the market reaction is expected to remain calm for now. While the path to resolution is uncertain, a default would be an unprecedented event that would have dramatic repercussions in the global financial markets. But this has never happened before; Congress has always managed to reach an agreement, and we think that this time will be no different.

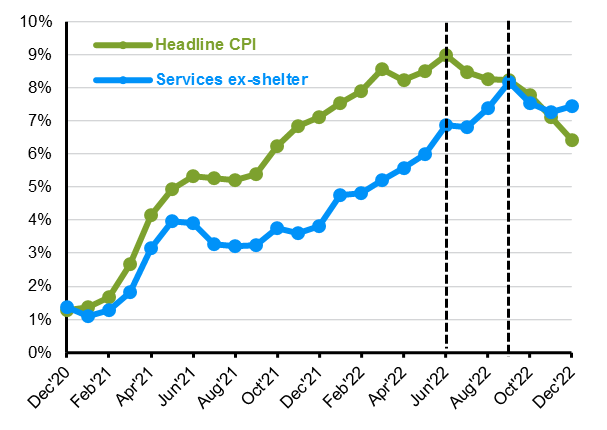

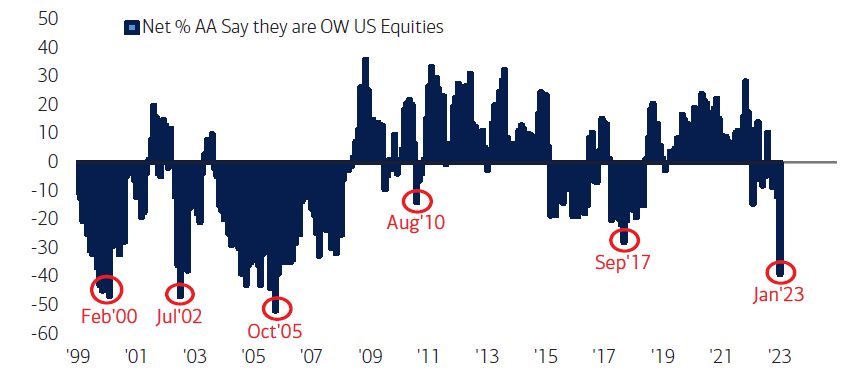

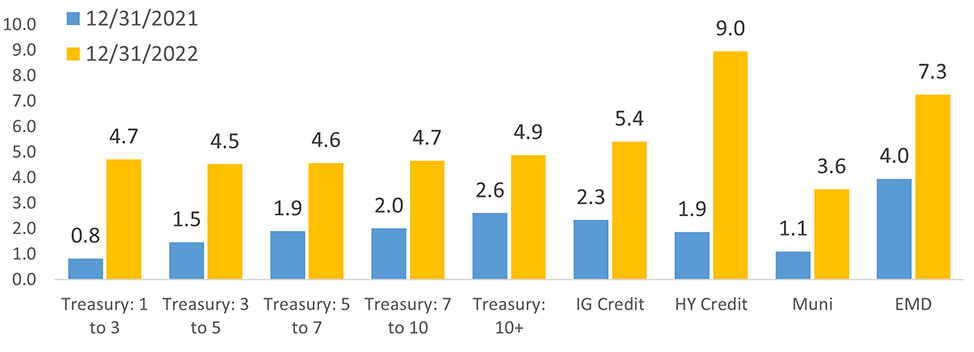

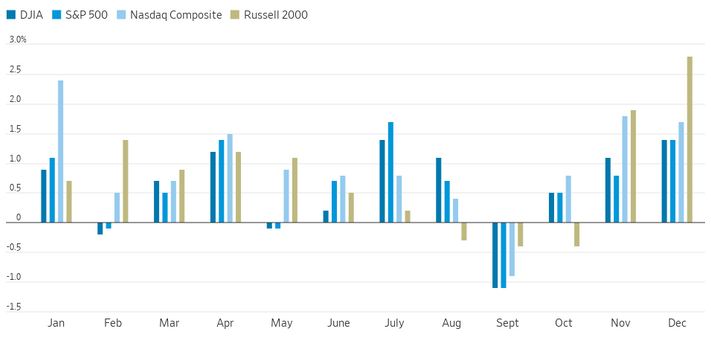

The debt-ceiling situation is only one factor among many that is likely to impact the markets in 2023. The markets continue to focus on the economy, jobs and inflation data, as well as the Fed’s interest-rate strategy.

All of these factors will have a much larger effect on investor sentiment over the next few months than the looming debt-ceiling drama.

As we get closer to the default deadline, we will determine if any changes need to be made to the portfolios. We would like to reiterate that a default has never happened, and we will continue to monitor the issue diligently.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

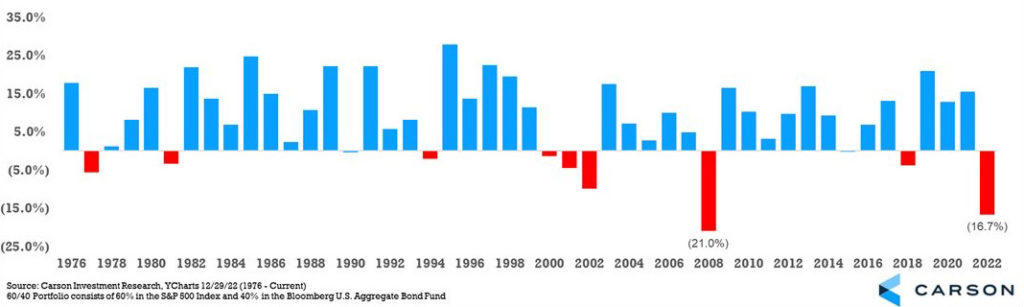

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Brookings Institute, CNBC, Schwab

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.