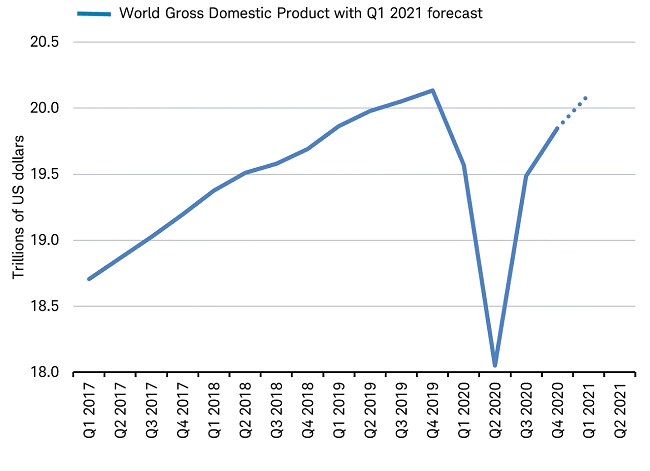

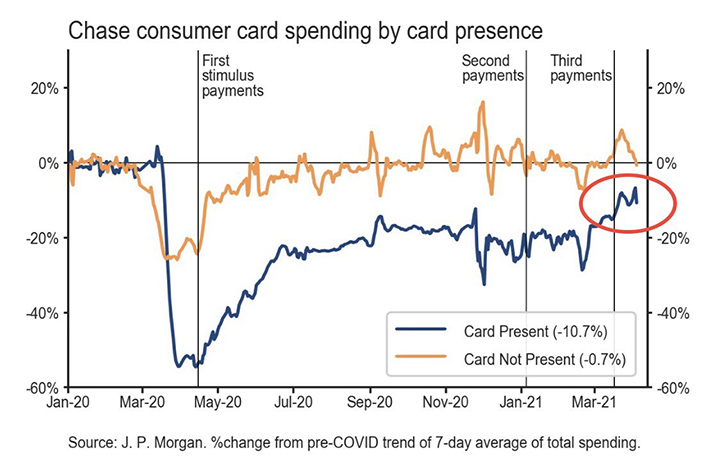

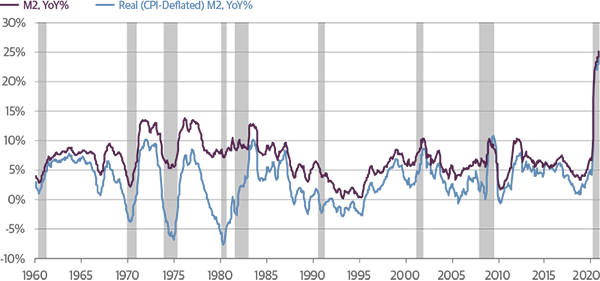

As we move closer to summertime, the pace of economic growth remains robust. Much of the strength of the U.S. economy can be attributed to the fiscal aid that has been injected through several rounds of stimulus. The recent boom in spending has stirred up fears of economic overheating and of potential longer-term inflation.

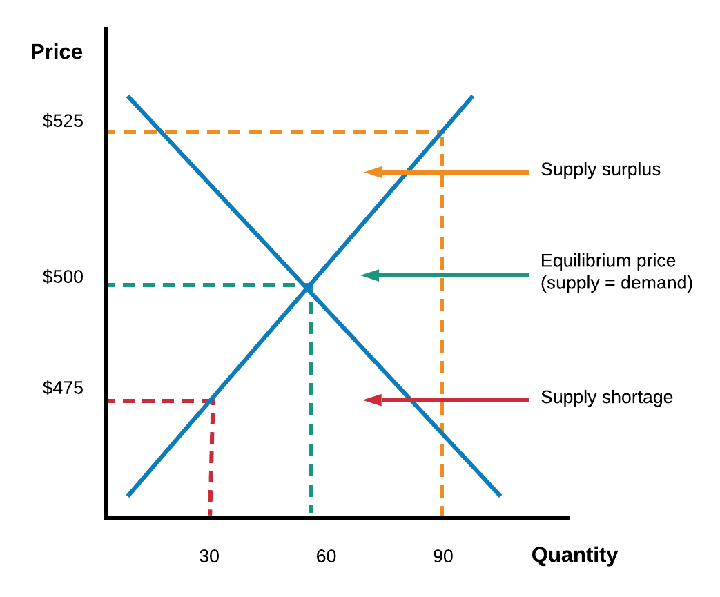

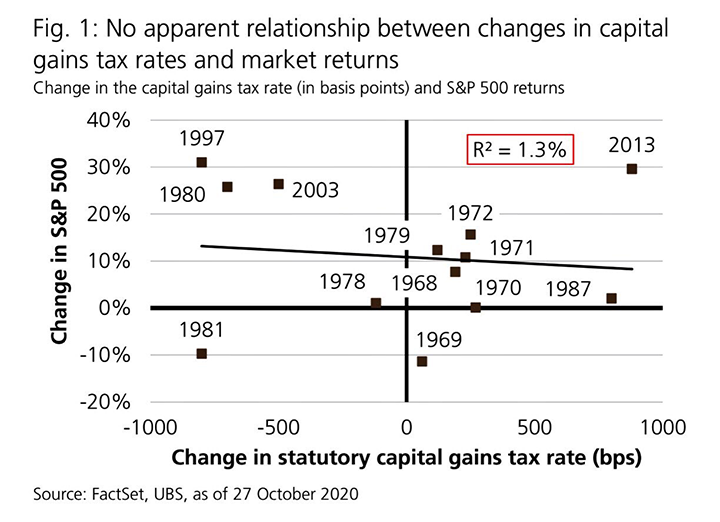

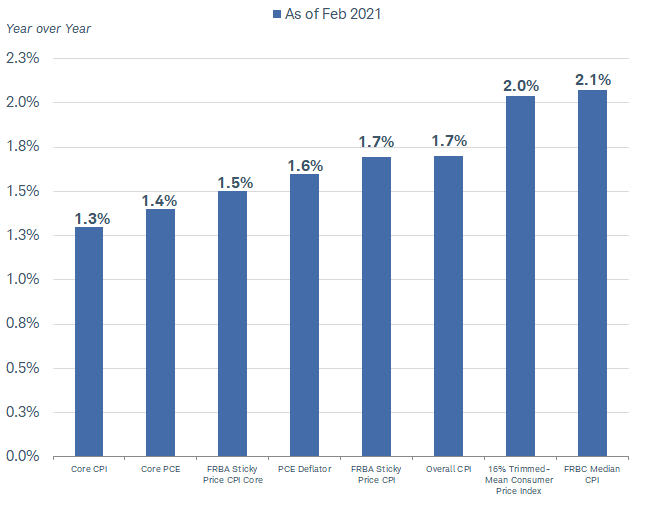

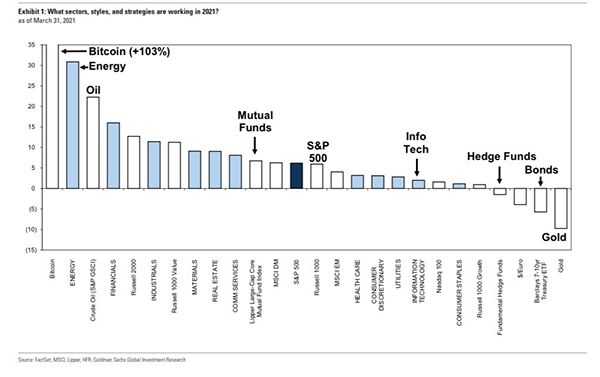

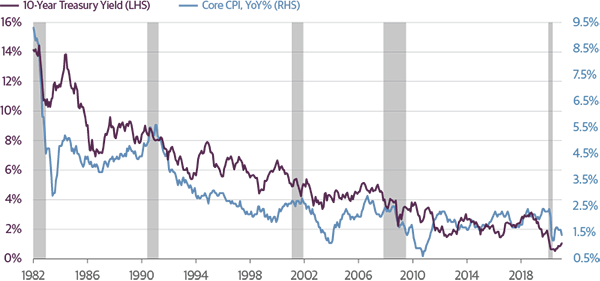

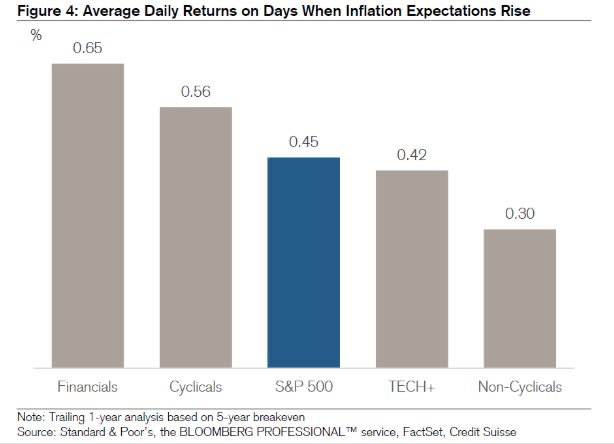

While prices generally have increased, metrics like the Consumer Price Index (CPI) are measured relative to the prior year, and a year ago was when the economy was broadly shut down. As seen in the chart below, the stock market (viewed by the S&P 500) reacts favorably as inflation expectations rise. In the past, sustained inflationary pressure has come from a severe tightening in the labor market. We are nowhere near a labor market crunch, as there are still millions of jobs that have not been recovered from the pandemic.

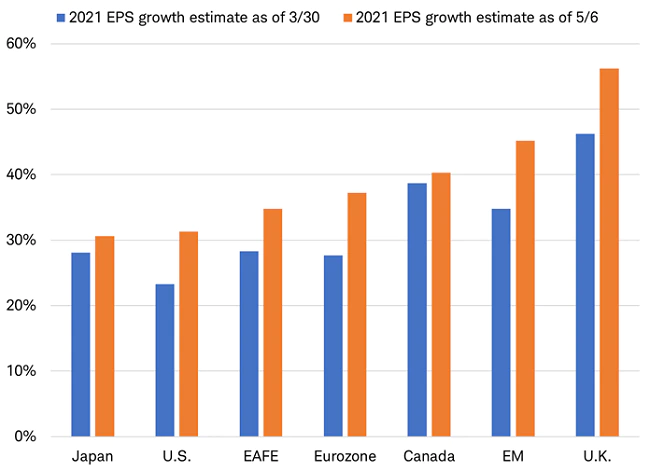

Europe’s economy finally is turning the corner, leaving its double-dip recession behind. Lockdowns, slow vaccine rollouts and delayed fiscal stimulus have hindered its recovery, but Europe is at an inflection point, and the rollout of its largest-ever stimulus plan should aid economic growth. First-quarter earnings in Europe outpaced those in the U.S. for the first time in years, another positive signal for European markets.

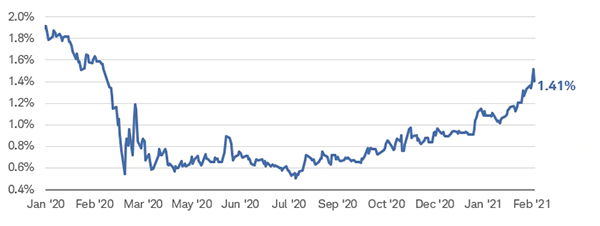

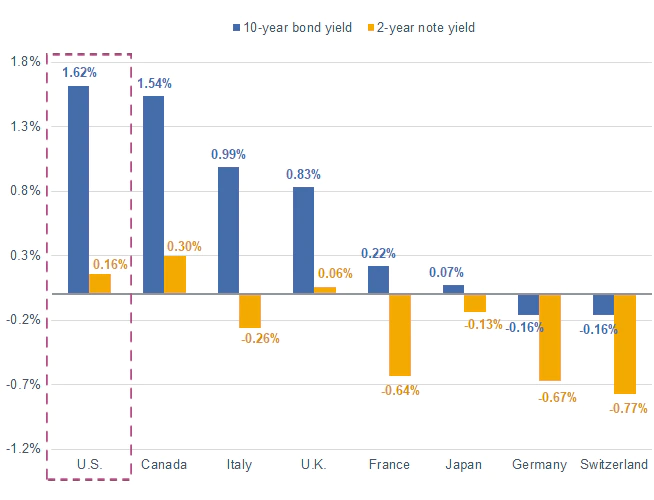

The global recovery should pick up in the second half of the year as widespread vaccinations allow more economies to reopen. The demand for U.S. Treasury bonds has helped keep a lid on rising Treasury yields, which are higher than those in Japan and Europe. If global growth picks up as expected in the second half of the year, bond yields in other countries may move higher, along with U.S bond yields.

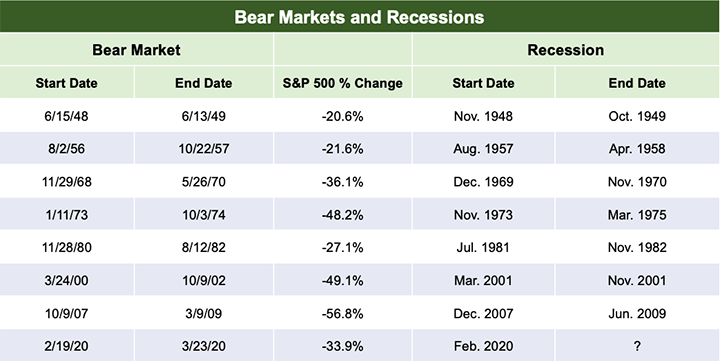

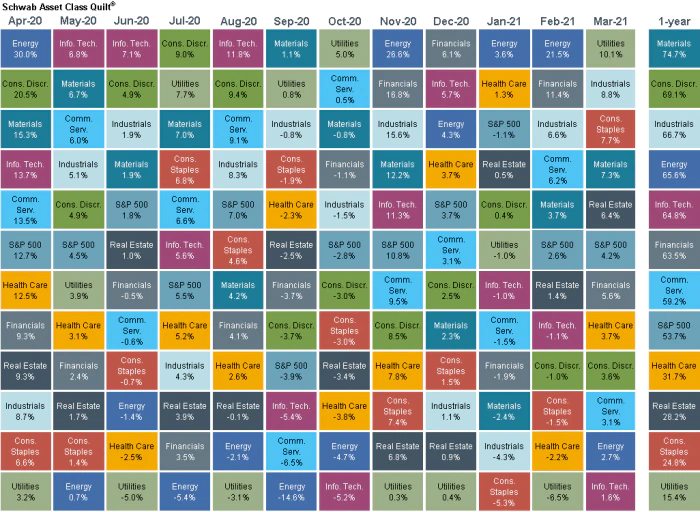

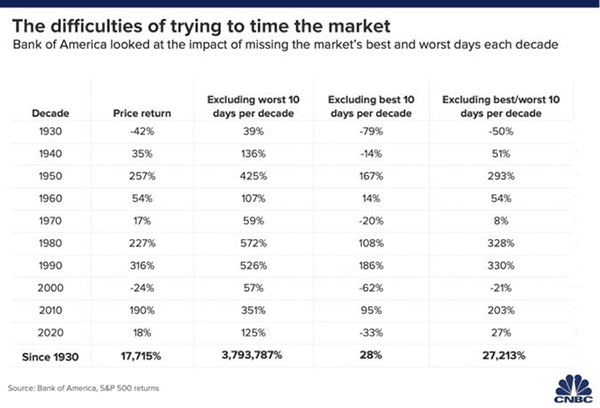

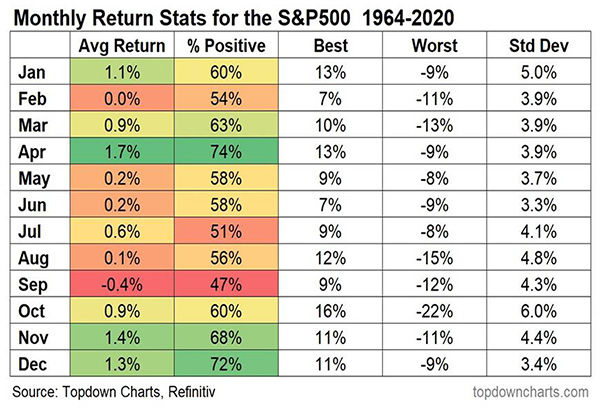

So, what can we learn from all this? Higher bond yields and inflationary pressures are not a reason to panic. Over the last 20 years, the S&P 500 has produced an average annual return of close to 6%. Optimism in the stock market remains elevated, even with the recent sell-off in the market and increased inflation concerns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. We believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: Bloomberg, Schwab, CNBC

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures