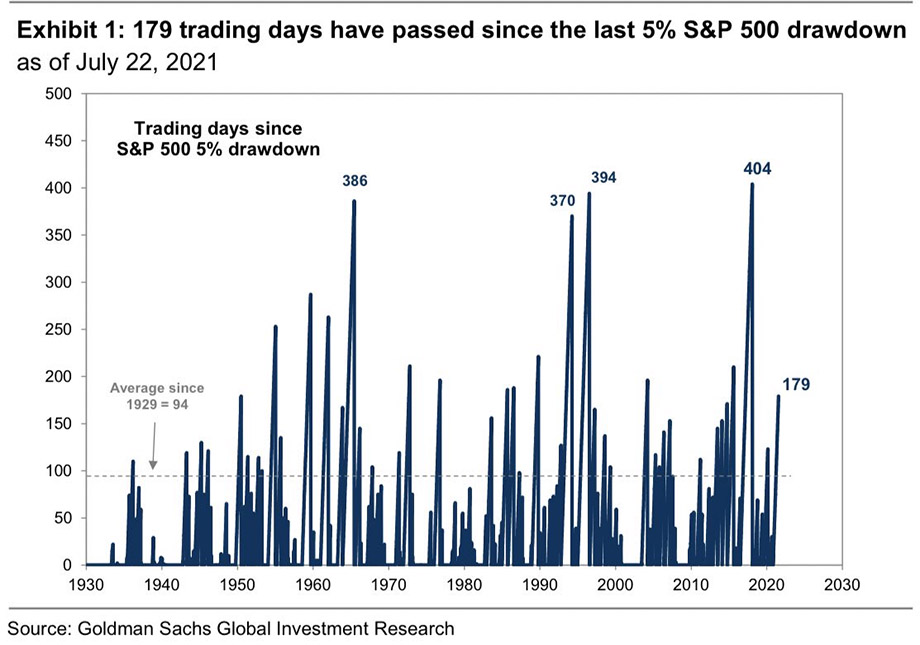

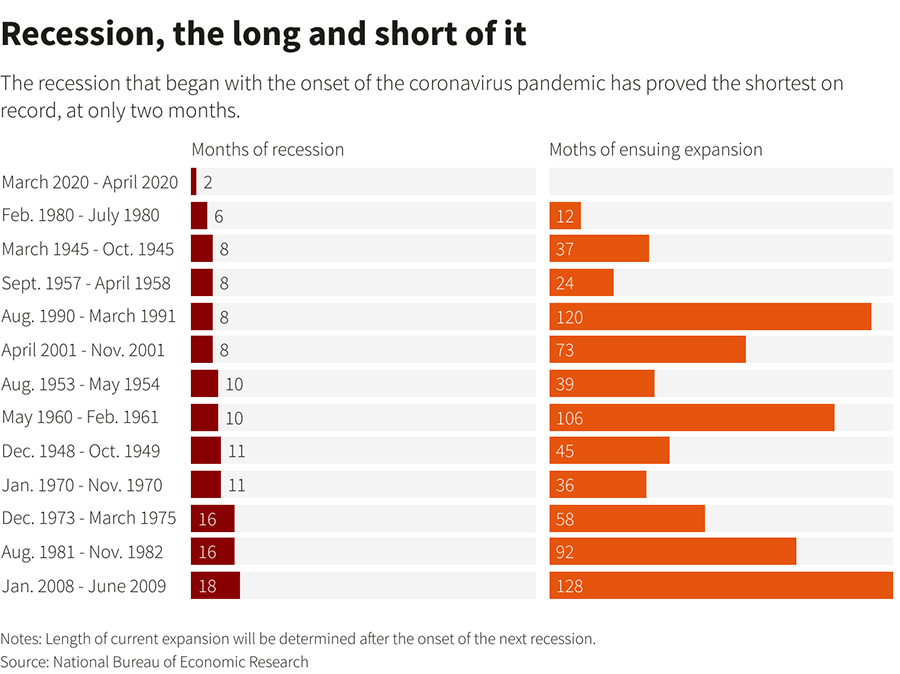

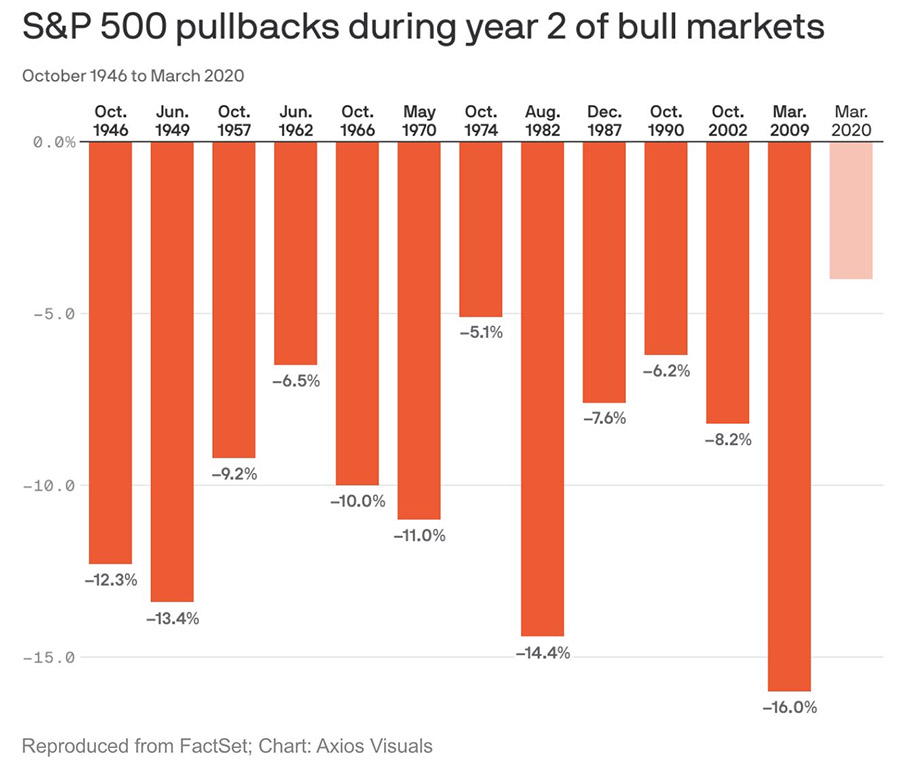

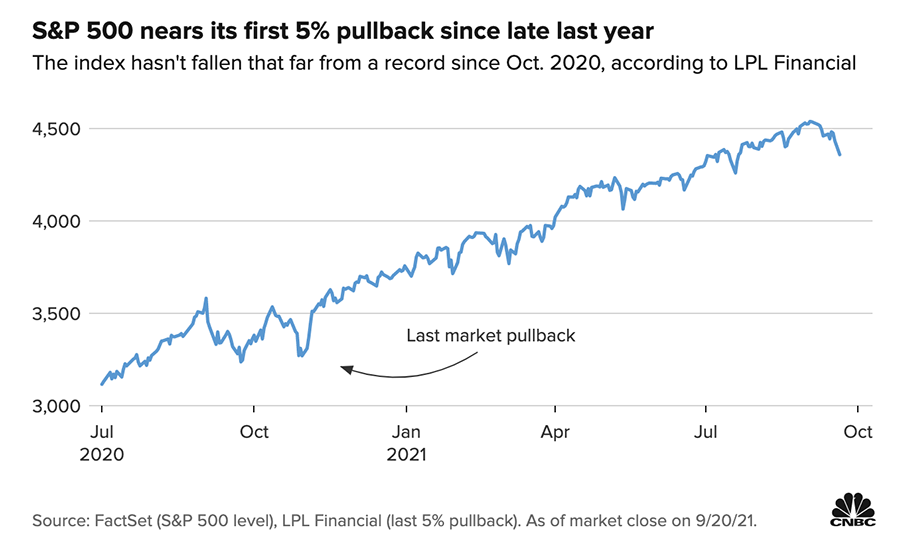

Global stocks started the week with the worst daily performance since May as investors digested the news over the weekend about the troubled Chinese property market. China Evergrande Group, the world’s most indebted property developer, is at risk of default this week on its debt payments. The potential long-term fallout from Evergrande’s liquidity crisis is unknown — as is any potential spillover to other financial markets. We also do not know how the Chinese government may act to bail out the real estate behemoth. Monday’s sell-off briefly pushed the S&P 500 to 5% below its last record on an intraday basis for the first time since October 2020 (see chart below).

Several other factors also are affecting the current market environment, and we will address each of them below:

1. Angst in Washington over the upcoming expiration of the borrowing limit (debt ceiling) and a potential government shutdown

2. New proposed tax increases

3. Lingering inflationary worries and when the Fed’s tapering may start

4. The effect of the Delta variant on the economy

Angst in Washington

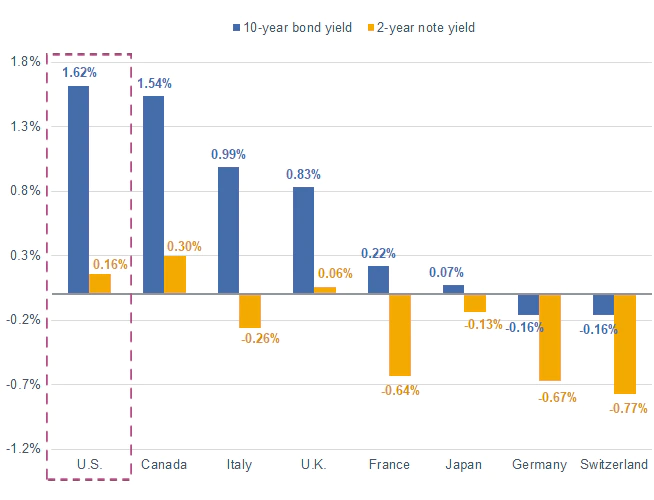

If Congress fails to raise the borrowing limit, the U.S. government would default for the first time. “The U.S. has never defaulted. Not once,” Treasury Secretary Janet Yellen said. “Doing so would likely precipitate a historic financial crisis that would compound the damage of the continuing public health emergency.” The deadline to avoid both a government shutdown and the debt ceiling issue is a moving target. Raising or suspending the debt ceiling does not authorize additional spending, but it increases the spending limit, similar to a credit card.

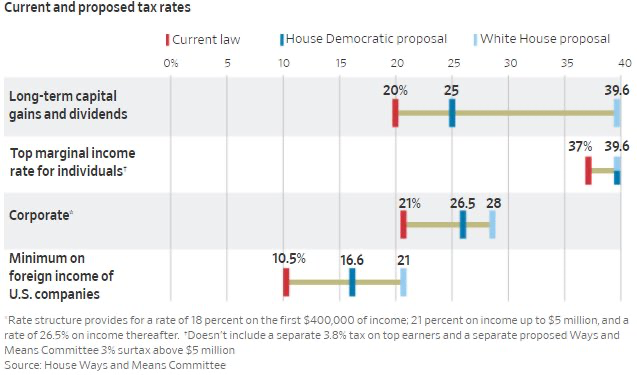

Proposed Tax Increases

As we wrote about last week, the House Ways & Means committee proposed tax increases on the wealthy to help fund a $3.5 trillion economic package. Remember, these are just proposed tax increases and not law. The main tax increases in the proposal are:

* Raise the top individual tax rate from 37% to 39.6%.

* Apply a 3% surtax on incomes greater than $5 million.

* Raise the long-term capital gains tax rate to 25% for couples making more than $450,000.

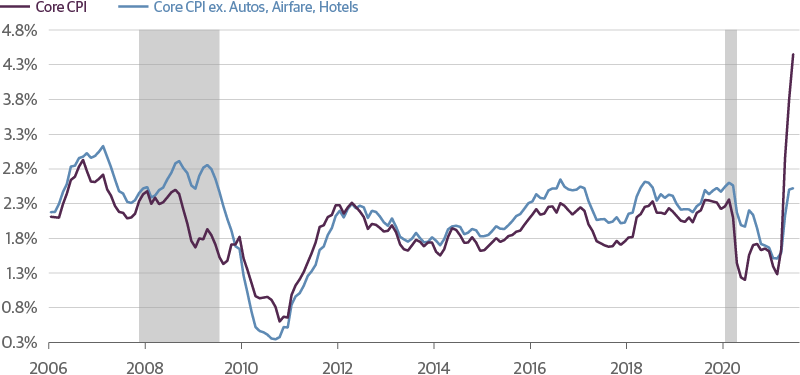

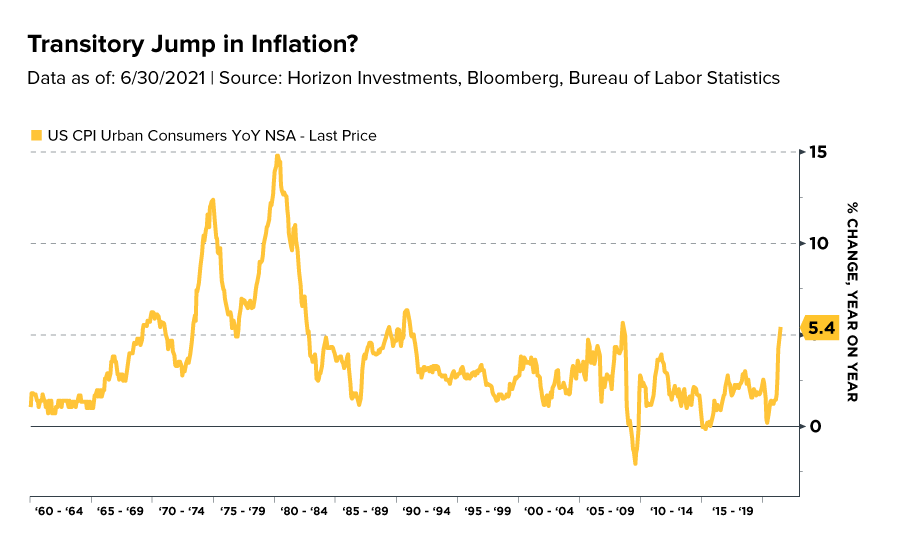

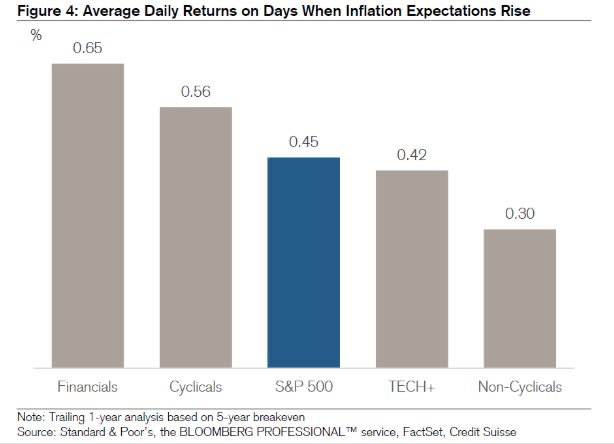

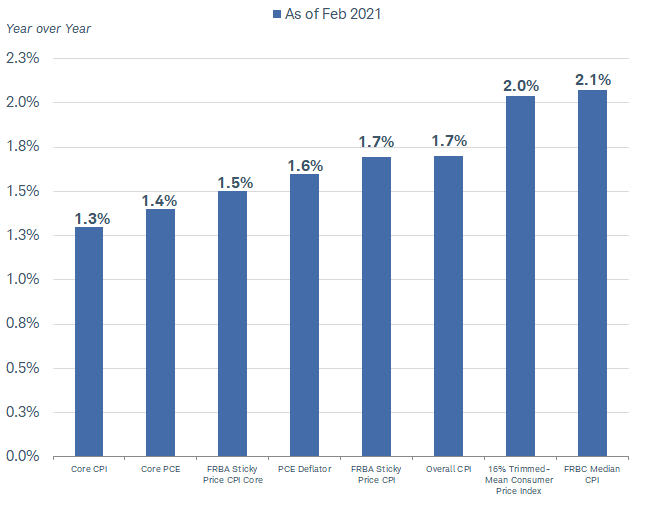

Inflation

Inflation remains on the forefront of consumers’ minds as prices of many goods and services continue to rise due to lack of inventory and empty shelves caused by shipping delay and costs out of China. The Federal Reserve Chairman, Jerome Powell, has stated on numerous occasions that the Fed believes inflation to be transitory – meaning temporary. His reasoning is as follows:

* It’s not broad based. Inflation is concentrated in a few sectors that were hit hardest by the pandemic.

* The biggest price surges already are receding. Lumber and used car prices are now stabilizing or dropping after rocketing higher.

* Wages are rising, but not faster than productivity gains.

* Globally, price pressures are downward with an aging population and advancements in technology.

The Federal Reserve concludes its two-day meeting this week and the focus remains on when the Fed will begin to taper its purchases. As we wrote about recently, “tapering” is a term that describes the process of gradually stopping asset purchases. When the Fed begins to taper, it purchases fewer bonds, which reduces additional money flowing into the economy, in hopes of slowing economic growth. All of this is done with the focus on controlling inflation and the economy. The Federal Reserve Bank tries to signal its intentions and be transparent with the hope that the impact to the financial markets is minimized.

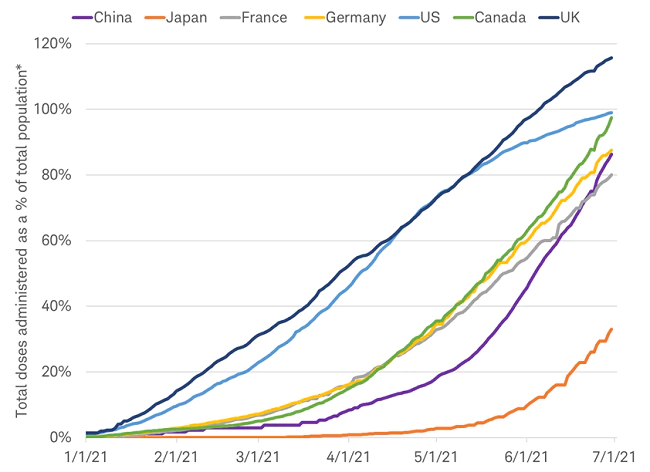

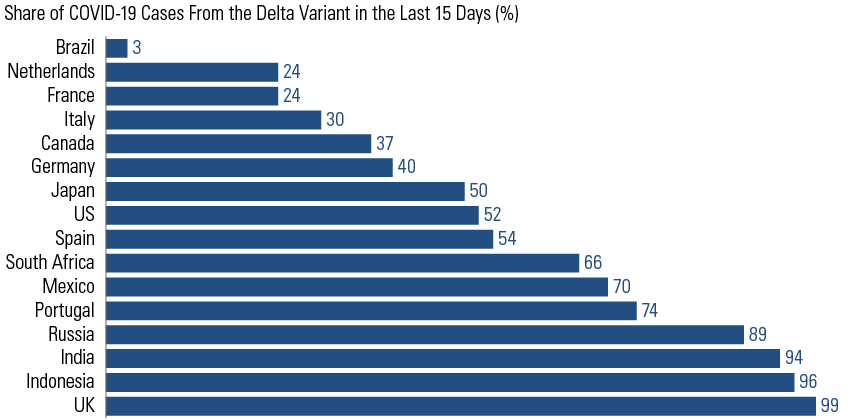

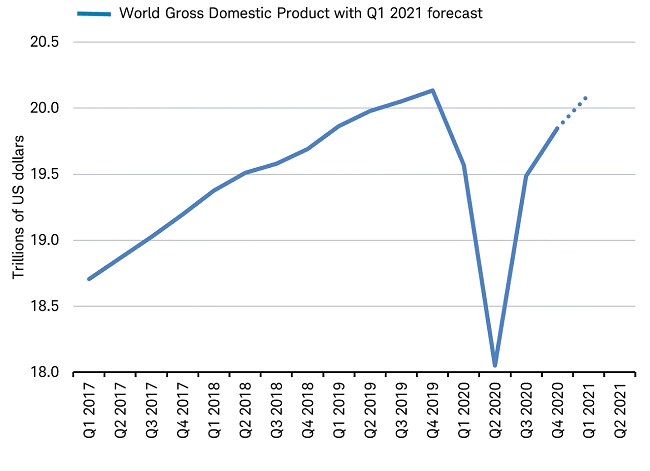

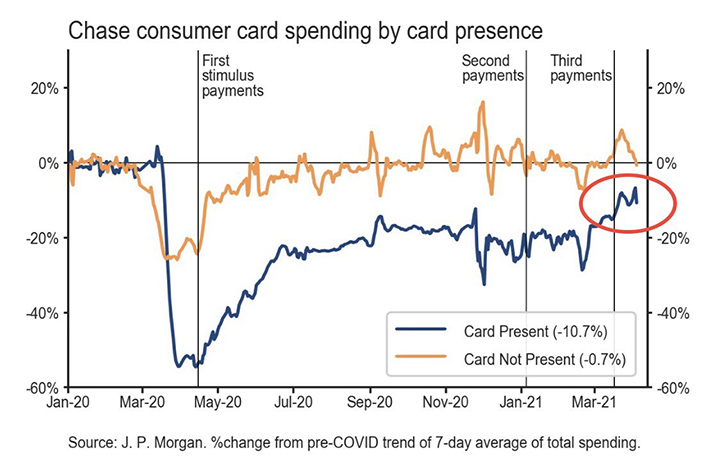

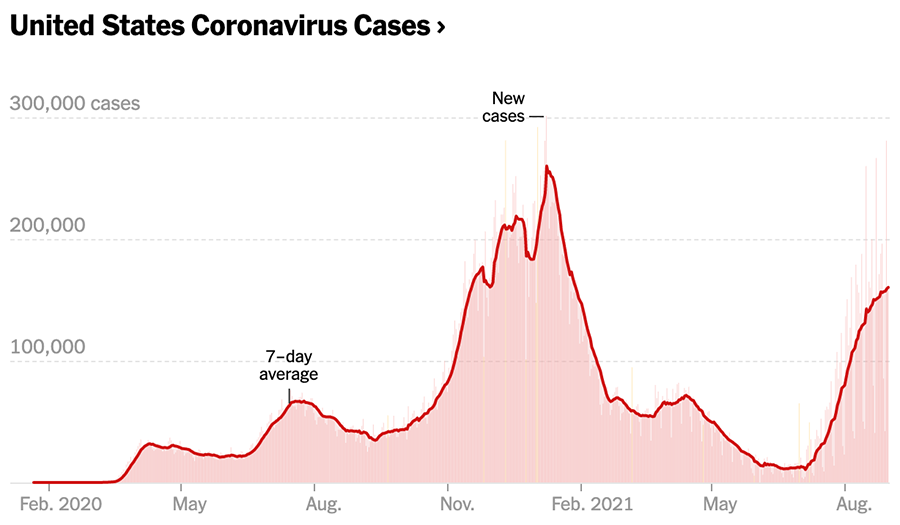

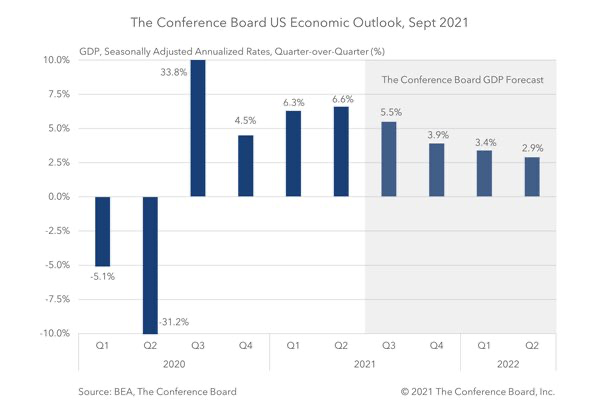

COVID

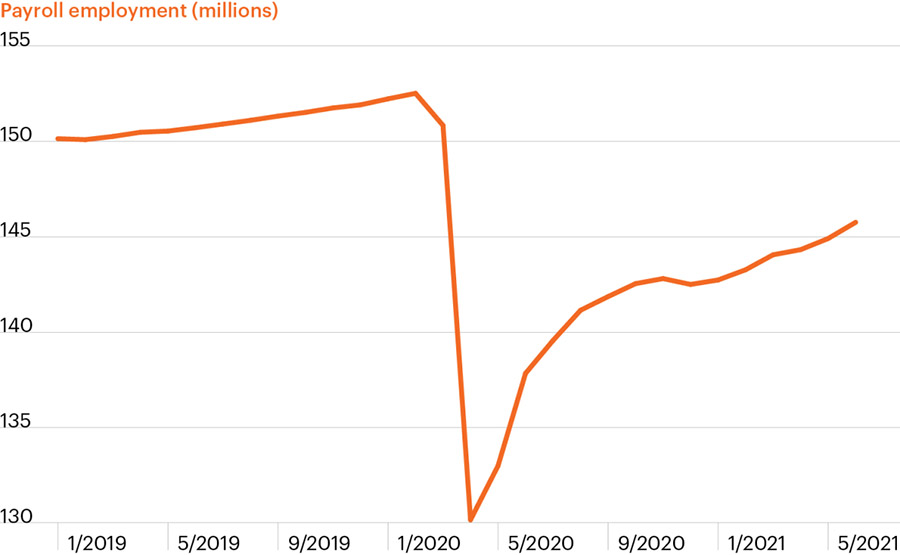

Due to the Delta variant, COVID cases remain near January levels. As colder weather approaches and flu season ramps up, the fear is that COVID variants could continue to slow economic growth. Future GDP forecast is expected to decline from recent highs — but it’s not expected to be derailed by COVID.

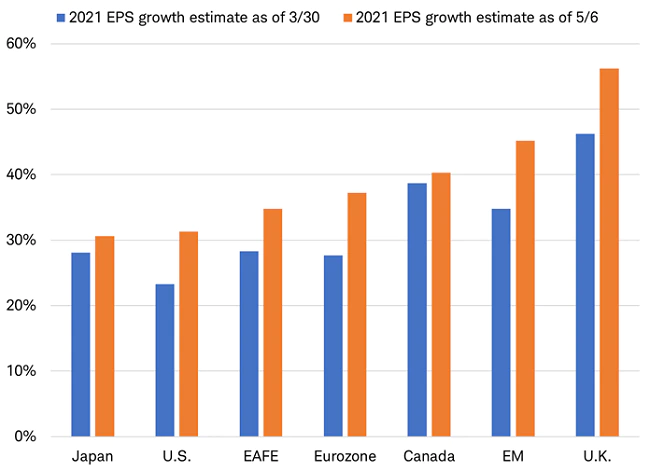

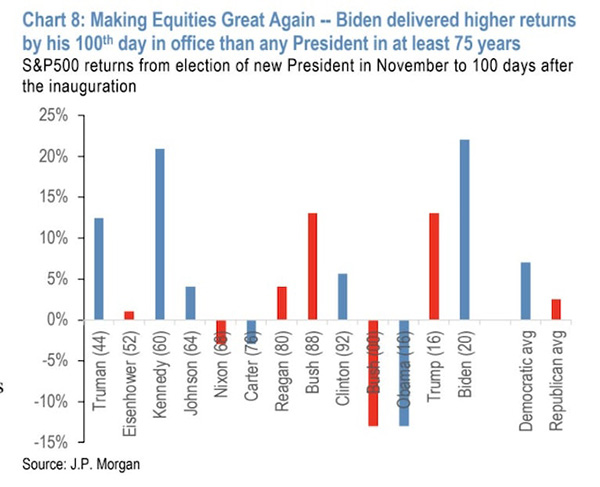

So, what can we learn from all this? The current stock market continues to digest a multitude of economic messages: a potential default by China Evergrande group, inflationary pressures, proposed tax hikes, the Federal Reserve’s plans to start tapering and increase rates, and the ongoing global pandemic. It is important to focus on the long-term goal — and not to focus on only one data point or indicator.

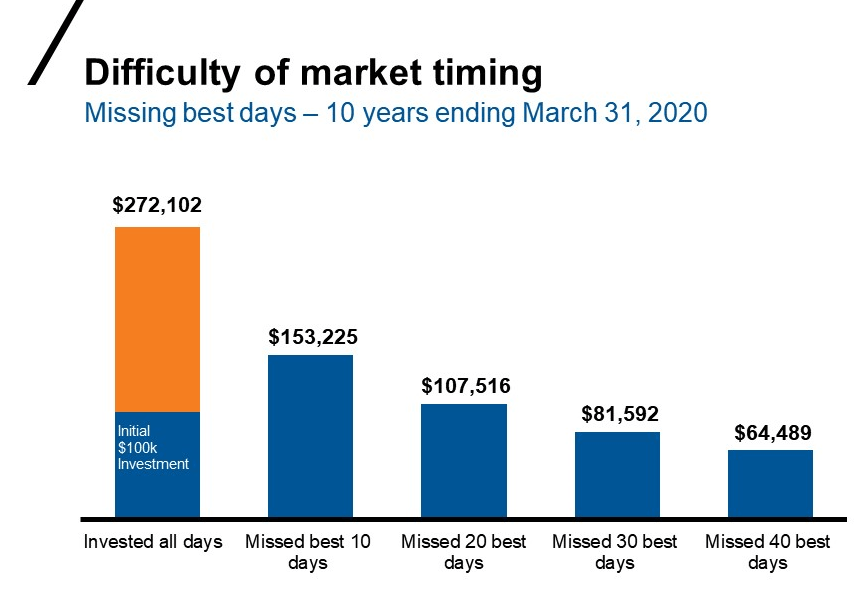

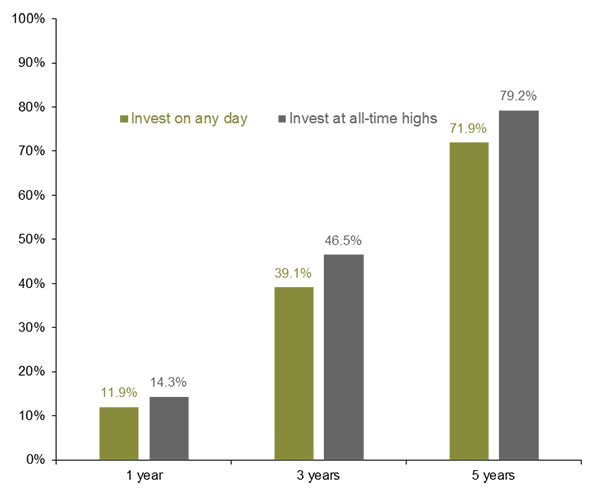

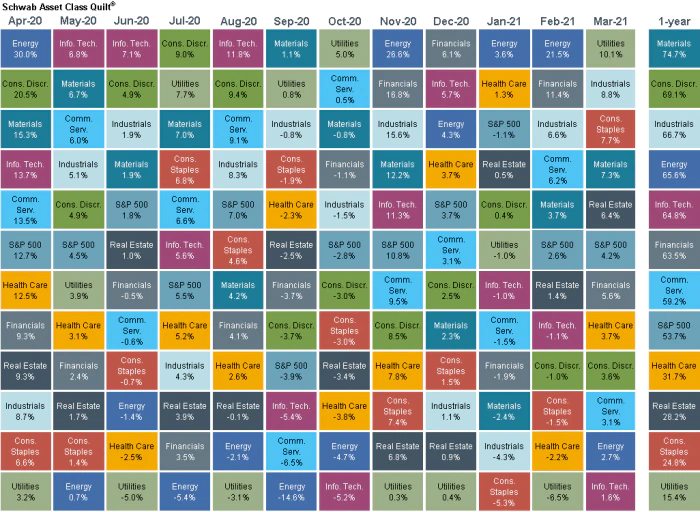

From a portfolio perspective, we continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been. Making market decisions based on what might happen may be detrimental to long-term performance. The key is to stay invested and stick with the financial plan. Markets go up and down over time, and downturns present opportunities to purchase stocks at a lower value.

It all starts with a solid financial plan for the long run that understands the level of risk that is acceptable for each client. Regarding investments, we believe in diversification and having different asset classes that allow you to stay invested. The best option is to stick with a broadly diversified portfolio that can help you to achieve your own specific financial goals — regardless of market volatility. Long-term fundamentals are what matter.

Sources: CNBC, Reuters, Schwab, BEA Conference Board

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. Kestra IS and Kestra AS are not affiliated with CD Wealth Management. Investor Disclosures: https://bit.ly/KF-Disclosures