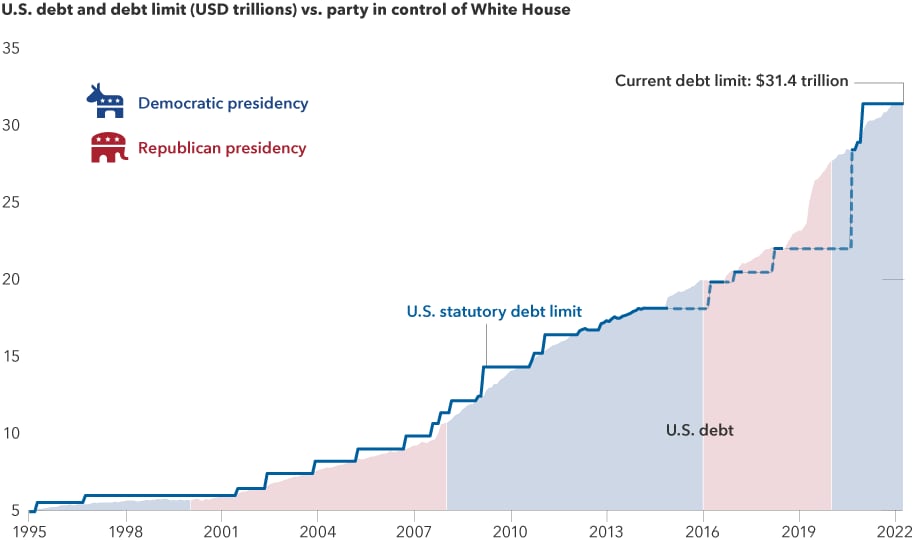

In January, we wrote about the impending debt ceiling and the Congressional showdown that was likely to occur. The current debt limit of $31.4 trillion was surpassed early in the year, and at that point, the U.S. government was not able to issue any new debt. It has been relying on emergency funds to meet short-term obligations. According to Congressional budget forecasts, emergency funding could run out as early as June.

Lawmakers often wait to the last minute to pass legislation, and the scene is set for what could be one of the most contentious debt ceiling showdowns in recent history.

The debt ceiling is the maximum amount the federal government can borrow to finance obligations that lawmakers and presidents have already approved. Increasing the debt ceiling does not authorize new spending commitments; rather, it allows the government to meet its existing obligations.

Congress established the debt ceiling more than 100 years ago, and it has been modified more than 100 times since World War II. Its purpose was to make it easier for the federal government to borrow money, but it has become a political battleground that makes its way into the news every few years. Each time the ceiling comes up for debate in Congress, lawmakers wrestle over the ability to restrict the growth of borrowing.

If the government were no longer able to borrow, it would not have enough money to pay its bills in full, including interest on the national debt. It would probably have to delay payments or default on some of its commitments, potentially affecting Social Security payments and federal worker salaries, for example. Thankfully, this has never happened, so no one knows exactly how the Treasury would handle the situation.

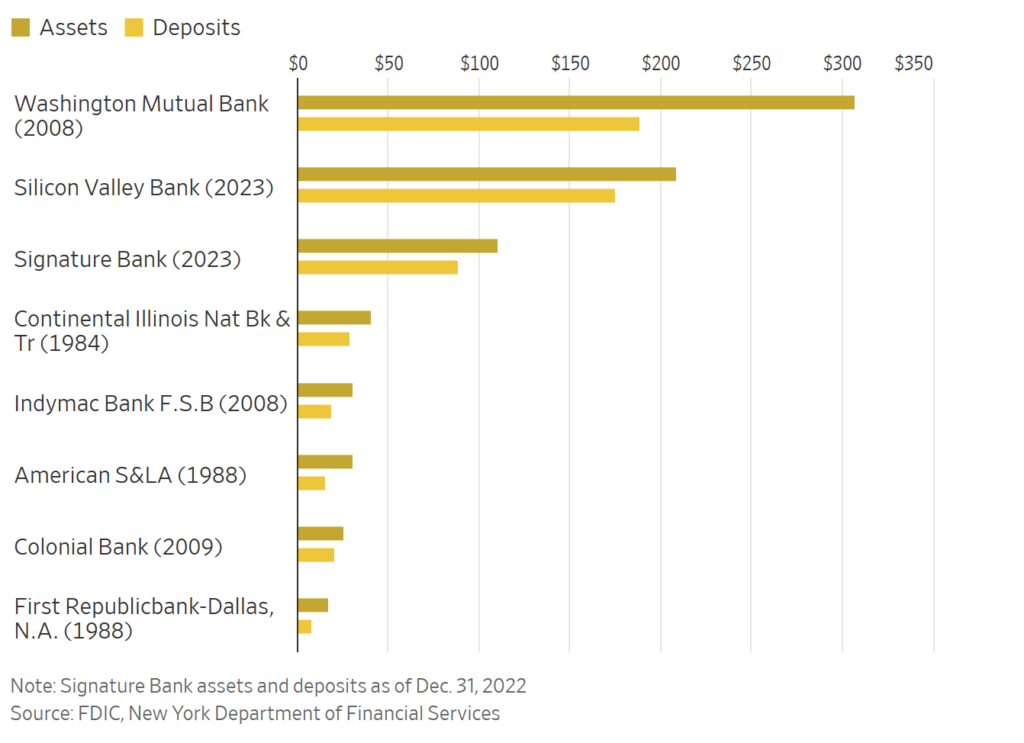

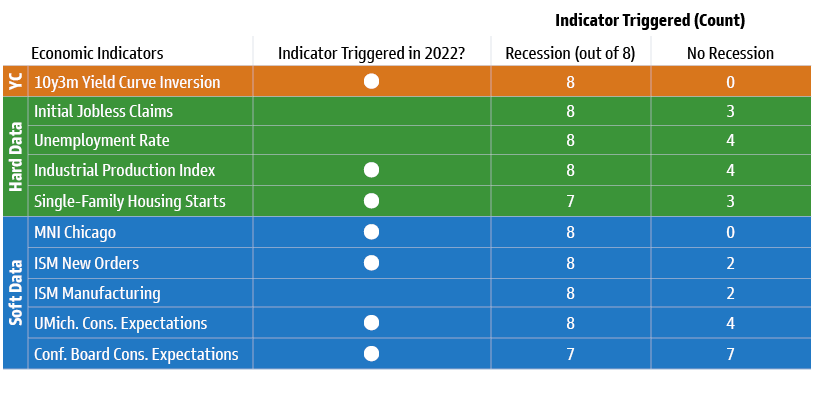

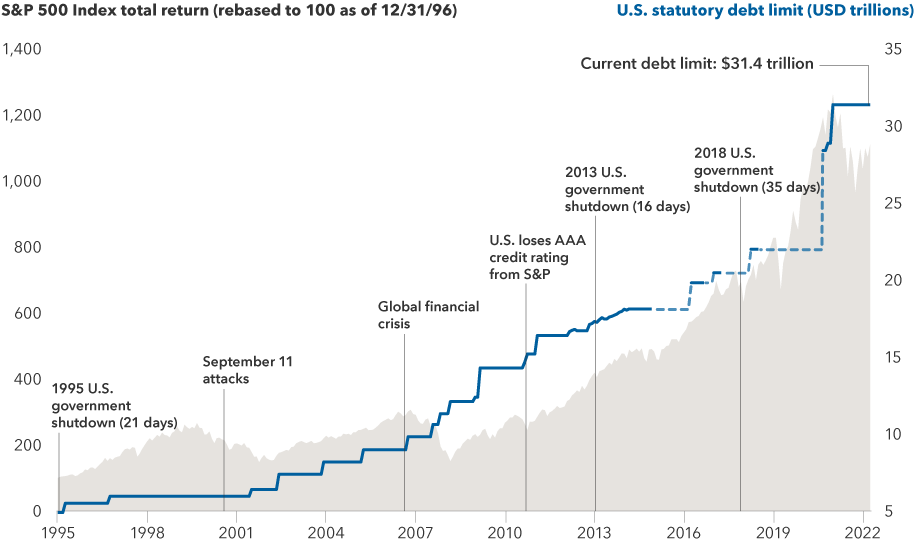

When Congress is divided, as it is today, a standoff can occur — and the creditworthiness of the U.S. government is at stake. These showdowns are not new; they have occurred under the control of both political parties and have always been resolved before the government had to default. The closest we have come to default was in 2011, when Standard & Poor’s downgraded the U.S. credit rating. In 2013, negotiations led to a 16-day government shutdown, and in 2018, we saw a shutdown of three days, followed later by a 35-day shutdown.

Debt Ceiling Showdowns Occur Regardless of Who Controls the White House

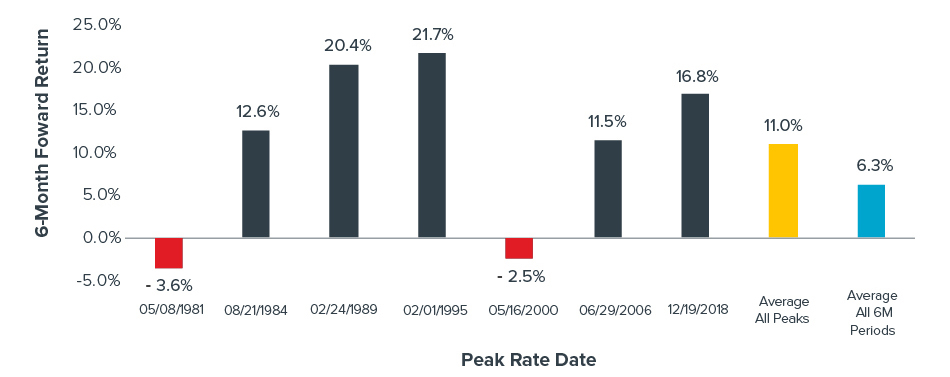

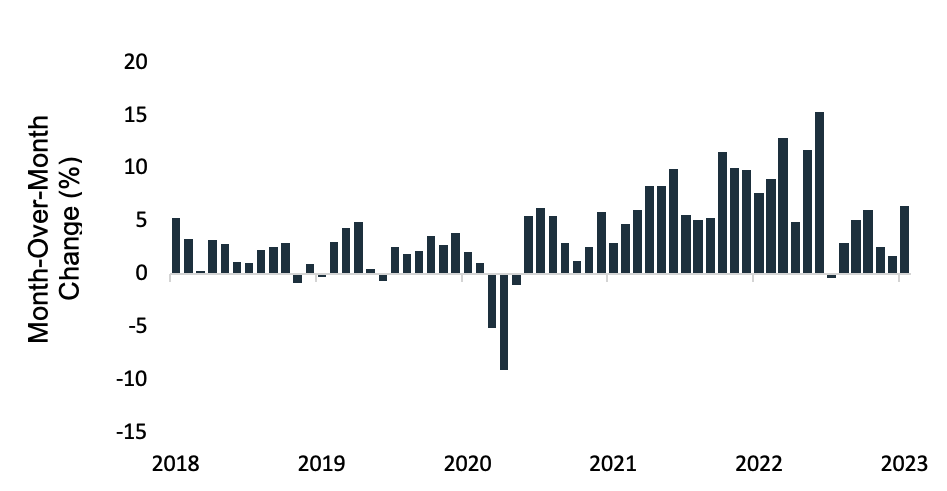

Over time, these showdowns did not tend to have a significant long-term impact. Even if the debt ceiling creates volatility in the market, now is not the time to take impulsive action. Well-managed companies adjust to shifting conditions, and the best companies ultimately learn to thrive, even in times of crisis. Markets have survived a great variety of disruptions in the past. The chart below shows different debt-ceiling showdowns. Over the long run, the market has trended up, despite the short-term volatility caused by debt disruption.

Markets Have Powered Through Debt-Ceiling Standoffs in the Past

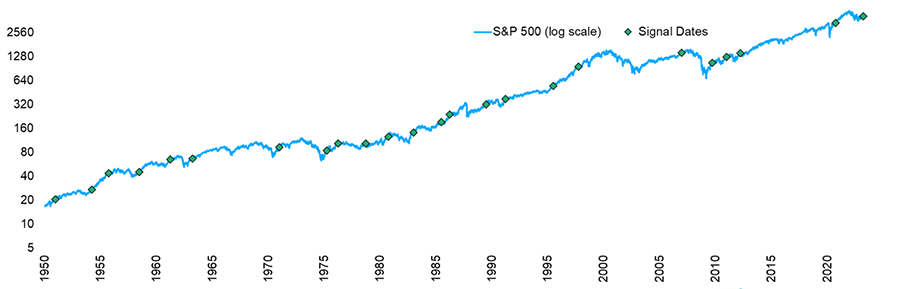

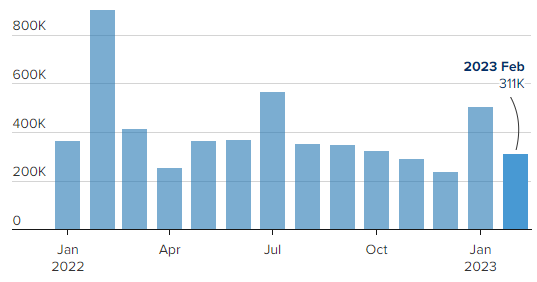

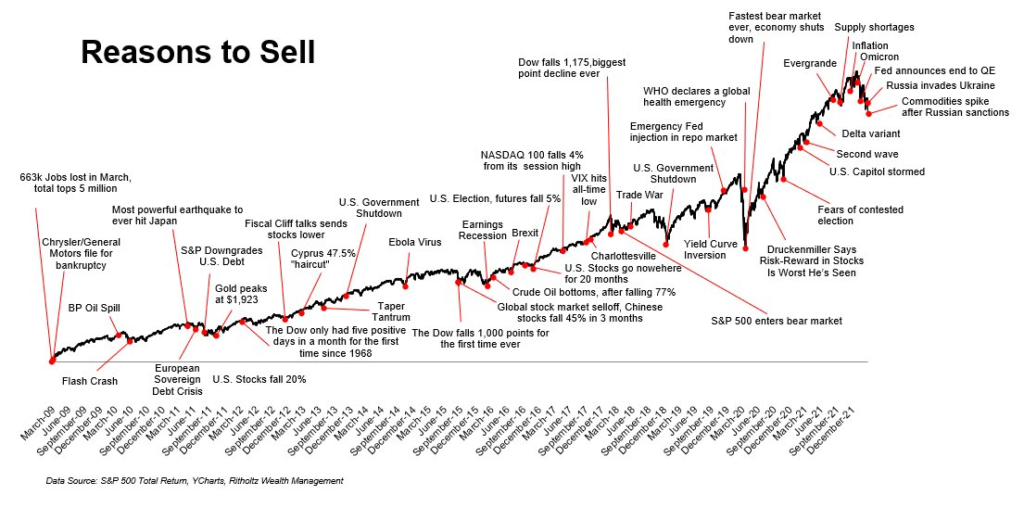

The markets have historically been resilient. Even if this crisis is new, market volatility is not. Investors who stay the course have historically benefited over the long term. The chart below goes back only to 2009, but it is very telling. See how many events could have been a cause to panic or sell. Clearly, COVID accounts for the largest drop in the chart, but you will be hard-pressed to find the 2011 and 2013 debt crises. Those 15% to 20% drops in the market are barely noticeable.

More importantly, as the chart above shows, the trend is up and to the right for those who stay invested. Over time, the market tends to go up, despite a multitude of reasons to sell. Over the next many weeks, we will hear a lot of noise about the impending debt showdown. If the U.S. misses a payment in June, it can and will cause a short-term shock to the markets.

This is not a time to panic, but a time to potentially put additional monies to work in the market — if cash is available and part of the overall financial plan. Hindsight has shown that these are buying opportunities — but of course, past performance is not a guarantee for future success.

The CD Wealth Formula

We help our clients reach and maintain financial stability by following a specific plan, catered to each client.

Our focus remains on long-term investing with a strategic allocation while maintaining a tactical approach. Our decisions to make changes are calculated and well thought out, looking at where we see the economy is heading. We are not guessing or market timing. We are anticipating and moving to those areas of strength in the economy — and in the stock market.

We will continue to focus on the fact that what really matters right now is time in the market, not out of the market. That means staying the course and continuing to invest, even when the markets dip, to take advantage of potential market upturns. We continue to adhere to the tried-and-true disciplines of diversification, periodic rebalancing and looking forward, while not making investment decisions based on where we have been.

It is important to focus on the long-term goal, not on one specific data point or indicator. Long-term fundamentals are what matter. In markets and moments like these, it is essential to stick to the financial plan. Investing is about following a disciplined process over time.

Sources: Capital Group, S&P, Ritzholtz

This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

Using diversification as part of your investment strategy neither assures nor guarantees better performance and cannot protect against loss of principal due to changing market conditions.

Past performance is not a guarantee of future results.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS) an affiliate of Kestra IS. CD Wealth Management and Bluespring Wealth Partners LLC* are affiliates of Kestra IS and Kestra AS. Investor Disclosures: https://bit.ly/KF-Disclosures

*Bluespring Wealth Partners, LLC acquires and supports high quality investment adviser and wealth management companies throughout the United States.

Fidelity Investments and Fidelity Institutional® (together “Fidelity”) is an independent company, unaffiliated with Kestra Financial or CD Wealth Management. Fidelity is a service provider to both. There is no form of legal partnership, agency affiliation, or similar relationship between your financial advisor and Fidelity, nor is such a relationship created or implied by the information herein. Fidelity has not been involved with the preparation of the content supplied by CD Wealth Management and does not guarantee, or assume any responsibility for, its content. Fidelity Investments is a registered service mark of FMR LLC. Fidelity Institutional provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.